Higher attachments clear in ILS fund recovery since hurricane Ian

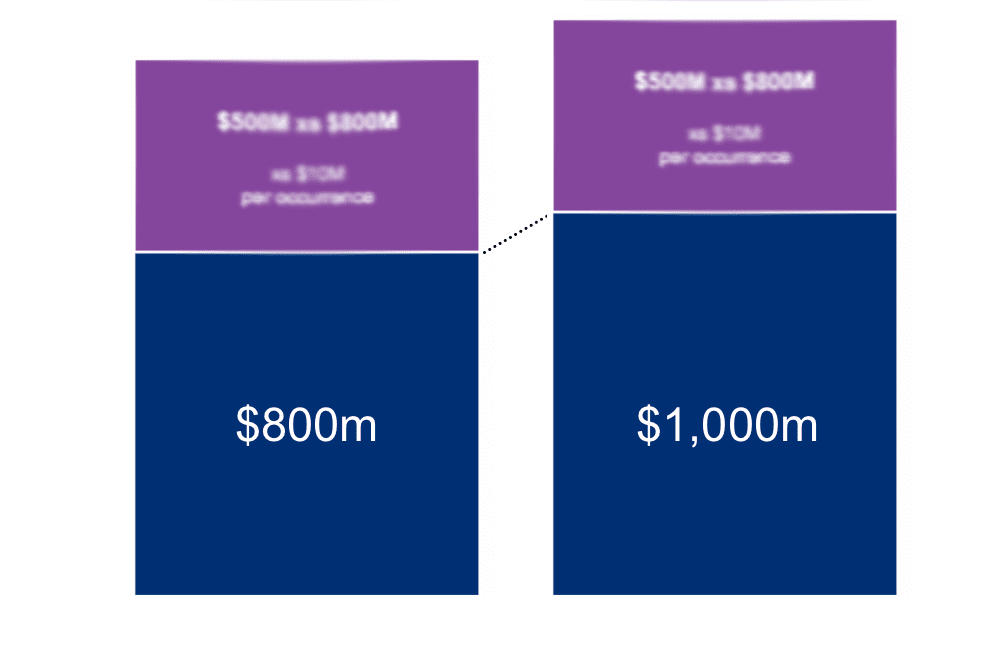

One of the key drivers for some insurance-linked securities (ILS) funds in their strong recovery following September 2022’s hurricane Ian struck Florida is the fact many of the contracts they had written were at higher attachment points, and so have avoided losses.

In fact, it is beginning to look as if hurricane Ian has provided the first test and clear results of the improvements made to the risk-return profiles of many ILS funds at renewals last year, improvements that have of course continued and perhaps accelerated through the reinsurance renewals in 2023.

This is particularly relevant to the collateralized reinsurance and retrocession contracts underwritten and allocated to by ILS funds that also invest in private ILS arrangements, as well as catastrophe bonds.

There has been some evidence of higher attachment points in cat bonds also benefiting funds and their investors, in deal’s that ended up escaping exposure to hurricane Ian that in older vintages might not have, but the effects are much clearer when you look at the collateralized side of the ILS market.

While cat bond attachments have risen in some cases, the cat bond market was also generally operating in the higher-layers of reinsurance and retrocession towers anyway.

On the private ILS, so the collateralized reinsurance and retro side, the elevation of attachment points as the market hardened has been far more pronounced, resulting in clearer benefits as many contracts ILS funds had exposure to turned out to avoid too much erosion from Ian.

This has been evident in two ways. First in the releases seen from side pockets set up for potential losses from the storm and the reduction in collateral trapped due to hurricane Ian exposure, as we’ve previously documented.

But second, in the way certain reinsurance program layers never even drove any trapping of collateral, which some ILS fund contacts suggest has clearly demonstrated the higher attachments, even though the hurricane industry loss estimate hovers at close to $50 billion.

At that level, had this been a couple of years prior, we’re told by ILS fund sources that the trapping of collateral could have been far more wide-spread in portfolios and more losses realised after the storm.

The fact many ILS funds writing collateralized reinsurance and retro, that had relatively significant exposure to Florida, came away from hurricane Ian with still near break-even, or better, returns for full-year 2022, was perhaps the first clear sign that the quality of the underlying ILS portfolios in the market have improved.

Of course, that would be to be expected, given the higher pricing and tighter terms and conditions being installed across reinsurance markets.

But, some sources now suggest that in 2023 the effect of this should be even more pronounced, with higher attachments set to help ILS funds avoid certain losses and reduce their losses, even when major catastrophe events occur.

In recent weeks we’ve had another sign of the improvements in the quality of ILS fund portfolios, as impacts from the heavy severe convective storm losses in the United States have been extremely limited, we’re told, with erosion of aggregate deductibles the main effect seen.

Even that, the erosion of the buffers sitting beneath aggregate reinsurance triggers, is now far less of an issue for many ILS funds, as the reduction in exposure to aggregate reinsurance and retrocession arrangements has reduced that issue for the market.

Overall, it seems the changes and improvements made to ILS fund portfolios are showing through some of the more recent loss activity. The important thing to see now, for investors, is that terms aren’t eroded and attachments lowered, if capital flows back in more meaningfully again.

Also read: Higher reinsurance attachment points the real hard market story: Jefferies.