Hiscox launching ESG syndicate with third-party capital target

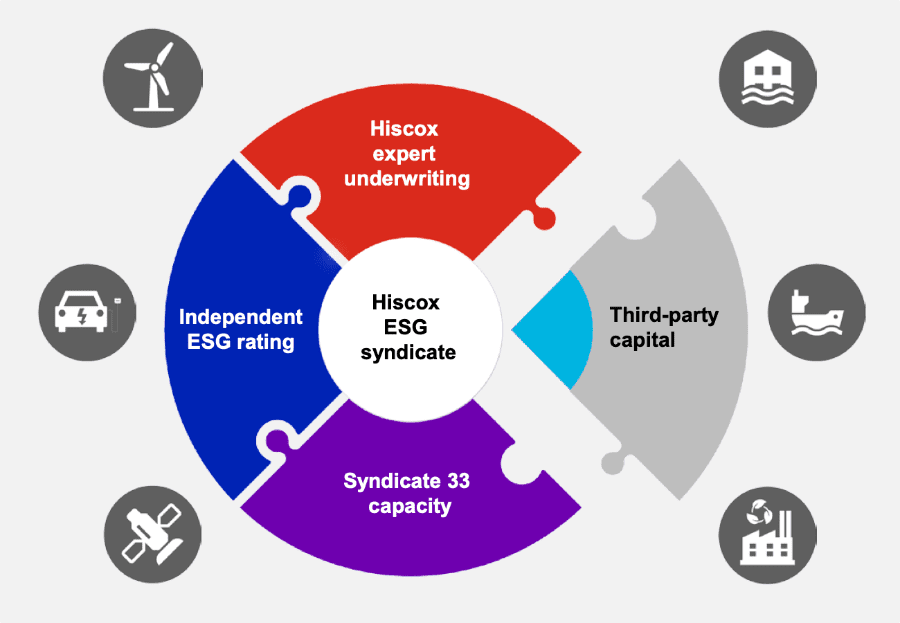

Hiscox has announced the launch of a new environmental, social and goverance (ESG) focused underwriting syndicate at Lloyd’s, for which it will look to partner with third-party capital partners in time.

CEO Aki Hussain announced this morning that the insurance and reinsurance firm plans to target deliver of an ESG-focused underwriting strategy, to also capitalise on investor demand for ESG-appropriate investments.

Speaking during a briefing, Hussain explained, “We’re launching an ESG syndicate, or sub-syndicate. Now, we see this as being a significant long-term growth opportunity, as around the globe economies increasingly invest in transition and green technologies.

“We will stay focused on our specialist areas, in those areas that we understand and know well and combine that specialism with investing in new capabilities, which we will build over time.”

Hiscox will operate the new syndicate, as a sub-syndicate, on which Hussain said, “At this early stage, this syndicate will be nested within our flagship syndicate 33.”

Adding, “This is in the early stages of development, it is a really exciting development for us. ”

The syndicate will leverage Hiscox’s existing relationships, drawing on in-house expertise in renewables and power focused opportunities, such as in electric vehicles and infrastructure.

The idea is to develop a sustainable underwriting strategy, that can deliver ESG-appropriate products and returns, which Hiscox set to be selective.

Hussain said that, “We’ll be using a third-party screening tool, to ensure each of the risks meets the ESG characteristics required by the syndicate.”

To begin the ESG syndicate underwriting strategy will leverage capacity from Hiscox’s syndicate 33, but in time, the goal is to partner with capital providers and investors with an appetite for ESG-appropriate returns to achieve further scale.

Hussain explained that, “In time, we’ll be marketing this syndicate to third-party capital providers, who want access to clients with ESG-positive characteristics and access to Hiscox’s first class underwriting.”

It seems likely that the plan would be for Hiscox’s new ESG syndicate to spin out of 33, once it has the scale necessary to become a Lloyd’s syndicate strategy in its own right.

Finally, Hussain said, “This is a client-centric proposition, as opposed to a customer-centric proposition and we’re all pretty excited about it, so watch this space.”

Hiscox won’t be the first with an ESG strategy backed by third-party capital at Lloyd’s. Beazley gained that honour with its ESG underwriting consortium that sits within Syndicate 4321, under the Lloyd’s Syndicate In A Box (SIAB) framework.

Investor interest in Beazley’s ESG syndicate was strong, we understand, with some backing sourced from investors that also allocate to ILS opportunities and Hiscox should find investor appetite abundant for its new ESG strategy as well, we’d imagine.