How to start a car insurance company from scratch

How to start a car insurance company from scratch | Insurance Business America

Guides

How to start a car insurance company from scratch

Launching an insurance business requires careful planning and lots of hard work. Here’s a step-by-step guide on how to start a car insurance company

Car insurance is one of the most popular types of policies in the market. Anyone who wants to operate a vehicle is legally required to have one. This makes selling this high-demand product a great opportunity for those wanting to venture into the insurance business.

But starting your own car insurance company can be a complex endeavor – one that requires careful planning and preparation.

To guide you in your journey, Insurance Business will give you a walkthrough on how to start a car insurance company from scratch. Whether you’re an industry first-timer wanting to dip your toes into the insurance market or an industry veteran wanting to take charge of your own business, this article can help. Find out what it takes to build a successful car insurance company in this guide.

A car insurance company is a business that specializes in providing clients with a range of auto policies. The main goal is to give motorists financial protection against the various risks associated with owning and operating a vehicle.

To offer suitable coverage, car insurance companies assess the risk each driver poses and draft policies detailing the terms and conditions. Car insurers then sell these policies in exchange for premiums. You can learn more about how insurance premiums are calculated in this guide.

Just like other types of insurance businesses, ownership of auto insurance companies comes in two kinds of structure:

Stock car insurance company: owned by stockholders, who share the profits and losses

Mutual car insurance company: owned by the policyholders and where the assets are managed for their benefit

Many auto insurance companies also offer products from other lines. These can include homeowners, renters, life, pet, and travel insurance. Offering policies in multiple lines allows insurers to act as a one-stop shop where buyers can purchase coverage for their varying insurance needs. This also gives companies more opportunities to boost profit.

What makes a car insurance business an attractive venture is the strong growth potential that comes with it. But establishing your own firm from scratch entails a lot of planning, hard work, and dedication. Here’s a step-by-step guide to starting your own car insurance company:

Step 1: Create a solid business plan.

If you’re planning to start any type of business, having a strong understanding of how companies operate is a must. This helps you create a sound business plan, which will act as your guide as you steer your car insurance business towards profitability. Having a solid business plan can also help you identify target markets and raise funding for your company.

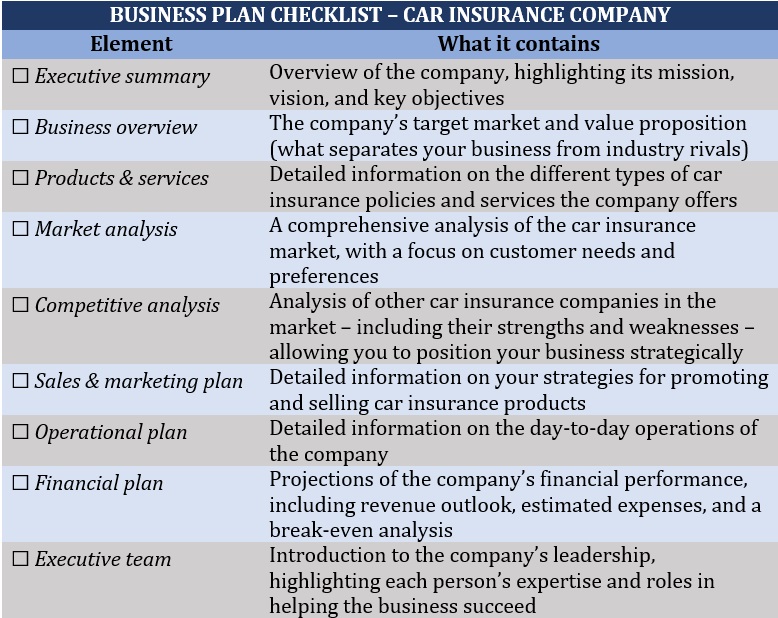

Here’s a checklist of what a comprehensive business plan for a car insurance company consists of:

Step 2: Decide on what car insurance policies to offer.

You can’t start a car insurance company without an in-depth understanding of how the different types of auto policies work. Each state implements varying requirements when it comes to standard coverage, which can make car insurance a complex form of protection.

Bodily injury liability coverage

Mandatory in almost all states, this policy covers the medical costs incurred by another person because of the injuries they sustain from an accident the policyholder caused. It also helps pay for legal expenses if an at-fault driver is sued due to the accident. Some policies provide compensation for lost income and funeral expenses.

Property damage liability coverage

This car insurance policy is required in almost all US states. Also referred to as PD coverage, it pays for the cost of replacing or repairing another driver’s vehicle and damaged property. It also covers legal and settlement expenses if the at-fault driver is slapped with a lawsuit.

Personal injury protection coverage

Personal injury protection, also known as PIP, covers the medical and treatment expenses the policyholder and their passengers suffer because of an accident. This is regardless of who is at fault. Coverage also includes lost wages and the cost of household services if the injury prevents them from performing daily tasks. Some policies provide a death benefit, which can be used to cover funeral expenses.

Medical payments coverage

Medical payments coverage or MedPay works the same way as PIP coverage but with a few differences. Just like PIP, MedPay covers the medical and treatment expenses of the policyholder and their passengers, regardless of who caused the accident. However, it doesn’t cover lost income. Depending on the state, MedPay can serve as supplemental coverage for a health insurance policy or as primary medical insurance after an accident.

Uninsured/underinsured motorist coverage

These car insurance types are often bundled together as they serve the same purpose. They are designed to fill the gap between the costs the policyholder incurs from an accident and the at-fault driver’s ability to pay.

UM coverage compensates the policyholder for the injuries and property damage they sustain if they are hit by an uninsured driver or get involved in a hit-and-run accident. UIM coverage kicks in if the at-fault driver’s car insurance isn’t enough to cover the entire cost of an accident.

Step 3: Secure funding for your car insurance company.

Establishing your own car insurance company can be an expensive project. On average, aspiring insurance business owners will need a startup capital of around $10,000 to $100,000, possibly even more. This amount will help you pay for your daily operational expenses, including rent, equipment, licensing and registration costs, tech expenses, and insurance coverage.

The actual amount you need to start a car insurance company will depend on a range of factors. These include the business’ structure and location, and the types of policies you plan to offer.

Here are the different ways you can raise funding for your auto insurance business:

Business loan: The most common method of raising capital for your startup is through a business loan. You can apply through banks and other lenders. To get approval, you must present a solid business plan and have a good credit history.

SBA-guaranteed loan: The Small Business Administration often acts as a guarantor to help businesses secure bank approval through an SBA-guaranteed loan.

Government-sponsored grants: The federal government implements several financial assistance programs to help fund new businesses. You can visit grants.gov to search for grants to help jumpstart your car insurance company.

Crowdfunding: Crowdfunding websites offer a low-risk option for businesses looking for donors to fund their insurance firm.

Personal funds: You can use your personal savings or sell properties and other assets to finance your car insurance company.

Step 4: Meet licensing and other business requirements.

For your car insurance business to legally operate, you must meet several registration and licensing requirements. The requirements may vary depending on the state where you intend to open your business, but typically include:

Registered name

You need to register the name of your car insurance company and pay a corresponding registration fee. Some states prohibit or restrict the use of certain terms in a business name. This is done to avoid misleading the public.

State registration

All types of insurance companies are required to register as a “resident business entity” through their state insurance commissioner’s office.

Business permits and licenses

Depending on where you plan to operate, you may need to secure a general business permit or license to legally run your company. You can find the complete list of permits and licenses you need on the SBA’s business licenses and permits webpage.

Tax identification number

The Internal Revenue Service (IRS) requires all partnerships and corporations to use their federal employer identification number (FEIN) when filing their taxes. Sole proprietorships or single member LLCs, meanwhile, may use the owner’s social security number.

Step 5. Get the necessary business insurance.

Wouldn’t it be ironic if your car insurance company operated without the necessary coverage? Some of the most essential types of business insurance you need to keep your firm protected include:

General liability insurance

General liability insurance plays a crucial role in protecting your car insurance company against claims of bodily injury or property damage that occur because of your business activities. Coverage also includes reputational harm such as libel and slander, and copyright infringement.

Workers’ compensation insurance

Depending on the state and the number of employees, you may need to take out workers’ compensation insurance for your staff. This policy pays for medical expenses if an employee becomes injured or sick while doing their job.

Health insurance

If your insurance company employs more than 50 full-time workers, the Affordable Care Act (ACA) requires you to purchase health insurance for your employees. If you have fewer than 50 staff, you can take out coverage through ACA’s Small Business Health Options Program (SHOP).

Commercial property insurance

If you own or rent your office space, commercial property insurance is a must. This policy covers damage to your company’s premises. It also pays for lost equipment, fixtures, office furniture, inventory, and supplies.

Commercial auto insurance

You’re legally required to take out commercial auto insurance if your company uses vehicles for business-related purposes. This policy covers the cost of repairing or replacing company vehicles if they’re accidentally damaged or stolen. It also pays for the cost of damage to other people’s property caused by a collision.

There are generally two ways for car insurance companies to make money:

1. Underwriting profit

Underwriting profit is calculated as the total premiums your business has generated for the financial year, minus the amount that your company has paid out in claims.

For example, if your car insurance company has written $10 million in premiums for the year but paid out only $6.5 million in claims, the remaining $3.5 million is considered your underwriting revenue.

2. Investments

Car insurance companies often invest a huge chunk of the premiums they collect in various assets to boost their earnings.

Car insurance companies across the country have written a combined $277 billion worth of premiums, according to the latest market share report from the National Association of Insurance Commissioners (NAIC). The figure represents a 6% increase from $261 billion compared to the previous year.

This also indicates a market heading on an upward trajectory, which presents a massive opportunity for those seeking to venture into the car insurance business.

Of the overall underwritten premiums in NAIC’s recent report, more than three-fourths are from the nation’s top 10 car insurance providers. This also goes to show that an auto insurance business, if managed well, can be a profitable venture.

One way of ensuring that your car insurance company weaves its way towards profitability is to keep abreast of the latest industry trends. You can do so by bookmarking and regularly visiting our Motor & Fleet News section where you can access breaking news and the latest industry updates.

What do you think of our guide on how to start a car insurance company? Do you know of any other tips and strategies for setting up a successful auto insurance business? Key in your thoughts below.

Keep up with the latest news and events

Join our mailing list, it’s free!