How to become a life insurance agent: a guide on how to be successful

How to become a life insurance agent: a guide on how to be successful | Insurance Business America

Guides

How to become a life insurance agent: a guide on how to be successful

Selling life insurance can be a rewarding career, but how can you be a successful life insurance agent? An industry expert shares his advice

What makes a life insurance agent’s job rewarding? Having the opportunity to leave a positive impact on their clients’ lives, especially following a tragic loss. Doing so in a highly competitive field, however, can be challenging.

If you’re thinking whether this is the right direction for you careerwise, then you’ve come to the right place. In this article, Insurance Business will give you a walkthrough of how to become a life insurance agent. We will discuss the pros and cons of the job and give you a checklist of the professional requirements. We will also share insights from an industry expert into what it takes to succeed in this career.

Read on and find out if a career selling life insurance matches your skills and qualifications in this guide.

Life insurance agents are licensed industry professionals tasked with selling the policies of their partner insurers. They typically represent one or several insurance carriers, providing potential clients with information about these companies and the products and services they offer.

Agents also have contracts with their partner insurers detailing what policies they can sell and how much they can expect from selling life insurance.

1. Captive life insurance agents

Captive agents work exclusively with one insurance carrier. If you decide to become one, you can work either full-time for a life insurance agency or as an independent contractor.

One of the benefits of working as a captive life insurance agent is that you often get operational backing from your partner insurers. This can include office space, equipment, and administrative support. You may also receive leads and referrals on potential clients.

2. Independent life insurance agents

Independent agents represent several life insurance companies. The main advantage of being one is that you can offer clients a wider selection of policies since you’re not tied down to a single carrier.

If you choose to be an independent life insurance agent, you will generally earn higher commissions than your captive counterparts. You will, however, need to shoulder your own business expenses such as rent, office supplies, and marketing costs.

The benefits of a life insurance career go beyond pay, notes Peter Roberts, owner of independent life insurance agency Legacy Family Life LLC.

“The best thing about being a life insurance agent is the ability to help people,” he explains. “Most people get into insurance to make a ton of money in commissions, but a good life insurance agent isn’t only able to provide well for their families, they are also able to protect families in general.”

Legacy Family Life offers life and burial insurance policies in 12 states. The company’s partner insurers include Liberty Bankers Life, Mutual of Omaha, Gerber Life, Great Western, Prosperity Life, and AIG.

As a life insurance agent, you act as an expert resource person for clients. They turn to you for help with making smart decisions on which policies are best suited for their needs. Before you can become one, there are several requirements you must meet. Here’s a checklist.

1. Basic eligibility requirements

The eligibility criteria vary by state, but in general, if you want to become a life insurance agent, you must tick all the boxes.

☐ You must be at least 18 years old.

☐ You must be free of any fraud or felony charges.

☐ You must not owe federal or state taxes.

☐ You must not have past-due child support.

☐ You must successfully complete a background check.

2. Pre-licensing education

All life insurance agents are required to get a license to legally sell insurance policies. Completing a pre-licensing coursework is the first step towards getting a life insurance license in most states. This is designed to help you prepare for the state licensure exam.

Some states like Texas don’t require pre-licensing courses. If you’re getting a Texas insurance license, studying for the state licensure exam falls on your shoulders.

Pre-licensing education covers a range of topics, including:

insurance industry regulations

different types of insurance policies

ethics

insurance principles

You can take these courses online or in a face-to-face classroom setting. Each insurance line, also called line of authority, come with minimum mandatory hours:

☐ Life insurance: 20 credit hours

☐ Health insurance: 20 credit hours

☐ Life, accident, and health (LA&H) insurance: 40 credit hours

☐ Property and casualty (P&C) insurance: 90 credit hours

☐ Personal lines insurance: 40 credit hours

You can take courses in more than one line of authority. This will allow you to branch out and sell policies in other insurance lines.

3. Licensure exam

You can often schedule the licensure exam through your state’s insurance regulation department. Do this at least 24 hours before your preferred date. Walk-in examinees are not allowed.

Before you can take the test, you will need to present these documents:

☐ Certificate of completion of pre-licensing education

☐ Proof of payment of testing fee (can range from $20 to $150 depending on the state and insurance line)

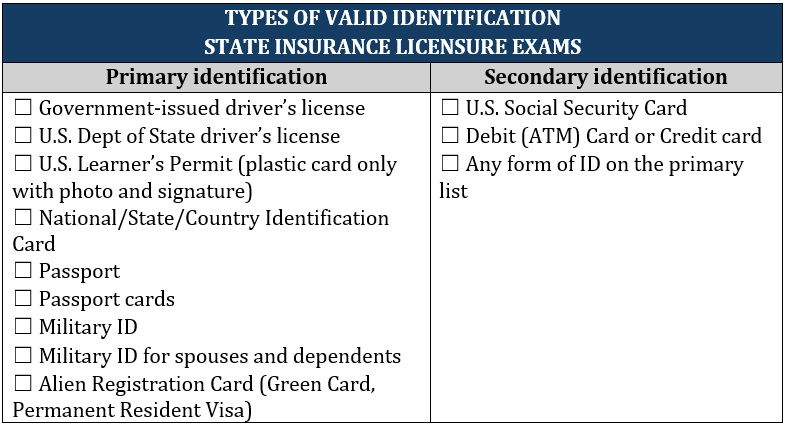

☐ Government issued photo- and signature-bearing identification (see list below):

You may be asked to present one or two valid IDs depending on where you’re taking the exam.

Once clear, you can take the state licensure examination. The tests are divided into two categories:

Life, accident, and health

Property and casualty

Each test consists of 50 to 200 items and needs to be completed within two to three hours. The passing scores vary depending on the state, but generally you need to get 70% of your answers right.

4. License application

Once you pass the state licensure exam, the next step is applying for your license. You can submit your application to your insurance regulation department in your state. Wait a few days after the test results have been released to allow the department to process the results.

Here’s a list of what you need:

☐ License application fee (around $50 but varies by state)

☐ Electronic fingerprint (some states require this for the background check)

Exam results are valid for one or two years, depending on the state. This means you must apply for your life insurance license during the period. If you fail to do so, you will need to take and pass the licensure test again.

5. Get your license

Your state’s insurance department will review your license application and conduct the background check. The process can take anywhere from three to five weeks. If something comes up from the background check, the department may contact you to provide clarity. This can slow down the process.

The department will also inform you of the status of your application through email. Here’s what you need to remember once you receive your insurance license:

☐ Your life insurance license is valid for two years.

☐ Some licenses require 24 hours of continuing education (CE) to be eligible for renewal.

☐ CE must include three hours of ethics-related training.

☐ At least half of the CE credits must be taken in a classroom.

Roberts reminds new life insurance agents to practice due diligence when choosing a company or agency to work for. “The insurance industry is a great industry, but you just have to be guarded in who you trust,” he warns. “Most new agents get taken advantage of. As a new agent, you want to find a team that has strong ethics and values and has a system that you can be successful in.”

Just like any profession, a career as a life insurance agent has its share of advantages and drawbacks. To find out if the role is a good fit, you must first weigh these pros and cons.

Here are some of the benefits and disadvantages of pursuing a career selling life insurance.

Pros of being a life insurance agent

1. Doesn’t require a college degree

Earning a degree is not a requirement to become a life insurance agent, although having one can be an advantage. Some insurance companies and agencies provide training and mentorship programs for new hires to help them learn the ropes of the job.

2. Opportunity to earn a high income

A career selling life insurance policies can be a good way to make money. Life insurance agents are presented with many opportunities to earn a high income with strong potential for growth – but you need the right mindset, according to Roberts.

“The true blessing of being a life insurance agent is the opportunity to serve others and ensure long-term security for their families,” he explains. “Selling life insurance with the right company can allow for an ‘uncapped’ earning potential. The more families you help, the more income you can make.”

3. Flexible work hours

Many life insurance agents get the freedom to set their own work schedules. The nature of the job offers plenty of opportunities to work from home, although you may need to go out to meet with clients in person.

4. Chance to work with the industry’s biggest names

By pursuing a career as a life insurance agent, you can also work with some of the country’s most prominent brands. You can check out our list of the largest life insurance companies in the US to find out where the biggest names in the industry rank.

Cons of being a life insurance agent

1. Commission-based earnings

This can either be an advantage or a drawback depending on your personal situation. If you’re a life insurance agent with an established client base and years of industry experience, you may have more opportunities to close more sales. If you’re an industry novice, you may struggle to find clients in a fiercely competitive market despite working long hours.

For new agents to have a chance, Roberts emphasizes the importance of finding a great mentor.

“The biggest thing to remember is that most people are not cut out to be insurance agents,” he notes. “They are sold the dream they will make all this money, yet they do not have any skills needed in the marketplace.

“This is why over 95% of new life insurance agents fail in their first year of business. You need a great leader and mentor who can show you how to actually succeed.”

2. Sales challenges

Life insurance is not a particularly easy product to sell. Most people do not like to acknowledge their own mortality, so talking about life insurance and what it covers can be challenging. These types of policies also do not provide immediate gratification, unlike car insurance for example, making it a difficult product to sell.

3. Difficulty in finding leads

Finding good leads is the lifeline of a life insurance agent’s career. But it is also the biggest challenge given the stiff competition in the market. There’s a strong likelihood that the leads you find may have already been contacted by several other agents.

4. Rejection and disrespect

Sometimes it doesn’t matter how good your intentions are. In your daily work, you will eventually meet people who treat life insurance agents with disdain and disrespect. You will also receive a lot of nos before getting a yes. That’s why having excellent people skills and an open mind will help you thrive in this career.

Roberts has built a successful career selling life insurance. Here are some of the most important lessons he learned along the way.

1. Success requires dedication and hard work.

Many new life insurance agents enter the profession attracted by the job’s high earning potential, which Roberts sees as a big mistake.

“Being an insurance agent is not easy – at least if you want to be a good one,” he explains. “Most people become agents because they think it will be easy to make a ton of money and have a passive income stream. But that is incorrect. To be a successful agent, you must work harder than you ever expected.”

2. Agents must have a passion for helping others.

A life insurance agent’s career should be built on the desire to help other people, Roberts points out. He adds that the opportunity to help others following the loss of a loved one is what makes the role a “blessing.”

“The most important skill to have as an agent is having ‘a heart of service,’” he notes. “You must have that desire to help and love others and protect families. To be the best life insurance agent, you must care more than others. You must be doing this to serve and help people.”

3. Don’t focus too much on the money.

To succeed as a life insurance agent, you must learn to play the long game and focus instead on building relationships. Roberts notes that one of the biggest mistakes new agents make is expecting to rake in lots of money immediately.

“Most new agents chase money, but end up not making any of it,” he explains. “The best advice is to come into this industry with a mindset of wanting to help others. It’s important to understand that this is not a ‘get-rich-quick’ scheme. This is a long-term business that you are getting into.

“Once you set your expectations on wanting to help other people, you will find a company that honors those values, and you will be able to sell products that do that for you. The end result is that you will provide a great living for yourself.”

4. Find a mentor who will guide you to success.

The life insurance industry is fiercely competitive, which can easily overwhelm new agents. That’s why Roberts emphasizes the importance of finding a great mentor who can help you flourish in your career.

“Life insurance is a beautiful product to sell,” he says. “If you are trained properly and you have a great leader, you can do very well.

“The biggest challenge of being a life insurance agent is finding a team or leader who can show you how to be successful. The problem with the industry is that most agents get licensed thinking that they can make all this money. So, they get signed up under a multilevel (MLM) insurance company and do not get the proper training, leads, support and care that they need.”

One more obstacle, Roberts says, is that many new life insurance agents are left to learn the ropes of the job on their own.

“Another struggle is that the life insurance industry is mainly structured to have insurance agents become their own boss,” he explains. “This means that they have to figure out how to operate their own business and learn essential skills like lead generation, customer service, and sales at a high level.

“The best way to overcome these obstacles is finding a successful mentor who has a proven track record of success and who has a system where they can train you with great resources. A leader who can spend time coaching and guiding you is super important.”

Having a role model that you can look up to is vital in helping you become a successful life insurance agent. To find one, visit our Hot 100 – Leading Insurance Professionals in the USA page. These industry professionals were handpicked by their peers and vetted by our panel of experts as trusted and dependable leaders.

Take the time to learn more about these talented professionals. Find out how they rose through the ranks to become the most respected players in the insurance industry.

Do you think that becoming a life insurance agent is a good move careerwise? Tell us why or why not in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!