Fundraising lunch to celebrate Robert Cooper’s life

Fundraising lunch to celebrate Robert Cooper’s life | Insurance Business Australia

Insurance News

Fundraising lunch to celebrate Robert Cooper’s life

Proceeds to the Leukaemia Foundation

Insurance News

By

Daniel Wood

In January, Robert Cooper (pictured above), co-director of CPR Insurance Services, died from leukaemia. Brisbane-based Cooper was a much-loved family man and a conscientious insurance broker who fought hard for his clients. He was also very active in the local community.

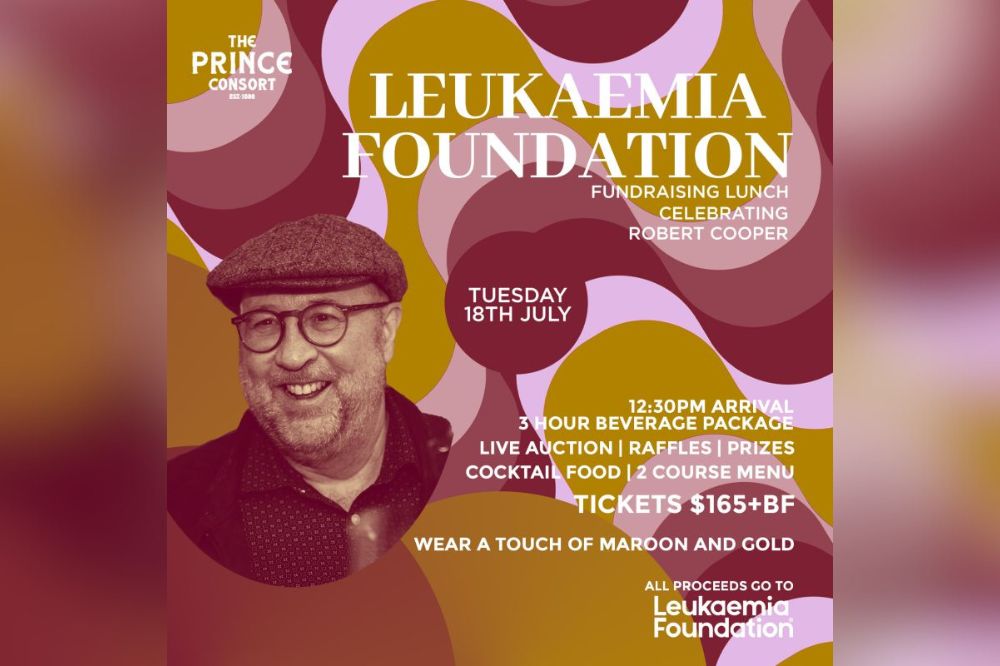

Cooper’s family is holding a fundraising lunch for the Leukaemia Foundation on July 18 in Robert’s honour. The lunch is at the Prince Consort Hotel in Brisbane.

Insurance Business talked to Robert’s wife and business partner Mandy, who co-directed CPR and continues to run the brokerage, about her husband’s life and work.

Never shy about supporting clients, “Robert was passionate about always acting in the client’s best interests,” said Mandy. She said they always saw their work as both local broker and part of the community.

Claims time: when brokers show their worth

“We always found it satisfying to help our local business owners at claim time,” Mandy said. “Heaven help an underwriter who did not read their policy wording on a claim, because Robert loved to take them on to act in our client’s best interests!”

Claims time, she said, is when Robert believed a broker shows their “true worth to the client”. She said her husband was also “passionate” about giving back.

“He would always take time to help fellow brokers or underwriters,” Mandy said. “He believed education was the key to our industry’s future.” Robert, she said, really enjoyed his work as a National Insurance Brokers Association (NIBA) mentor. “It was hard for him to not always do his weekly catch-ups last year when he was sick; he felt like he was letting everyone down,” Mandy said.

“Giving back was in his DNA, as it is in mine, which is why we were perfect together.”

“£10 pom” who went on to run a brokerage

The couple met through the insurance industry. “We were both very happily single brokers who became good friends, and the rest is history,” Mandy said.

She fondly remembers that Robert and his family were “£10 poms”. They settled in Adelaide in 1968 where Robert grew up. Robert’s first step in a 45-year insurance career was in the mailroom of Edward Lumley & Sons in Adelaide.

A few years later he joined the financial lines team at Willis. “This is where he found his passion,” Mandy said. “He loved working in the financial lines space and was passionate about researching it and supporting clients.” The couple married soon afterwards in 1998.

When Robert finished an MBA in early 2000, they considered jobs in Perth, Melbourne, Brisbane and central Queensland. “‘Let’s be sea changers,’ he said,” Mandy recalled.

Her husband won a job in Rockhampton as AMP’s regional manager. Mandy transferred with QBE. “We lived in Yeppoon, walked on the beach each day and drove the commute to Rocky,” Mandy said. “Our first child, Johnny, was born there, and Robert loved living by the sea.”

At the end of 2004 the family moved to Brisbane where Robert’s broking work included stints at Aon and another brokerage, but both firms retrenched him. It was just after the 2009 financial crash and Robert, she said, took time to reassess.

CPR Insurance Services is born

“Two redundancies in just over 12 months was hard to take, but from the darkness came strength to keep doing what he loved,” Mandy said. “He decided to go it alone, and CPR Insurance Services was created in November 2010.”

She said it was tough because he built the business from scratch with no clients. Mandy said her health then “took a turn for the worst”, forcing her to leave her full-time broker job.

She began helping her husband part-time. “It was scary with two little kids – our second child was born in Brisbane – a mortgage and only a few clients,” Mandy said. “Luckily we came from good jobs with savings behind us, and since then we haven’t looked back.”

Running their CPR Insurance business has been tough at times, but “would I change it?” she said. “No!” Mandy said they avoided the difficulties many couples have running a business together by creating equal broker roles for themselves and carefully separating their duties.

“We got some great advice in the early days from another married couple that worked together,” she said. “Always let each other know what you’re doing and have segregation in your roles.”

Twelve years later, Mandy said she has a well-established business with “a huge circle of clients who are also friends”.

“It’s been tough along the way, but we always got there, even now doing this alone,” she said. When she doubts herself, she asks herself what Robert would say. “He would say, ‘I know you can do it and go with your gut feeling’,” Mandy said. “He was my biggest supporter and always will be.”

CPR was founded when agency numbers started growing

Mandy recalled that when she and Robert started CPR, the number of underwriting agencies was just starting to grow.

“In the early days it gave us an opportunity to do business and not be bound to the big boys in town,” she said. “We have always supported underwriting agencies as they are great at finding their niche market and doing it well.”

She said without these agencies their business would have really struggled. “They supported us, so we have supported them,” she said.

Community work: street renovations, schools, Christmas festivals

Robert was also very active in local community groups in the Brisbane area, including Rotary, the Windsor and District Historical Society (he was president) and running the local Anzac Day service. Mandy said his main legacy in their Wilston/Grange community in Brisbane is the annual Christmas Festival.

“In 2021 Robert worked with local shop holders and Rotary to run the Wilston Village Christmas Festival,” she said. “It brought the community together.”

However, the couple also enjoyed impressive success when they formed the Kedron Brook Business Group for local businesses to network and share stories once a month. Robert and Mandy secured federal and council funding to beautify the local Wilston Village.

“Ten years ago, shops were empty and there was little life in the village,” Mandy said. “Now every shop is full, and it’s a thriving community.”

Robert was also involved with Wilston State School P&C, the Grange Bowls and Community Club and ChaplainWatch. “He lived life twice and never stopped,” Mandy said.

Cricket was another of Robert’s loves. Mandy said every year he would go to the opening day of the GABBA test match with a group of mates. Each year they would choose and design a different shirt for the occasion.

“Robert was never asked to choose the shirt design, as they all knew they would be wearing CPR hats and shirts covered in the CPR logo,” Mandy said.

Switching flowers for leukaemia funds

Supporting and giving back was “in Robert’s DNA”, Mandy said. When her husband died, she encouraged people who were sending flowers to donate to the Leukaemia Foundation instead.

“We loved the flowers, but please spend the money on something that can help,” she said. “We can’t change our journey, but we can change others’.”

Robert’s celebration of life included fundraising for the Leukaemia Foundation and the July 18 lunch in Robert’s honour will also raise funds.

“We will have raffles, sporting memorabilia to auction, and I’m gently talking to his friends who loved guitars as much as Robert to play in a band,” Mandy said. “It will be more like a jam session, but he would have loved that.”

If you would like to attend the Leukaemia Foundation fundraising lunch celebrating Robert Cooper, please click here.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!