Global insured natural disaster losses at least $58 bn for H1 2024: Aon

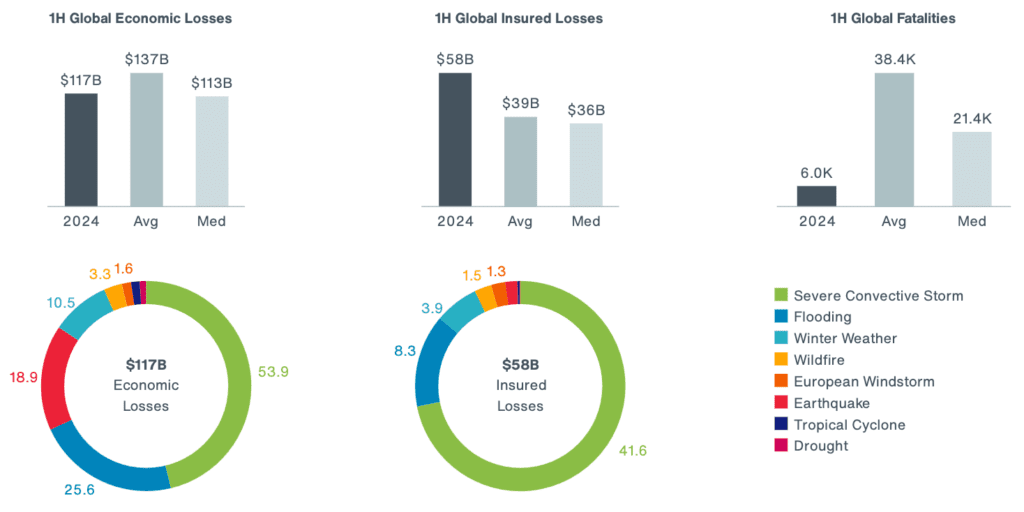

According to insurance and reinsurance broker Aon, global insured losses from natural disasters will come in above $58 billion for the first-half of 2024, which is well-above the 21st century average, but lower than the last three years when adjusted for current prices.

The brokers’ Impact Forecasting unit said that its preliminary estimate is for more than $117 billion in economic losses from global natural disasters in the first-half, which is lower than the 21st century average and significantly lower than the $226 billion recorded for H1 of 2023.

As a result, the protection gap was around 50%, which Aon notes is lower than normal and attributes this to a high-contribution from severe convective storm (SCS) losses in the United States, where insurance penetration is higher.

In fact, the protection gap is one of the lowest on record for the first-half, as US natural disasters accounted for nearly 80 percent of global insured losses in H1 2024, reaching nearly $46 billion, Aon explained.

Aon’s estimate for over $58 billion of insured catastrophe losses around the globe in H1 2024 compares to Gallagher Re’s estimate of at least $61 billion.

30 economic loss events exceeded $1 billion H1, while the most costly for the insurance and reinsurance market was a US SCS outbreak in March, estimated at $4.7 billion.

22 of the billion-dollar economic loss events were in the United States, but Japan’s Noto earthquake on January 1st was the costliest, causing over $17 billion in direct damage.

“It is great to see a lowering of the global protection gap, which is a result of the high levels of insurance coverage for the SCS events observed in the first half of 2024,” explained Michal Lörinc, head of Catastrophe Insight at Aon.

“However, the re/insurance industry needs to continue its efforts to increase levels of insurance in emerging markets, through provision of not just capital and capacity, but also advanced data and analytics, which help to qualify and quantify the risk, and ultimately shape better decisions,” Lörinc added

Andy Marcell, global CEO of Aon’s Risk Capital and Reinsurance Solutions, also said, “Our Risk Capital experts leverage analytics to bring capital to clients and ensure that the impact of natural catastrophes is spread across the risk transfer chain to protect communities and businesses.”