FM Global Center provides hands-on experience of risk

International property insurer FM Global opened the FM Global Center in Singapore earlier this month, providing commercial property owners in Asia-Pacific the opportunity to see first-hand various risks that could lead to property loss, as well as learn about solutions to these risks.

The Singapore experiential risk management facility is FM Global’s third research center, following two located in the northeastern US. Located at Singapore Science Park, FM Global’s center focuses on bringing its research, training, and education capabilities to the fast-emerging Asia-Pacific region, which is exposed to a wide variety of natural catastrophe risks, which are exacerbated by climate change.

“[Asia-Pacific] is a part of the world that is probably more catastrophe-exposed than anywhere,” said James Thompson, senior vice president, Asia-Pacific division manager, FM Global. “If you look at our exposure across the region – from tropical storms to flooding, major hail events, to Australia’s bushfires – and contrast that with other parts of the world, you will see that climate exposure in our part of the world is severe, and its severe for all our clients. So, having climate-related science and engineering coming out of Asia-Pacific makes sense. This center is about developing climate resilience solutions that really resonate with the local market.”

FM Global’s Singapore center is a six-story, 125,000 sq. ft. facility that houses multiple interactive simulation labs and learning spaces that help visitors learn how investment in risk mitigation and engineering can prevent losses and deliver business value. Some of the simulation labs focus on various natural hazards, such as high-wind events, floods, and earthquakes, and how loss can be prevented by improving an organization’s climate resilience. Other labs illustrate various parts of an industrial facility, such as fire pumps, warehouses, electrical rooms, and sprinkler systems, and the various risks and mitigation measures present in each.

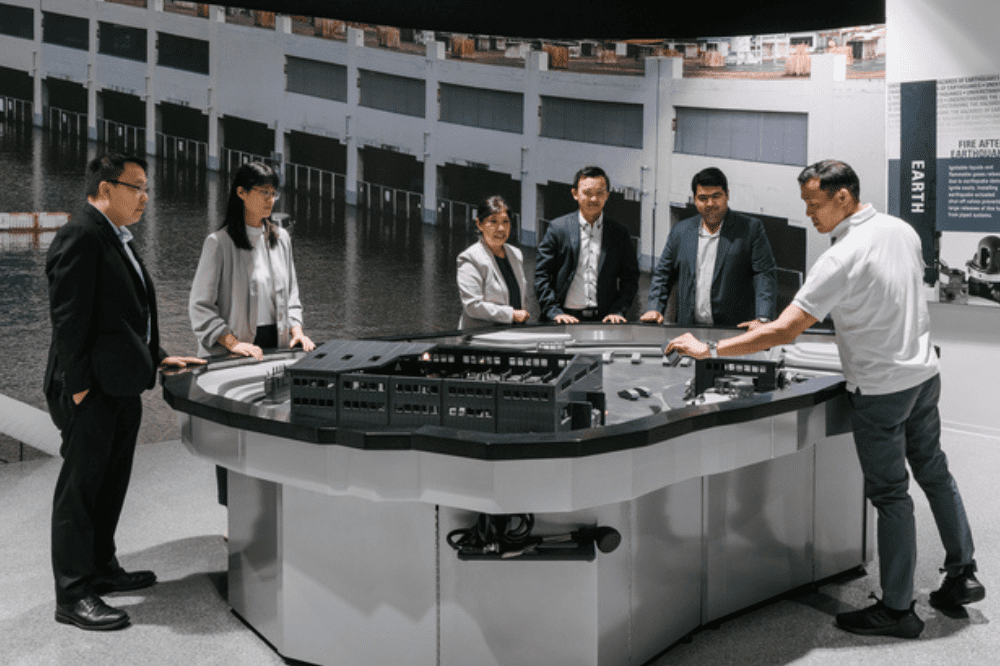

The simulations make use of augmented reality, which allows visitors to learn about various risks and their effects with the help of technology. The flood table allows visitors to interact with a simulated flood and discover how various flood mitigation solutions can protect an industrial site. The center also has a hurricane simulation cannon, which tests how various materials interact with debris sent flying by strong winds.

According to Tan Hian Hong, FM Global’s operations manager for Asia, the company chose Singapore as the site for its Asia-Pacific center due to the city being a business and learning hub for Southeast Asia and the high volume of transit visitors. Singapore is also located in an area that is not as exposed to typhoons and earthquakes as other countries in the region, which demonstrates what FM Global is telling its clients – that they should pick the right spot for their businesses, alongside ensuring their buildings’ resilience.

Tan also said that the Singapore center applies what FM Global has learned about risk resilience. With the center located at the foot of the hill, it is exposed to rainwater flowing down, so the facility was constructed with this in mind, with a specially designed drainage system to prevent flooding. It also features double-glazed windows, which makes the building more energy-efficient, with air-conditioning using less energy to cool the building amid Singapore’s tropical climate.

“The construction here, it’s all designed to FM Global standards,” Tan said. “We used FM-approved materials that have low combustibility or are non-combustible, and are green, as well. These are part of what we’ve done to make sure that we reduce risk to the maximum and apply what we preach in terms of property protection.”

Thompson said that property loss protection is especially important today, given the higher likelihood of damage due to climate change, as well as the higher cost of losses due to rapid inflation.

“There are many market studies that are pointing to greater number of losses, and the losses themselves are getting larger due to price inflation,” Thompson said. “Putting back a factory today is a lot more expensive than it was 12 months ago. So, the financial exposure that insurance companies are carrying are significantly higher. Insurance companies need to be able to cover future losses, so prices have to go up – that’s just a product of inflation and losses getting higher. When you overlay the fact that climate events seem to be getting more severe, then it’s natural to expect that insurers are going to need to cover their costs with higher premiums.”

Thompson added that, as an insurer, FM Global looks at how their clients implement their loss protection strategies, which has a significant effect on premiums charged.

“Those clients that do put in place mitigation, those clients that do smart risk management, they’re clearly going to be better at risks and, therefore, they’re going to be priced preferentially,” he said.