How much does it cost to start an insurance company?

How much does it cost to start an insurance company? | Insurance Business America

Guides

How much does it cost to start an insurance company?

If you want to run your own insurance business, you need to raise a lot of funding. This guide breaks down the cost to start an insurance company

Getting an insurance business up and running often requires heavy financing – but how much funding do you really need?

To give you an idea of the overall expenses, Insurance Business breaks down the different costs involved when launching your own insurance company. We will also explore the various ways you can secure funding and keep your business profitable.

If you’re an aspiring insurance entrepreneur but not quite sure if you can afford the startup expenses, you’ve come to the right place. Read on and find out how much it costs to start an insurance company in this guide.

Starting your own insurance company can be an expensive project. You need sufficient funding not just to sustain your daily operations but also to maintain a positive cash flow, especially in the first few years of your business.

Depending on the size and structure of the business, industry experts estimate startup capital of between $50,000 and $500,000, possibly even more. Let’s break down the different costs involved in starting your own insurance company.

1. Licensing fees

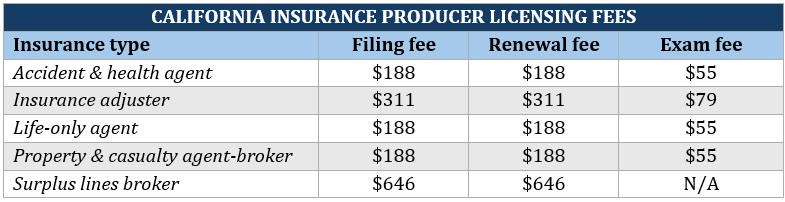

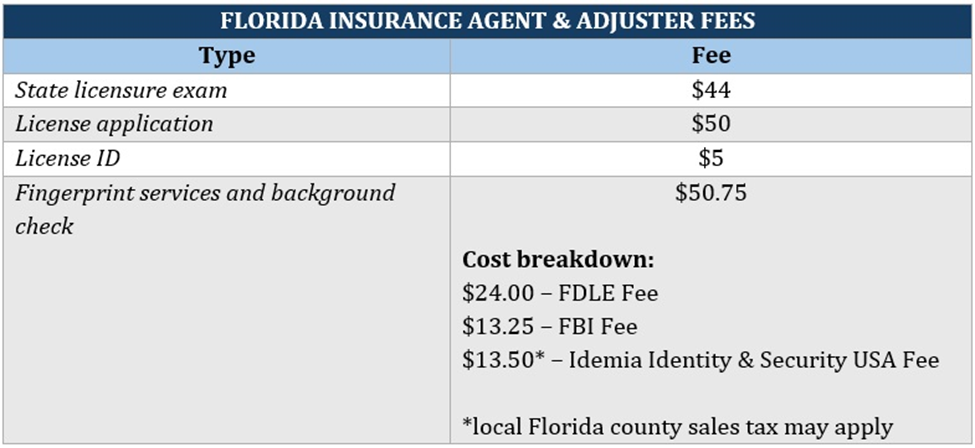

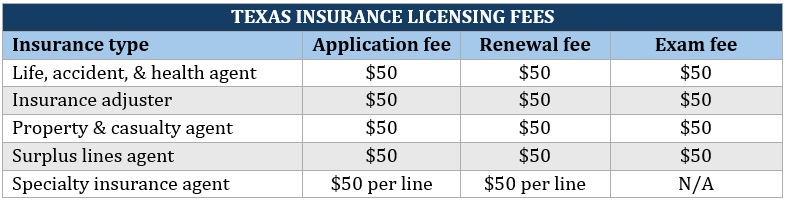

One of the first and most important steps you must take if you’re planning to launch your own insurance company is getting the right licenses. Almost all businesses and professionals operating in the industry need a license to legally provide a product or service. The licensing requirements – including related fees – vary depending on the state and specialization, which have a direct impact on your startup costs.

To illustrate, we will break down the costs of obtaining an insurance license in California, Florida, and Texas.

2. Business licenses and permits

Apart from industry licenses, you may need to secure the necessary business licenses and permits for your insurance company to legally operate. Just like insurance agency licenses, the requirements for getting a business license vary depending on the state.

Here’s a list of business registration and licensing requirements, along with the estimated costs, that you may need to meet to start an insurance company.

State registration

Insurance companies are required to register as a “resident business entity” through their state insurance commissioner’s office. Because each jurisdiction has different requirements, it’s difficult to provide a single estimate of how much state registration fees cost.

To make the process easier, the National Association of Insurance Commissioners (NAIC), has created a portal where you can file your uniform certificate of authority application (UCAA). You can contact the corresponding agency in your state to find out the requirements and how much registration costs. NAIC charges a usage fee of $30 for domestic filings.

You will need to register the name of your insurance company. Some states prohibit or restrict the use of certain terms to avoid misleading the public. Among the information you need to provide to register your business are:

where the business is located

the business structure

ownership and management structure

It may cost you around $300 to register your insurance company.

Business permits and licenses

Depending on your location, you may need to secure general business permits or licenses for your insurance business. These may include:

General business license: $15 to over $300

Sales tax permit: usually a small fee, less than $20

Zoning and land-use permits: the cost depends on several factors, including square footage and construction costs

Health licenses and permits: can range from $50 to $1,000, depending on various factors, including the building’s age and location

Signage licenses: $50 to $350

This step-by-step guide on how to start an insurance company can give you a rundown of the different business registration and licensing requirements.

3. Operational expenses

Once you get your business up and running, you will need funding for your daily operational expenses. Here’s a breakdown of the estimated operational costs when starting an insurance company.

Office space

The cost of renting an office space for your business depends on a range of factors, including:

location: offices in prime locations have higher rental costs

size: a larger office space costs more to rent

amenities: parking spaces, conference rooms, and security push up rental expenses

market demand: if demand for office space in a location is high, rental prices follow

proximity to business district: offices close to business districts are costlier to rent because of convenience and status

Office spaces are also categorized into classes, which are based on amenities, location, and overall quality. Here’s a breakdown of how much it costs to rent an office space based on these classes, according to this industry website.

Cost to start an insurance company – office space

OFFICE SPACE RENTAL COSTS BY CLASS

Class

What it means

Average cost per square foot

Class A

Prime location, state-of-the-art facilities, professional management

$30 to $60

Class B

Decent location with reasonable amenities

$20 to $35

Class C

Affordable location, fewer amenities, may require maintenance or renovation

$10 to $20

Source: ACRE Real Estate Partners

Office supplies and equipment

Having the right equipment plays an important role in helping your insurance business succeed. Equipment-wise, each employee should have access to:

a reliable laptop

strong internet connection

video-conferencing software

a good headset

smartphone with excellent reception

A 2014 study by OPI.net has found that small companies paid the highest to keep their offices supplied. Here’s a breakdown of the costs. Since the estimates are a bit old, the Insurance Business research team adjusted the numbers to account for inflation.

Cost to start an insurance company – office equipment and supplies

OFFICE SUPPLIES & EQUIPMENT ESTIMATED SPEND

Business size

Monthly cost per employee

(2014)

Monthly cost per employee (inflation adjusted)

1 to 4 employees

$77 to $92

$102 to $122

40 employees

$45 to $53

$60 to $70

200+ employees

$27 to $32

$36 to $42

Even if you’re running your business remotely, you will still need to invest in quality equipment. This article shows you how to start an insurance agency from home.

Staffing and compensation

You may choose to operate your insurance company on your own or employ staff. If you choose to hire employees, you’re legally required to provide compensation, including:

salaries

commissions

bonuses

overtime pay

paid holidays, vacations, and sick leave

payment to employees through a profit-sharing plan

annuity plans

Insurance companies on average spend between 50% and 75% of their revenue on employee compensation. This is an insurance business’ single largest expense.

Marketing and advertising costs

Effective marketing is one of the keys to attracting and retaining clients. Insurance companies typically spend between 1% and 10% of revenue on advertising. Since your business is new, you can find affordable ways to build your customer network. These include building a user-friendly website and establishing a professional social media presence.

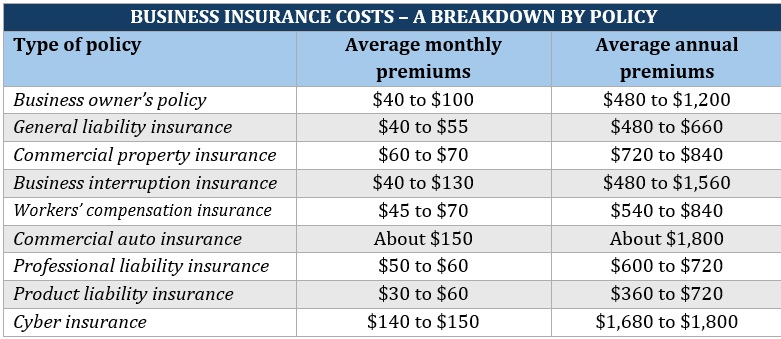

Business insurance

Wouldn’t it be ironic if your insurance company operated without the necessary coverage? Having the right business insurance policies can go a long way to keeping your insurance firm financially protected. Here’s a breakdown of how much premiums for the different coverages cost.

You can use your personal funds to cover the cost of starting an insurance company. These may include money from your personal savings or an amount you raise by selling properties or other assets. But if your personal funds still aren’t enough, there are other ways for you to secure financing to launch your insurance business. These include:

Business loan

This is the most common way of raising capital for a startup business. You can apply for a business loan through banks and other lenders. A solid business plan and a good credit history are often required to get approval.

SBA-guaranteed loan

The Small Business Administration can act as a guarantor to help you secure bank approval through an SBA-guaranteed loan.

Government-sponsored grants

The federal government has several financial assistance programs to help fund new businesses. You can visit grants.gov to look for grants to help you start your own insurance company.

Crowdfunding

Crowdfunding websites offer a low-risk option if you’re searching for donors to finance your insurance business.

The continued growth of the insurance industry presents a big opportunity for business owners who want to start their own insurance company. Insurance products and services remain in high demand as people are always in need of financial protection.

Just like any type of business, running an insurance business requires careful planning and preparation. To keep customers coming and the cash flow running, you must have a clear vision of how to maintain your business’ profitability. Here are some ways for your insurance company to sustain revenue growth.

Set clear targets

Having clear goals gives your insurance company a picture of where it wants to go. You should also have a plan in place for how to reach these targets. If set correctly, these goals can help you measure the success of your insurance business.

Cultivate fresh leads

To succeed in the insurance market, you need to drive leads continuously. This is the lifeline of your business in a highly competitive industry.

Find your niche

Clients’ needs evolve constantly, pushing demand for different insurance products. This gives your business an opportunity to find a niche that will help it grow. This can take a lot of time and effort but can reap dividends in the long run.

Make technology work to your benefit

The insurance industry is increasingly embracing technology to move forward. This is evident in advanced technology such as AI, telematics, blockchain, and cloud computing. Take advantage of these technological innovations to help your insurance company reduce costs, mitigate risks, and attract and retain customers.

Pay attention to employee engagement

Don’t forget to take care of your insurance company’s most important asset – your employees. A great insurance employer provides the best work environment for staff to thrive and grow. A positive workplace culture also contributes to an engaged workforce, which is key to boosting productivity and maintaining profitability.

Do you think you’re ready to start an insurance company? Share your plans in the comments

Keep up with the latest news and events

Join our mailing list, it’s free!