How much do State Farm agents make?

How much do State Farm agents make? | Insurance Business America

Guides

How much do State Farm agents make?

How much do State Farm agents make? Is the figure higher or lower than those from its industry competitors?

State Farm is among the most recognizable brands in the industry, being the country’s largest property and casualty (P&C) insurer that controls almost a tenth of the entire market. Apart from this, it is the top provider of auto and home insurance in the US, taking up about a fifth of the overall share in both lines. These reasons alone make the company an attractive option for professionals wanting to pursue or continue a career as an insurance agent.

But how much do State Farm agents make? That is the question Insurance Business will provide answers to in this article. If you’re working out if taking a job as an agent for the Illinois-headquartered insurance giant is the best move for your career, then this guide can help you make an informed decision. Read on and find out what it takes to be a State Farm insurance agent.

Different employment websites provide varying figures on how much State Farm insurance agents make, that’s why it’s tough to come up with an exact amount. Even the insurer’s website doesn’t disclose how much insurance agents earn. But based on the data Insurance Business gathered, the median annual salary ranges between $36,000 and $47,000.

The table below shows the percentile wage estimates for State Farm agents across the country from this website, which also ranks the top-paying cities for the role.

How much do State Farm agents make – salary range from lowest to highest

PERCENTILE WAGE ESTIMATES (STATE FARM AGENTS)

Percentile

Annual wage

Monthly wage

Weekly wage

Hourly wage

10th

$28,250

$2,354

$543

$14

25th

$36,500

$3,041

$701

$18

Average

$47,365

$3,947

$910

$23

75th

$54,000

$4,500

$1,038

$26

90th

$65,000

$5,416

$1,250

$31

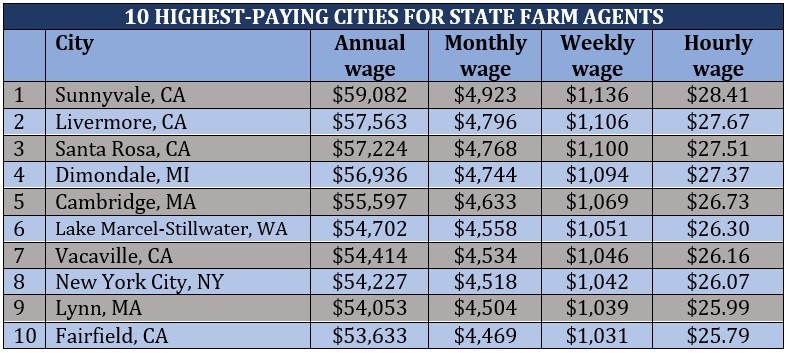

How much State Farm agents make is also influenced by where they sell policies. Because states impose varying rules on how insurance is sold and who can distribute such products, the average pay agents receive is likewise impacted. Here’s a list of the highest-paying cities for State Farm agents.

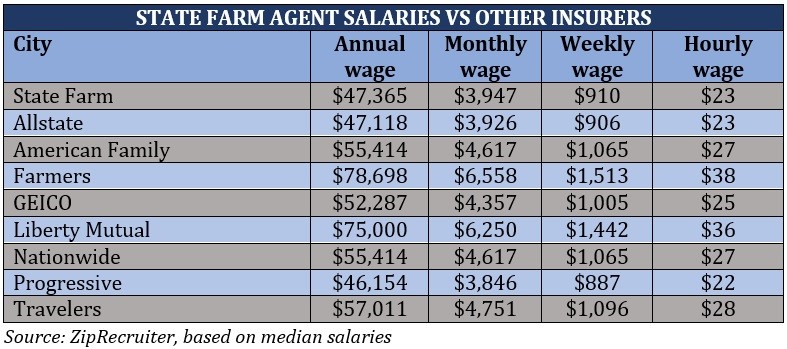

How much do State Farm agents make compared to those from the insurance giant’s main competitors? Here’s a summary of the data we gathered.

As you may have noticed, State Farm agent salaries are not among the highest in the list. Industry rivals Farmers and Liberty Mutual offer insurance agents significantly higher salaries, while the wages from Travelers, American Family, Nationwide, and GEICO are likewise above State Farm’s average. Only Allstate and Progressive give insurance agents slightly lower median salaries.

State Farm agents, however, can also earn income through commissions and other means. The insurer also offers a good benefits and compensation package. We will discuss these topics in more detail in the succeeding sections.

If you want to get an idea of how much insurance agents make in general, you can click on the link to access our guide.

On its website, State Farm listed the following benefits of being an insurance agent for the company:

Access to a wide of insurance products that caters to the different needs of clients

Flexible work schedule

Opportunity to build and lead your own team

Travel opportunities here and abroad

Nationwide advertising and marketing support

Signing bonuses and training programs

Hands-on field development training and continued mentorship from established State Farm agents

Access to 24/7 customer care centers

In terms of compensation, State Farm’s offerings include:

Competitive pay and incentives

Tuition assistance for those who are working on earning their degrees

Time off for agents who need to see a doctor or take a vacation

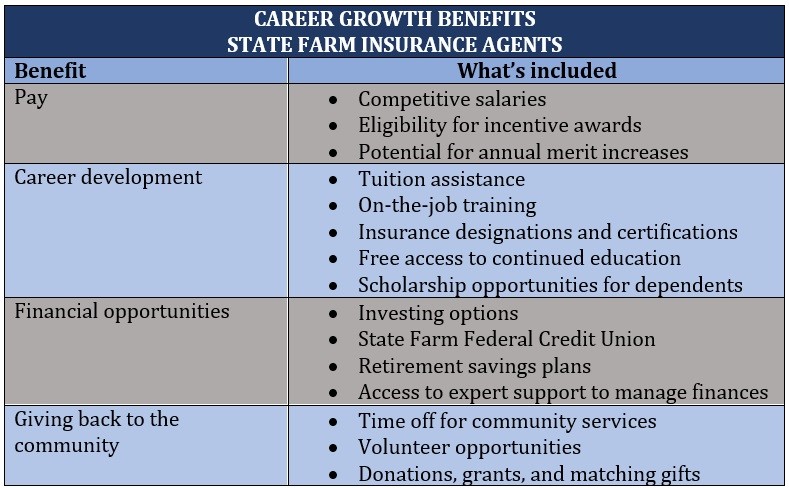

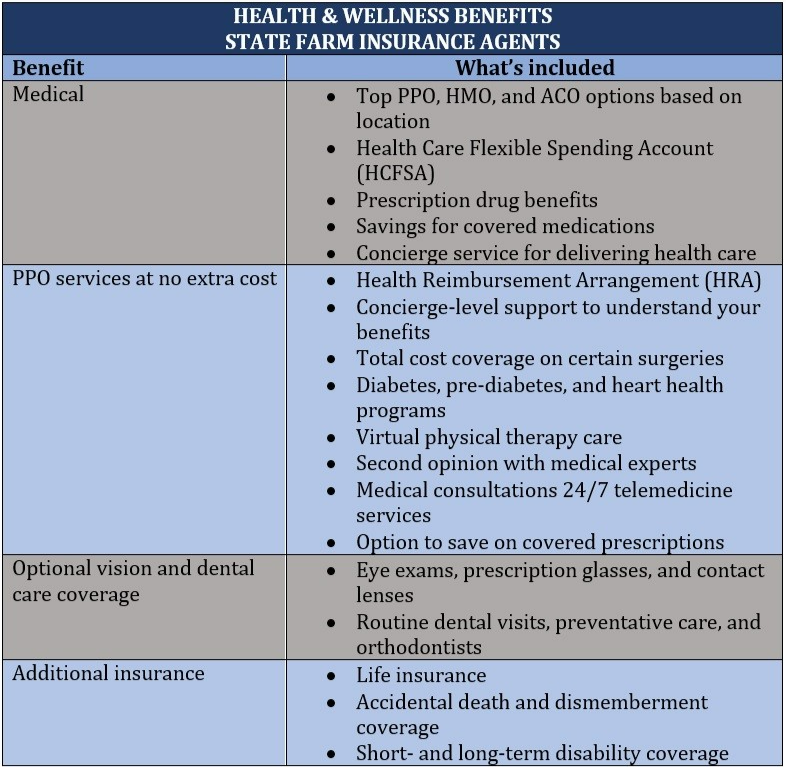

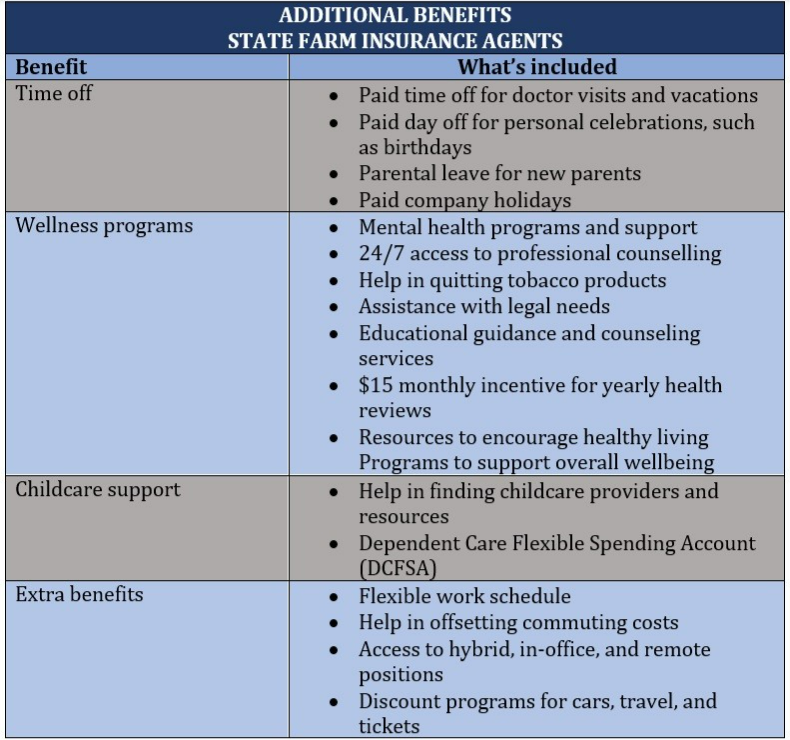

The tables below sum up the benefits insurance agents can access are categorized into three areas:

Career growth

Health and wellness

Additional benefits

State Farm is constantly looking for candidates who share the company’s mission of “working like a good neighbor.” The insurer’s website lists the attributes it is looking for in a candidate, including:

Proven ethical behavior

Passion for networking and building relationships to obtain new customers and retain existing ones

Ability to organize, operate, and assume the risk of running a business with a focus on marketing and customer service

Drive for personal and financial achievement through meeting customer needs

Demonstrated success in driving business results, not necessarily limited to the insurance and financial services sectors

Strong track record of professional success, ideally in external sales, business ownership, or management positions

Positive presence in the local community

Has the financial resources to start and sustain a business

Desire to make a positive difference in people’s lives and the community they serve

Wants a career that is both personally and financially rewarding

Possesses key entrepreneurial traits, including the desire to manage their own time and personal financial success

If you feel that you have all the attributes listed above and have what it takes to be an independent State Farm insurance agent, you can jumpstart your way to your new career by undergoing these 10 steps.

Application: Submit your application to State Farm’s Agency Career Track Program.

Questionnaire: Get an “acceptable” score on a series of questionnaires that predicts the likelihood of your success as an insurance agent. Otherwise, you’ll need to wait for 12 months to be eligible for reapplication.

Assessment: Complete an assessment where candidates are introduced to the skills and attributes needed to become a successful State Farm agent.

Candidate review: State Farm reviews and evaluates your credit history to determine your fiduciary capacity and ability to meet applicable licensing and sponsorship requirements.

Career understanding: Build a better understanding of the role through various learning modules and by talking to State Farm contacts and other candidates.

Business proposal presentation: Present your business proposal to the recruitment and sales leadership team.

Licensing and requirements: Obtain the necessary licenses in your state.

Posting: Once your state licenses are confirmed, you can access a range of agent opportunities across the country.

Site interview: Sales leaders may prefer to conduct interviews for new agents in their market area. If you’ve been selected, a job offer as an agent intern will be made contingent on the successful completion of applicable background and licensing checks.

Internship: Successful candidates will enter State Farm’s internship program for leadership and product training, which includes field development experience with an established agent.

You might have already seen him in a few State Farm commercials, but probably one of the more famous, if not the most famous, agents the company has had was the original Jake from State Farm. Jake Stone was an actual employee of the company but has since moved on. But still, the original Jake continues to have a loyal fan base, still claiming his place among the best insurance mascots of all time.

Apart from being the biggest P&C insurer in the country, State Farm tops the list of the largest home insurance companies in the US, controlling almost a fifth of the market. Among the policies under its home and property lines are:

Homeowners’ insurance

Condominium insurance

Renters’ insurance

Rental property insurance, also known as landlord insurance

Personal articles coverage

Manufactured home insurance

Farm and ranch insurance

Identity restoration coverage

State Farm also accounts for 17% of the nation’s entire auto insurance market based on the figures from the National Association of Insurance Commissioners (NAIC), ranking number one as well when it comes to the largest car insurance providers in the US. The following are the policies under State Farm’s car insurance portfolio:

Auto insurance

Motorcycle insurance

Boat insurance

Insurance for off-road vehicles

Motorhome insurance

Insurance for travel trailers

Roadside assistance coverage

Apart from these, State Farm offers the following coverages:

Small business insurance: Consists of business owners’ policy (BOP), commercial auto insurance, contractors’ policy, liability umbrella insurance, workers’ compensation insurance, and coverage for surety and fidelity bonds.

Life insurance: Term, universal, and whole life insurance

Health insurance: Medicare supplement and supplemental health coverage

Disability insurance: Short- and long-term disability insurance

Pet medical insurance

Liability insurance: Personal, and business and professional liability coverage

The question of whether State Farm is a great company to work for mostly depends on what your priorities are for your insurance career. If you’re looking for a company that is financially stable and provides job security, State Farm ticks the boxes being one of the largest insurers in the US and having a wide range of product offerings.

If you’re looking for an above-average salary, however, State Farm offers an amount that’s lower than most of its industry rivals, although the insurer makes up for this by providing insurance agents with a comprehensive list of benefits. In addition, the company’s commission-based structure for independent agents allows them to earn higher wages the more policies they sell. The drawback to this, based on employee reviews Insurance Business checked out, is that the pressure to sell more can often lead to burn out and exhaustion.

At the end of the day, the best insurance employers are those that provide highly competitive compensation coupled with a positive workplace culture. If you want to know which industry players made our list of the top insurance companies to work for in the US, be sure to click on the link.

Do you think being a State Farm agent is a good career? Is the role worth it if you consider how much State Farm agents make? Chat us up in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!