Gallagher Re publishes report on the impact of Hurricane Debby

Gallagher Re publishes report on the impact of Hurricane Debby | Insurance Business Australia

Insurance News

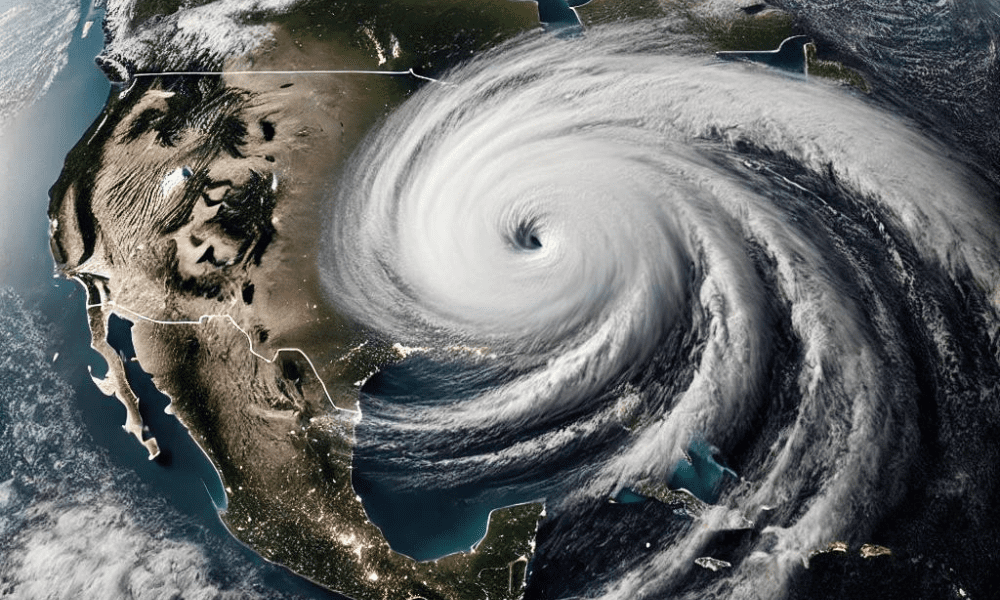

Gallagher Re publishes report on the impact of Hurricane Debby

NFIP take-up rates in coastal counties are up

Insurance News

By

Kenneth Araullo

Hurricane Debby, the second hurricane of the 2024 Atlantic season, is projected to result in combined wind and water-related insured losses between $1 billion and $2 billion for the private insurance market and public entities, including the National Flood Insurance Program (NFIP) and the USDA’s Risk Management Agency (RMA) crop insurance program, according to Gallagher Re.

The financial loss estimates are preliminary and may change as the event unfolds, particularly as rain and flooding continue across the Southeast.

Economic losses from Debby are expected to be significantly higher than insured losses. Gallagher Re notes that while NFIP take-up rates in coastal counties of Florida, Georgia, and the Carolinas range from 10% to 50%, the percentage of active policies drops significantly inland.

This suggests a substantial portion of flood damage may be uninsured, especially as the storm’s impact extends into the Mid-Atlantic and Northeast, where NFIP participation is also low. Additionally, the agricultural sector is likely to experience notable impacts.

Debby made landfall in Florida nearly a year after Hurricane Idalia’s landfall as a Category 3 storm in August 2023. Many residents in the Big Bend area were still in the recovery and rebuilding process when Debby struck, just miles from Idalia’s landfall site.

Gallagher Re highlights that recent Category 1 hurricanes in Florida have typically led to insured losses around $1 billion, primarily due to wind impacts. However, Debby’s stalling nature and heavy rainfall caused oversaturated soils, leading to more extensive wind-related damage than might be expected from a weaker storm.

Preliminary assessments suggest that while wind-related damage was less severe than initially feared, insured losses could still reach into the hundreds of millions of dollars. The widespread presence of trees and brush in northern Florida, Georgia, and the Carolinas contributed to the damage, as saturated soils made it easier for even moderate winds to topple trees.

Flood-related insured losses are expected to be more complex, with significant impacts already reported and more likely to emerge as the storm progresses. Gallagher Re anticipates that the private insurance market will face losses in the hundreds of millions of dollars, particularly from auto policies and privately underwritten residential or commercial flood policies.

NFIP payouts are also expected to reach into the hundreds of millions of dollars, depending on the final extent of the rainfall and flooding. For comparison, Hurricane Florence in 2018 resulted in $920 million (adjusted to 2024 dollars) in NFIP payouts.

Gallagher Re emphasizes that NFIP participation drops sharply in inland counties, increasing the likelihood that a significant portion of flood damage will go uninsured. In 2023, NFIP payouts from Hurricane Idalia exceeded $380 million, with most losses concentrated in the Tampa Bay area.

The overall expectation is that Debby will be a manageable event for the reinsurance industry, with combined wind and water-related insured losses falling within the $1 billion to $2 billion range.

Debby is the sixth hurricane to make landfall in Florida in August since 1990 and follows Hurricane Beryl’s record-breaking path earlier in the 2024 season.

As of the latest reports, Debby has caused at least seven fatalities and left over 350,000 customers in Florida without electricity at its peak, with additional outages reported from Georgia to the Carolinas. Thousands of flights were canceled or delayed, and the governors of Florida, Georgia, North Carolina, South Carolina, and Virginia have declared states of emergency.

What are your thoughts on this story? Please feel free to share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!