Fuse re/insurance communications platform launched by Sean Bourgeois

Having successfully exited his previous start-up Tremor, Sean Bourgeois is back very quickly with another, launching Fuse as a modern, secure communications platform for the global commercial insurance and reinsurance industry.

Bourgeois was the founder of programmatic risk placement company Tremor Technologies and has now turned his hand to modernising the way insurance and reinsurance market participants manage their communications.

Recently, Bourgeois revealed on Linkedin that Tremor had “successfully exited” and that a new insurtech start-up was in the works.

With the industry still laser-focused on the importance of the relationships participants build with brokers, counterparties and markets, modernising the flow of communication seems a logical next step.

Giving market participants the ability to communicate more easily, seems a natural progression to Bourgeois’ efforts and an area where efficiencies can be realised by all those involved in the risk transfer chain.

“A common communications layer is entirely missing in the commercial insurance and reinsurance industry – this technology is commonplace and vital throughout most capital markets,” Sean Bourgeois, fuse Founder & CEO explained.

He continued, “I believe, if executed properly, a modern commercial re/insurance communications platform will be welcomed by industry participants and have the potential to revolutionize how the market meets, negotiates and transacts.”

He continued, “I believe, if executed properly, a modern commercial re/insurance communications platform will be welcomed by industry participants and have the potential to revolutionize how the market meets, negotiates and transacts.”

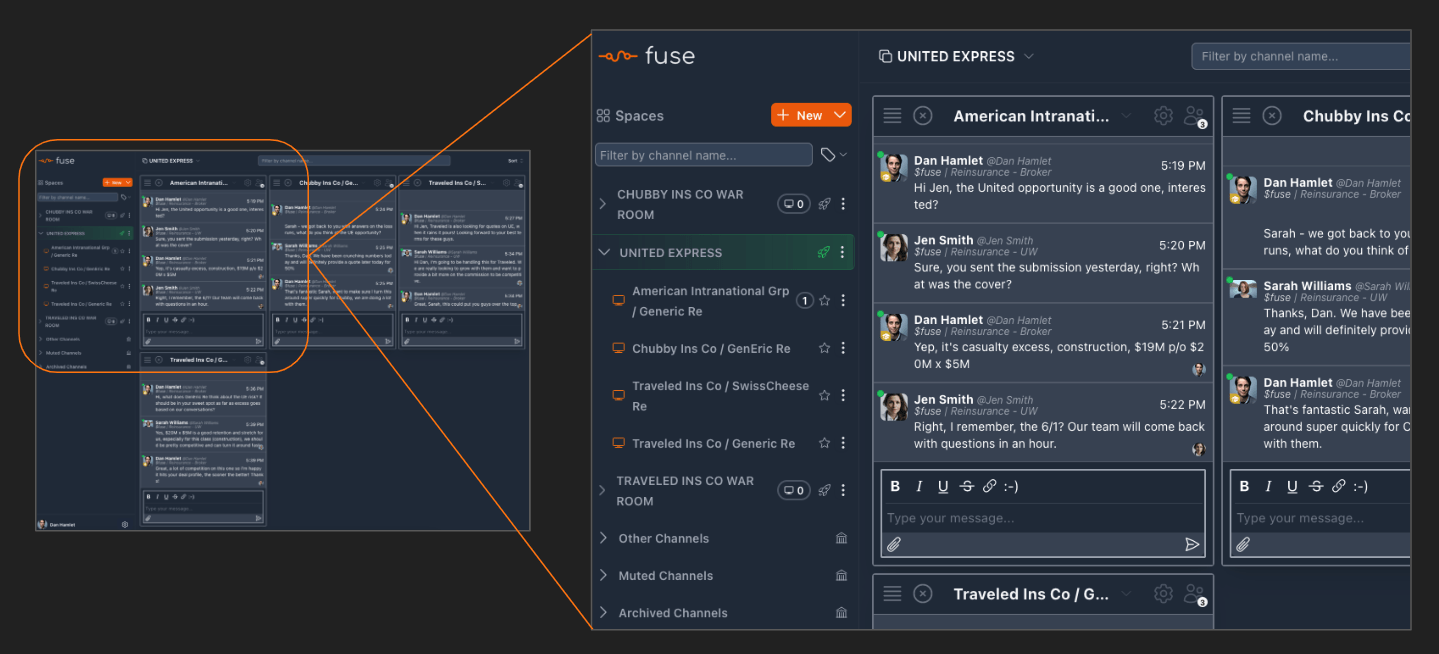

Fuse provides a web-based communication that is available 24/7 for retail, wholesale and reinsurance brokers, insureds, insurers and reinsurers, with the goal of enabling them to better connect and speed re/insurance transactions to placement.

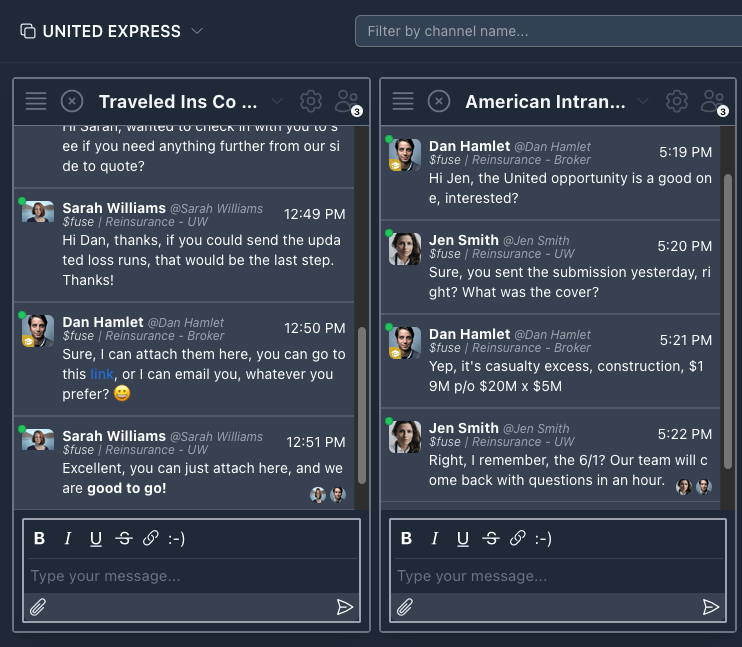

The goal is to “dramatically reduce time from submission to placement with modern technology,” with the company further explaining that, “fuse offers its users a “single pane of glass” to work through multiple transactions with multiple parties in real time wherever they are.”

“Precious hours and days are lost trying to keep track of and answer disparate unsecure emails and texts as commercial insurance transactions move through negotiation to close. Meanwhile, in the capital markets, advanced inter-company communication services exist to connect the market to accelerate trade and improve compliance. Fuse is bringing the same modern messaging tech to commercial re/insurance,” added Bourgeois.

The fuse platform offers users the ability to create, manage and archive live transaction conversations across insurance or reinsurance deals and across companies, all in one place.

You can organise your conversations, coming together in groups around ideas, deals, placements and entire programs, all within a secure, auditable communications protocol that is available through a wide range of devices.

The company said that, “Fuse incorporates the best of popular messaging applications fit-for-purpose for commercial re/insurance. Fuse is available as a desktop web application and is also fully mobile-compliant for true 24/7 access on-the-go.”

Fuse has already been working with brokers, insureds and underwriters to test its application and gather valuable feedback.

The fuse application is now available in public beta and market participants interested in testing the application can sign up directly on the company’s website: www.fuserisk.com.