How do I start an independent insurance agency?

How do I start an independent insurance agency? | Insurance Business America

Guides

How do I start an independent insurance agency?

How do you start an independent insurance agency? We talked to an expert to explain the pros and cons and what it takes to be successful

Unlike captive agencies that sell policies exclusively for their partner insurers, independent insurance agencies offer clients a wider range of coverage from different providers. This is one of the many benefits of running your own independent agency. But just like any type of business, this venture requires careful planning and preparation.

This leads to the question: How do I start an independent insurance agency?

To shed light on this matter, Insurance Business interviewed an insurance entrepreneur who had successfully built her own insurance agency from scratch. She will give us a rundown of the pros and cons of starting an independent insurance agency and what it takes to succeed.

If you’re wondering if opening an agency is the right business move for you, then you’ve come to the right place. Find out what you need to know about launching your own independent insurance agency in this guide.

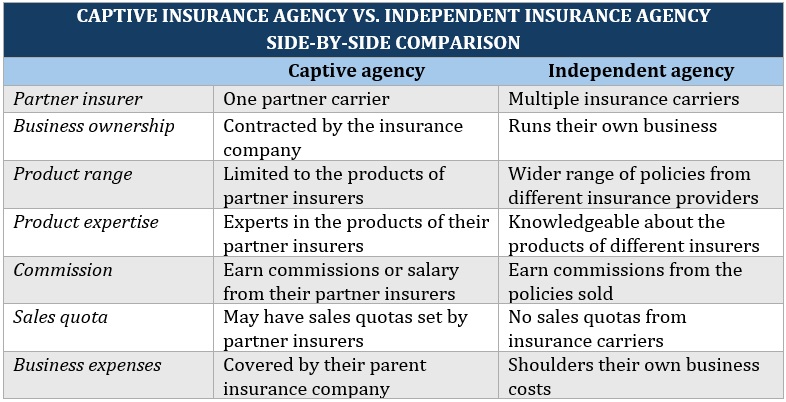

There are two types of insurance agencies: captive insurance agencies and independent insurance agencies. The main difference between these two is the number of insurers they are contracted to work with.

Independent insurance agencies hold partnerships with several insurance providers, allowing them to offer a wider selection of products. This means that clients aren’t locked into buying from a limited number of policies that may be too expensive or don’t match their needs entirely.

By offering more choices, independent insurance agencies ensure that buyers find the policies that fit their unique needs. This can also lead to greater customer satisfaction.

Captive insurance agencies, on the other hand, serve just one carrier. They sell policies for this insurer. Some of the industry’s biggest names partner with captive agencies to sell their products. These include Allstate, Farmers, and State Farm.

Captive insurance agencies can be a good option for first-time insurance buyers who aren’t sure how much coverage they need. Going with captive agencies can make the process simpler as there are fewer policies to choose from. Since these agencies are also experts in the products of their partner insurers, they can give clients a rundown of the different discounts and add-ons they’re eligible for.

Here’s a summary of the key differences between a captive agency and an independent insurance agency:

What makes starting an independent insurance agency an enticing venture is the strong potential for growth. Building a successful insurance agency, however, is no simple feat.

Here are the steps you need to take to launch your own insurance business.

1. Have a sound business plan

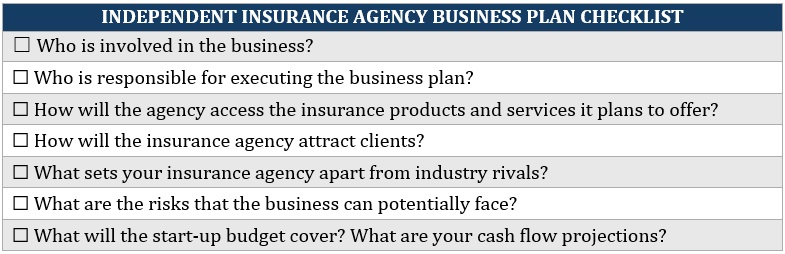

The first step to establishing an independent insurance agency is gaining a deep understanding of how businesses run. An important part of this is having a sound business plan.

A business plan outlines your goals for the business and the steps you intend to take to achieve them. Having a reasonable business plan also helps identify your key markets and raise funding for your agency.

Here’s a checklist of what your business plan should include:

2. Build your industry knowledge

Although it’s possible to start an insurance agency with no experience , it will be hard to sustain your business if you don’t have a solid understanding of how the industry works. Several years of experience as an insurance professional can help build the necessary expertise to run an independent insurance agency.

3. Raise your startup capital

Setting up your own insurance agency often requires heavy financing. The actual amount you need will depend on several factors such as:

what the business structure is

where you plan to launch the business

what policies you intend to offer

Your funding must be enough to cover your agency’s daily operational expenses such as rent, office equipment, licensing, and business insurance. You will also need enough funds to maintain a positive cash flow in the first few years.

5. Get your business insured

It would be ironic if your insurance agency operated without the necessary coverage. Any business would benefit from purchasing the right insurance policies. This guide on the different types of business insurance you should consider can give you an idea of the policies you may need.

Starting an independent insurance agency is just the first step on your business journey. The real challenge is keeping your business profitable.

“Starting an independent insurance agency can be a rewarding venture for the right individual,” explains Jessica Weaver, owner and commercial risk advisor at Weaver Insurance Agency. “But it requires careful planning, commitment, and a diverse set of skills to overcome the inherent challenges and succeed in the competitive insurance industry.”

Weaver set up her own insurance agency in 2009. What started as a family-owned business in Wyoming has since expanded to serve clients in Arizona, Montana, Nevada, and South Dakota. The company offers a range of commercial, farm, and personal lines insurance policies.

Here are what Weaver says are the most essential skills that you need to start your independent insurance agency and keep it running.

1. Deep industry knowledge

Understanding the ins and outs of various insurance products and staying up to date on industry trends and regulations is crucial, according to Weaver.

“I always have my nose in the books,” she says. “I also require my agents to do so. If you do not study, you fall behind. Stay educated and stay fresh.”

2. Business acumen

Insurance expertise should be paired with business savvy. According to Weaver, skills in business management – including finance, operations, and strategic planning – are essential for running a successful agency.

“I started mine without any of that,” Weaver admits. “I had to learn through hard knocks until I decided to put myself through school. I came from a medical career background, none of which required me to know strategic planning. It was a skill I had to learn quickly.”

3. Sales and marketing

The ability to sell insurance products and market your agency effectively is key to attracting and retaining clients, Weaver explains.

“People in general do not like to be sold to. Know your products, be a source of caring and understanding, and show that you are the agent they need by their side.”

4. Customer service

Excellent customer service is the most effective way to set your independent insurance agency apart from your competitors. Another benefit – it often leads to repeat business and referrals.

“Same day phone calls returned, doing what we say we are going to do, and explaining how this industry works is how we have kept wonderful clients over the years,” Weaver says. “Service is number one in our agency. Sales eventually follow from referrals and word of mouth.”

5. Adaptability

The insurance industry is constantly evolving. The ability to adapt to changes quickly is crucial if you want your independent insurance agency to succeed.

“The ability to adapt to changes in the market, technology, and customer preferences is important for long-term success,” Weaver explains. “I came into the industry in 2009 when the economy was tanking. I had no choice but to pivot and adapt as difficulty after difficulty was thrown my way. Today in 2024, post-COVID pandemic, we are pivoting and adapting to the ever-changing hard market.”

Starting an independent insurance agency comes with its share of benefits and drawbacks. Weaver shares what you can expect once you get your business up and running based on her experiences.

Pros of starting an independent insurance agency

1. Autonomy and flexibility

As owner, Weaver has the freedom to make choices on how to run her business. Some of these key decisions include which insurance carriers to work with, which markets to target, and how to structure operations.

2. Diverse revenue streams

“Independent agencies can offer products from multiple insurance carriers. This allows for a diverse portfolio that can appeal to a broad customer base and provide multiple revenue streams,” says Weaver. Like our agency, we provide many options for commercial, farm/ranch, and health insurance, and all personal lines products.”

3. Potential for high income

Owning an independent insurance agency can come with financial rewards, but you have to put in the work. “The income potential is largely tied to my effort and ability to grow the business,” Weaver says.

4. Personal satisfaction

“There’s a significant level of personal satisfaction that comes from building your own business and helping clients find the right insurance solutions to protect their assets and families,” Weaver shares. When clients need their agent during a claim or an audit, this is when Weaver and her colleagues can truly help. “This is when the agency can shine. We will be there with transparency, compassion, and certain skill sets that make a difference in the lives of our insureds.”

Cons of starting an independent insurance agency

1. High initial investment

Weaver cites some basic requirements for an agency:

licensing

office space

technology

marketing

other operational expenses

All this requires capital; you can start small, then build your way up. “I started mine with a very low budget and have built it through hard work and sheer determination,” Weaver shares.

2. Regulatory compliance

“The insurance industry is heavily regulated. Navigating the complex landscape of legal and compliance requirements can be challenging,” Weaver says. She also explains that working on the operations side is separate from running the business. “Staying abreast of the ever-changing legalities can be overwhelming.”

3. Market competition

The competitive nature of the insurance industry requires making your agency stand out and building relationships with your clients. Weaver emphasizes the importance of relationship-building, saying, “Insureds want to do business with people they know, like, and trust. That takes many hours in your community to build that trust.”

4. Risk of failure

The success of an independent insurance agency depends on several factors, such as:

market demand

competition

your business acumen

According to Weaver, worrying about the numbers won’t help. Focus instead on good service, good communication, sheer grit. Don’t give up. “There have been many moments in my career that made me question why I am in this field,” she says. “I always recall why I started it from the beginning – insurance provides a greater good to the community, and that is worth it for me.”

Whether starting an independent insurance agency is a good idea depends on several factors. These include your education and professional background, skills, financial resources, and the market demand in your area.

According to Weaver, launching your own agency can be a good idea if you can tick off these boxes:

☐ You have a solid understanding of the insurance industry and a passion for helping people protect their assets.

☐ You have the necessary business acumen and are prepared to handle the challenges of starting and running a business.

☐ There’s a market opportunity in your area or niche that you can capitalize on.

Weaver points out that conducting thorough market research is essential. This includes creating a detailed business plan and considering the financial and personal risks involved.

“Consulting with industry professionals and potentially working in an insurance agency before starting your own can also provide valuable insights and experience,” she adds. “I had nine months of experience in an independent agency as the CSR before starting mine. Limited experience, but I jumped at the opportunity anyway. The leap of faith was all I needed.”

Did you find our guide on “How do I start an independent insurance agency” helpful? Do you think launching your own insurance agency is a good business move? Let us know in the comments.

Keep up with the latest news and events

Join our mailing list, it’s free!