Health premium "pressure" is on for PM Albanese

Health premium “pressure” is on for PM Albanese | Insurance Business Australia

Life & Health

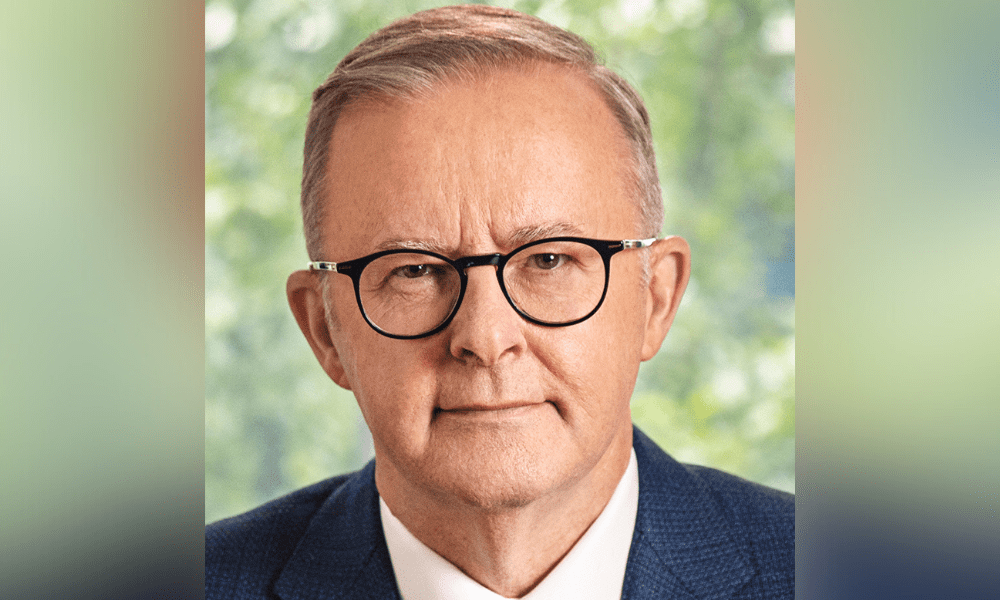

Health premium “pressure” is on for PM Albanese

How will the prime minister address this burning issue?

Life & Health

By

Noel Sales Barcelona

The pressure is on for Prime Minister Anthony Norman Albanese and the ruling Labor party, as influential lobbyists from major healthcare providers stress the need for an “independent umpire,” which will determine how high insurance premiums can rise as it already ignited a war in costs, according to an Australian Financial Review (AFR) report.

The report said that the Australian Medical Association (AMA), representing thousands of doctors in the country, and Catholic Health Australia (CHA), a major operator of private hospitals, both want the question of how much premiums increase taken out of the hands of the government.

Citing the submissions by the two groups to Australia’s health department, the AFR report noted that both groups argue that private health insurers may be gouging consumers with management fees that have risen 30% in just four years.

The submissions come ahead of meetings between insurers and the Health Department to negotiate next year’s premium hikes, AFR reported. Loss making hospitals have warned that unless insurers contribute more funding, there could be a rash of closures, the report said.

A political landmine

Based on the current system, the increase in insurance premiums, which determines how much funding should go to private hospitals, is being decided by the health department once a year.

The situation threatens to turn into a “political minefield” according to AFR, since health minister Mark Butler will need to give his approval. He approved a 3% premium hike this year – the largest annual increase since 2019, AFR reported.

However, the announcement has been delayed until after the Dunkley byelection. Nevertheless, since most of the marginal electorates suffer from high rates of private health insurance coverage, this is a sensitive issue for an election, said the report.

Since Butler’s decision in April, hospital operators have intensified their lobbying efforts to push insurers to contribute more the the system, AFR reported.

Stakeholders asking for more transparency

Meanwhile, Coalition health spokesperson Ann Rushton said there should be more transparency and due process from the government when it comes to private health insurance premiums, for the benefit of patients and our entire health system.

“The government’s desperation to hide [last year’s] increase in the midst of the Dunkley byelection meant that customers were given the least amount of notice of a premium change in 15 years,” she told AFR, referring to private health insurance.

In the submissions, the report said that the AMA has singled out a 32% (equivalent to $760 million) increase in insurers’ management expenses over the four years to the end of June 2023, as an area of concern.

To ensure transparency, both the AMA and the CHA called for the creation of an independent regulatory mechanism to oversee the private healthcare system, including overseeing health insurance premium settings, the report said.

But the insurance industry seems “uncomfortable” with the idea of creating another regulatory body, saying the tax money can be put somewhere else.

“All prioritise consumers’ interests. Spending millions of dollars to create a new authority will not solve any of the problems currently facing the private health system,” Rachel David, the chief executive of industry group Private Healthcare Australia, told AFR. She also added that all the information that the public needs to know about health funds’ operating costs is already available.

Nevertheless, the insurance sector agreed that there should be more information about how management fees are reported including costs associated with call centres, processing claims, cybersecurity, and preventative health programs.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!