Florida Citizens only buys $3.564bn of reinsurance for 2024, despite 7.9% drop in price

Florida’s Citizens Property Insurance Corporation, the state’s insurer of last resort, has completed its reinsurance renewals for 2024, but only purchased $3.564 billion of coverage across its traditional reinsurance and catastrophe bond arrangements, despite experiencing a softer market environment and lower pricing than a year ago.

Florida Citizens had been expected to buy its largest single reinsurance tower ever, with its Board signing off a budget to buy a total of $5.5 billion of reinsurance limit this year.

Already, Florida Citizens had success in the capital markets, securing $1.1 billion of reinsurance from a newly issued Everglades Re II Ltd. (Series 2024-1) catastrophe bond that was issued in May.

Adding to that capital markets and multi-year reinsurance protection, Citizens still has $500 million of protection from the Lightning Re Ltd. (Series 2023-1) industry-loss trigger cat bond as well.

The $1.6 billion of catastrophe bond cover that Citizens has in-force for this hurricane season puts the insurer in sixth place on our catastrophe bond sponsor leaderboard.

This being the first year where Florida Citizens has merged its accounts into a single reinsurance tower, the expectation was that the insurer would buy a significant amount of reinsurance to fill that, likely its largest purchase ever.

But, that’s not how it’s turned out, Citizens Board documents show, as the Floridian property insurer of last resport bought far less traditional reinsurance coverage than expected, or budgeted for.

With an initial target to secure $5.5 billion of reinsurance, a figure that includes the $1.6 billion of cat bond coverage, the Citizens Board had previously increased its budget for reinsurance and risk transfer spend for 2024 to a maximum of $750 million.

In the end the insurer opted not to spend that much, focusing instead on the most efficient use of capital and sources of risk transfer, resulting in a much smaller reinsurance tower than anticipated.

This despite encountering more favourable reinsurance market conditions in 2024, which the insurer noted as “softer”.

A year ago, Florida Citizens secured $5.38 billion of risk transfer for 2023, made up of $2.4 billion of outstanding catastrophe bonds, at the time of the renewal, and a fresh placement of $2.98 billion of traditional and collateralized reinsurance.

That was a significant increase in risk transfer purchased compared to 2022, when Florida Citizens only had around $2.51 billion of risk transfer in-force, across its reinsurance and cat bonds.

Having gone to market this year targeting $5.5 billion of protection for 2024, with a budget of $750 million available, Citizens Board documents state, “Citizens was able to place a cost-efficient risk transfer program of approximately $3.564 billion; which includes $3.064 billion of new placement and $500 million of existing, multi-year coverage from 2023; at a cost of approximately $482 million.”

This despite the fact reinsurance markets “softened slightly in 2024” Citizens explained.

“This softening can be attributed to additional inserted into the risk transfer market, especially in the capital markets, due to the attractive nature of risk transfer pricing relative to other asset classes and optimism around the anticipated impact of Florida’s legislative reforms, specific to litigation, which have only just begun to be realized,” the insurer explained.

However, Citizens continued to state, “There was also some slight hardening as capital was reduced related to multiple forecasts for a very active Atlantic hurricane season.”

Because of this, the insurer of last resort noted that, “Risk adjusted risk transfer pricing was relatively flat or approximately +/- 5% for most Florida carriers and capital markets transactions were able to upsize and priced at levels close to initial guidance.”

But added that, “However, specific to Citizens’, risk adjusted pricing was down approximately 7.9%.”

Which is interesting, as the market was softer and Florida Citizens secured lower pricing than most Floridian property insurers, it seems, but still opted not to place the full tower.

Which might suggest appetite just wasn’t there for it, or that Citizens became very price and budget sensitive during the reinsurance renewal process this year.

So, roughly $1.964 billion of traditional reinsurance limit was procured at the 2024 renewals, some of which will be from collateralized sources as always.

That’s in addition to the $1.6 billion of catastrophe bonds.

Citizens said that the renewal was placed at, “a weighted average gross rate-on-line (ROL) of 14.07%, a net ROL of 13.44%, and net premium of approximately $482 million.”

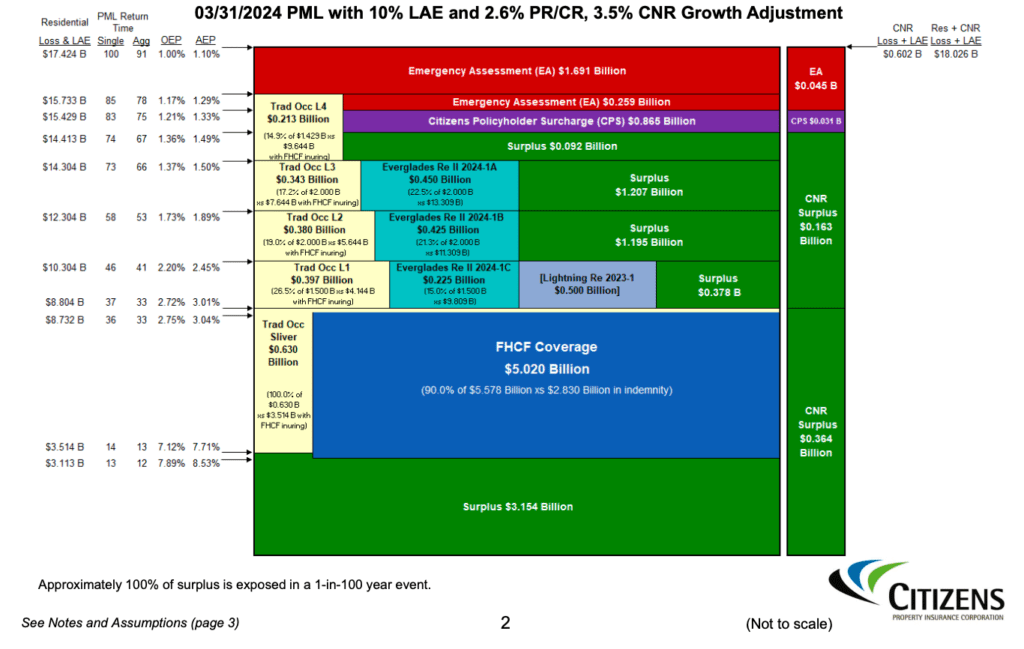

The program breaks down into a sliver layer sitting alongside FHCF coverage and then layers above that see catastrophe bonds sharing parts of the tower with traditional reinsurance and surplus, while policyholder surcharges and emergency assessments make up the upper layers of the tower.

Traditional reinsurance begins to attach at $3.514 billion of losses and the tower’s reinsurance protection exhausts at $15.733 billion of losses.

But, the top of Florida Citizens reinsurance tower is at $17.424 billion and with less reinsurance purchased and emergency assessments sitting in the upper-layers, the chances of taxpayers coming on the hook for large hurricane losses are more significant than had more private market risk transfer been purchased.

The original reinsurance tower outline for 2024 had been to have reinsurance and cat bonds above the FHCF, sharing layers with surplus and then policyholder surcharges at the top, with risk transfer attaching at $3.514 billion and exhausting at $16.738 billion, then surcharges taking the tower to $17.289 billion, but with no emergency assessments required to support that level of losses.

You can see how the reinsurance tower for 2024 has turned out below:

It seems decisions were taken to adjust the tower design to secure the most optimal pricing, when comparing all capital sources and risk transfer options.

It is surprising perhaps that more higher-layer cat bond cover wasn’t procured, to prevent the need for emergency assessments, but those only come due in the event of a really significant storm loss, so the ramifications of this decision depends on the weather.

Florida Citizens staff noted, “The 2024 risk adjusted price reflects some improvement in the market, despite the appearance of an increase in pricing in both the traditional and capital markets.”

But said that, “The 2024 gross ROL of 14.07% compared to the risk adjusted gross ROL of 15.2% for 2023 and the 2024 net ROL of 13.44% compared to the risk adjusted net ROL of 14.5% for 2023.”

Importantly going on to highlight, “The combining of the three previous accounts into the Citizens Account enhanced Citizens’ ability to pay claims for future storms and minimized the potential for assessments. In 2022, the Personal Lines Account (PLA) surplus could have been depleted with a 1-in-67-year event and in 2023, PLA surplus could have been depleted with a 1-in-4-year event. However, in 2024, with combined accounts, surplus could be depleted with a 1-in-74-year event.”

Also read:

– Florida Citizens budget for 2024 cat bonds & reinsurance lifts to $750m max.

– Florida Citizens expects slightly higher risk transfer rate-on-line for 2024.

– Florida Citizens secures $1.1bn of reinsurance with new Everglades Re cat bond.