Higher layer reinsurance demand can drive catastrophe bond market growth

One of the talking points at the Monte Carlo Rendez-Vous over recent days was the expectation that more demand for catastrophe reinsurance will emerge at the higher layers of ceding company towers, something which should help to ensure the catastrophe bond market continues to expand.

While there’s evident demand for more catastrophe reinsurance at lower, or working layers of towers too, these seem less likely to be satisfied, with appetite among both reinsurers and insurance-linked securities (ILS) funds remaining diminished for lower-layer cat risk.

There’s a recognition in the market that buyers failed to secure as much reinsurance as they wanted at the January 2023 renewals, or some purchased less due to cost.

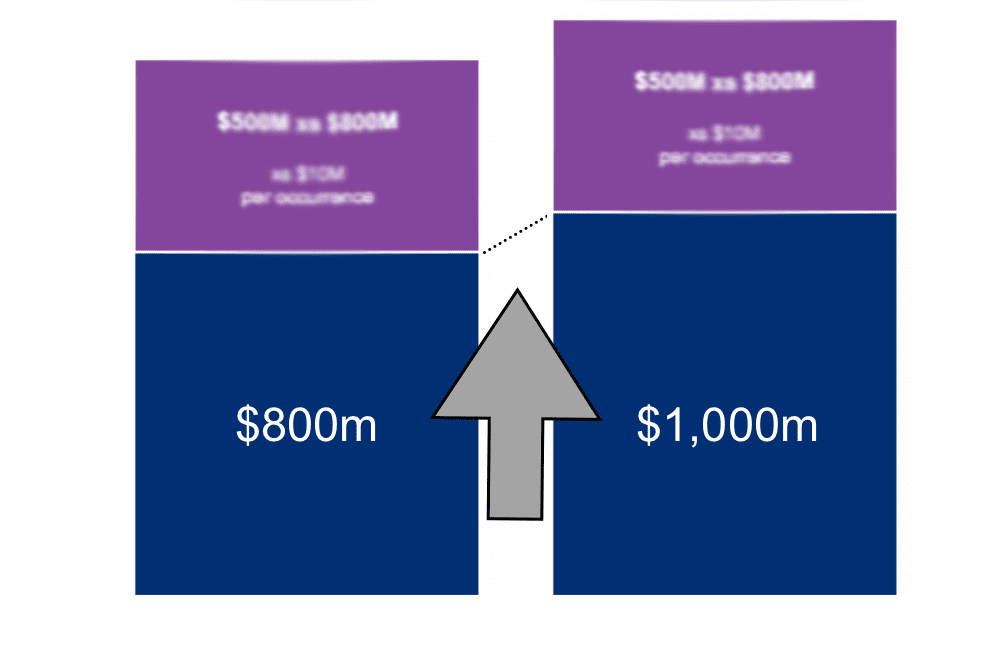

As a result of which, it’s expected we’ll see more catastrophe reinsurance buying in the upper-layers of towers, as cedents look to fill them out more in what is anticipated to be an easier renewal environment.

Renewal costs may not come down much, but cedents now seem accepting of higher prices, at least to a degree.

But, their reinsurance brokers are certain to be pushing for reductions at those upper-layers, where it’s already anticipated the renewals could be particularly competitive, as more demand comes in and the cat bond market looks primed for further expansion and has been competitive on price.

Aon’s Reinsurance Solutions chief Andy Marcell said as much recently and the feeling in Monte Carlo was that all brokers will push for a more competitive solution for their clients at the January 2024 renewals and intend to leverage the appetite of the capital markets and ILS investors to try and make things as competitive as possible.

KBW’s analysts team picked up on this thread in a report, saying that, “Reinsurers expect growing industry-wide demand for catastrophe reinsurance in 2024, mostly to add protection above current towers in response to rising exposure, with some openness to (likely very costly) lower layers for a few cedents whose attachment points rose too much in 2023.”

In addition they said, “Catastrophe-exposed property risks moving from large admitted carriers – whose rates and policy language are more tightly regulated – to often-small non-admitted carriers and MGAs should also translate into incremental well-funded (via rate increases) demand.”

Which should all feed into both a more competitive renewal, as those higher-layer catastrophe reinsurance participations are going to be attractive at the rates currently available in the market, as well as an opportunity for the catastrophe bond market to further expand and increase its relevance to cedents.

With cat bond fund managers seeing particularly strong investor demand at this time, a well-managed pipeline of deals is already forming for the end of the year and there appears the capacity to add more cedents, should demand prove stronger than anticipated.

All of which could mean that 2023 ends with an even more impressive cat bond market issuance record than has been anticipated, while given the time to get new cedents to market with debut cat bonds can be quite long, this should also bode well for issuance in early 2024 as well.

It remains to be seen just how competitive things will get, but we are also hearing of some ILS funds planning higher-layer collateralized reinsurance strategies, which could prove attractive to investors looking at a cat bond-like level of risk and return, but with greater diversification and perils or regional variation.

Read all of our coverage from this year’s Monte Carlo Reinsurance Rendez-Vous here.