Hannover Re grows retrocession protections by 56% at January renewals

During a January 1st renewal season the reinsurer describes as a very challenging market environment for all participants, Hannover Re secured an increase in natural catastrophe retrocession, including the expansion of its capital markets backed K-Cessions quota share sidecar facility of almost 85% to $831 million.

An announcement from the firm today around its experience at the January 1st, 2023, reinsurance renewals, reveals that all but one of Hannover Re’s main retrocession protections are larger for 2023, which follows consecutive years of the German reinsurer shrinking its retro program at 1/1.

After contracting the size of its K-Cessions quota share retro reinsurance sidecar facility at the 2021 renewals by 10% to $610 million, the company reduced the size of this sidecar by a further 26% at the 2022 renewals to $450 million.

This year, however, market conditions were conducive for the reinsurer to reverse the trend of the past couple of years, as Hannover Re has reported an 85% year-on-year increase in the size of its K-Cessions quota share retro sidecar to $831 million, taking it above the size seen in 2020 when it was renewed at a size of $680 million.

The K-Cessions retro structure is important for Hannover Re, allowing the company to partner with institutional and insurance-linked securities (ILS) capital investors within its retro program, sharing its underwriting profits and losses. In the past, the firm has described the sidecar structure as the backbone of its retro arrangements.

So, it’s promising to see this important part of its overall retro program grow once again, which suggests that ILS market support for these structures has picked up somewhat after consecutive heavy loss years dented the attractiveness of quota shares.

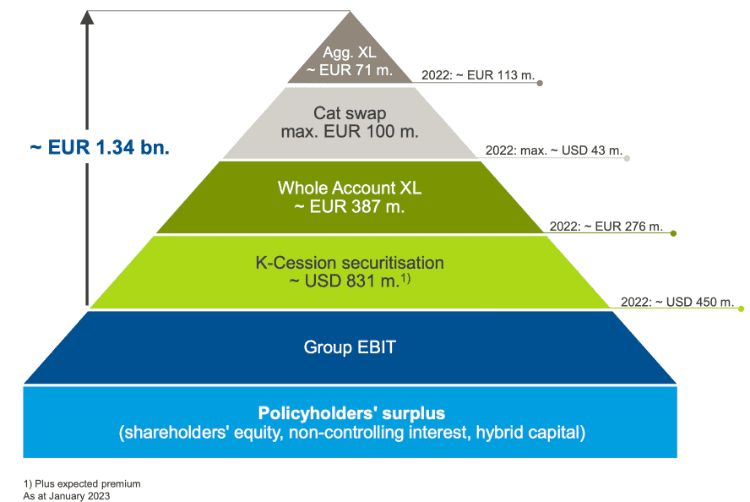

Hannover Re’s retrocessional reinsurance arrangements for 2023 can be seen in the diagram below:

The European reinsurer’s core retro protections also include its large loss aggregate excess-of-loss worldwide retro reinsurance arrangement, a number of catastrophe swaps, and a whole account excess of loss retrocession cover.

Of these, the large loss aggregate excess-of-loss worldwide retro arrangement was the only slice to shrink year-on-year, falling from EUR 113 for 2022 to EUR 71 million for 2023, which is significantly lower than the EUR 225 million secured for 2021.

The only piece of Hannover Re’s retro tower to grow in 2022, the catastrophe swaps, expanded further at the 2023 renewal. Sized at $43 million for 2022, Hannover Re has today announced that this has grown to EUR 100 million ($107m) for 2023.

Next on the tower sits the company’s whole account excess of loss retrocession cover, which after being renewed at EUR 337 million for 2021, came down by 21% to EUR 265 million at the 2022 January renewals. However, for the 2023 renewal, Hannover Re has increased the size of this retro protection by 46% year-on-year to EUR 387 million.

Alongside these core protections, Hannover Re’s retro programmes for 2023 includes a new cyber quota share retrocession facility of $100 million, which is backed by New York based asset manager, Stone Ridge Asset Management.

The reinsurer says that it sought long-term partners at the January 2023 renewals to participate in reinsurance rate improvements.

Overall, Hannover Re’s natural catastrophe retrocession programme has grown by more than 55% year-on-year, from EUR 860 million for 2022 to EUR 1.34 billion for the 2023 calendar year, with the firm noting a further improved volatility profile.

The growth in its retro programmes comes as the firm grew the premium volume of its natural catastrophe book of business by around 30% at 1/1, with further growth expected in the upcoming renewals.

As a result of the above, Hannover Re has also revealed a rise in its large loss budget from EUR 1.4 billion to EUR 1.725 billion, as it notes that growth in 2022 was significantly higher than expected when it set its 2022 nat cat budget. Further, it expects the 2022 underwriting year growth to also influence growth in cat claims exposure in full-year 2023.

At the January 1st, 2023, reinsurance renewals, Hannover Re this morning announced that it achieved an inflation-and-risk-adjusted price increase on renewed business of 8% in traditional property and casualty reinsurance.

All in all, treaties with a volume of EUR 9.87 billion, or 63% of the business, were up for renewal as at 1 January 2023. Hannover Re renewed a premium volume of EUR 8.494 billion, while treaties worth EUR 1.376 billion were either cancelled or renewed in modified form.

The company says that it saw the strongest price momentum since 2005, driven by an imbalance of supply and demand on the back of inflation and elevated natural catastrophe exposure.

Jean-Jacques Henchoz, Chief Executive Officer of Hannover Re, commented on the renewals, “We had to take some conscious decisions on portfolio steering in order to respond to the market challenges. As a result, we have achieved a durable improvement of the quality of our portfolio from which we will benefit in the long run.”