Federal study of third-party litigation funding reveals maturing and growing markets, lack of transparency, and scarce regulation.

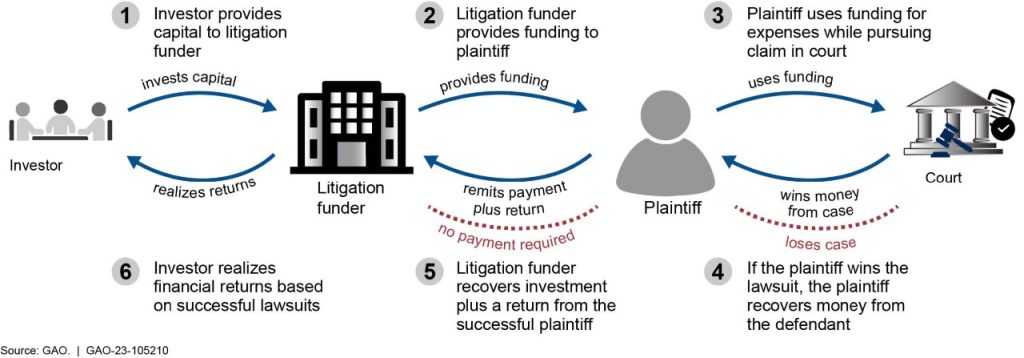

At the end of 2022, the U.S. Government Accountability Office (GAO) released a report, Third-Party Litigation Financing: Market Characteristics, Data and Trends. Defining third-party litigation financing or funding (TPLF) as “an arrangement in which a funder who is not a party to the lawsuit agrees to help fund it,” the investigative arm of Congress looked at the global multibillion-dollar industry, which is raising concerns among insurers and some lawmakers.

The GAO findings summarize emerging trends, challenges for market participants, and the regulatory landscape, primarily focusing on the years between 2017 and 2021.

Why a regulatory lens on TPLF is important

The agency conducted this research to study gaps in public information about the industry’s practices and examine transparency and disclosure concerns. Three Republican Congress members – Sen. Chuck Grassley (IA), Rep. Andy Barr (KY), and Rep. Darrell Issa (CA) — led the call for this undertaking.

However, as GAO exists to serve the entire Congress, it is expected to be independent and nonpartisan in its work. While insurers, TPLF insiders, and other stakeholders, including Triple-I, have researched the industry (to the extent that research on such a secretive industry is possible), the legislative-based agency is well positioned to apply a regulatory perspective.

Example of Third-Party Litigation Financing for Plaintiffs

The report methodology involved several components, many of which other researchers have applied, such as analysis of publicly available industry data, reviews of existing scholarship, legislation, and court rules. GAO probed further by convening a roundtable of 12 experts “selected to represent a mix of reviews and professional fields, among other factors,” and interviewing litigation funders and industry stakeholders. Nonetheless, like researchers before them, GAO faced a lack of public data on the industry.

Third-party litigation funding practices differ between the consumer and the commercial markets. Comparatively smaller loan amounts are at play for consumer cases. The types of clients, use of funds, and financial arrangements can also vary, even within each market.

While most published discussions of TPLF center on TPLF going to plaintiffs, as this appears from public data to be the norm, GAO findings indicate: 1) funders may finance defendants in certain scenarios and 2) lawyers may use TPLF to support their work for defense and plaintiff clients.

How the lack of transparency in TPLF can create risks

Overall, TPLF is categorized as a non-recourse loan because if the funded party loses the lawsuit or does not receive a monetary settlement, the loan does not have to be repaid. If the financed party wins the case or receives a monetary settlement, the profit comes from a relatively high interest payment or some agreed value above the original loan. Thus, the financial strategy boils down to someone gambling on the outcome of a claim or lawsuit with the expressed intention of making a hefty profit.

In some deals, these returns can soar as high as 220%–depending on the financial arrangements–with most reporting placing the average rates at 25-30 percent (versus average S&P 500 return since 1957 of 10.15 percent) The New Times documented that the TPLF industry is reaping as much as 33 percent from some of the most vulnerable in society, wrongly imprisoned people.

Usually, this speculative investor has no relationship to the civil litigation and, therefore, would not otherwise be involved with the case. However, the court and the opposing party of the lawsuit are typically unaware of the investment or even the existence of such an arrangement. On the other hand, as the GAO report affirms, knowledge about the defendant’s insurance may be one of the primary reasons third-party financers decide to invest in the lawsuit. This imbalance in communication and the overall lack of transparency spark worries for TPLF critics. GAO gathered information that highlighted some potential concerns.

Funded claimants may hold out for larger settlements simply because the funders’ fee (usually the loan repayment, plus high interest) erodes the claimant’s share of the settlement. Attorneys receiving TPLF may be more willing to draw out litigation further than they would have – perhaps in dedication to a weak cause or a desire to try out novel legal tactics – if they had to carry their own expenses.

Regardless, typically neither the court, the defendant, nor the defendant’s insurer would be aware of the factors behind such costly delays, so they would be unable to respond proactively. However, insurance consumers would ultimately pay the price via higher rates or no access to affordable insurance if an insurer leaves the local market.

As the report acknowledges, a lack of transparency can lead to other issues, too. If the court does not know about a TPLF arrangement, potential conflicts of interest cannot be flagged and monitored. Some critics calling for transparency have cited potential national security risks, such as the possibility of funders backed by foreign governments using the funding relationship to strategically impact litigation outcomes or co-opting the discovery process for access to intellectual property information that would otherwise be best kept away from their eyes for national security reasons.

Calls for TPLF Legislation

GAO findings from its comparative review of international markets reveal that the industry operates globally, essentially without much regulation. The report points out that while TPLF is not specifically regulated under U.S. federal law, some aspects of the industry and funder operations may fall under the purview of the SEC, particularly if funders have registered securities on a national securities exchange. Some states have passed laws regulating interest charged to consumers, and, in rarer instances, requiring a level of TPLF disclosure in prescribed circumstances.

Active, visible calls from elected officials for regulatory actions toward transparency come mostly from Republicans, but, nonetheless, from various levels of government. Sen. Grassley and Rep. Issa have tried to introduce legislation, The Litigation Funding Transparency Act of 2021, requiring mandatory disclosure of funding agreements in federal class action lawsuits and in federal multidistrict litigation proceedings. In December of 2022, Georgia Attorney General Chris Carr spearheaded a coalition of 14 state attorney generals that issued a written call to action to the Department of Justice and Attorney General Merrick Garland.

“By funding lawsuits that target specific sectors or businesses, foreign adversaries could weaponize our courts to effectively undermine our nation’s interests,” Carr said.

Triple-I continues to research social inflation, and we study TPLF as a potential driver of insurance costs. To learn more about third-party litigation funding and its implication for access to affordable insurance, read Triple-I’s white paper, What is third-party litigation funding and how does it affect insurance pricing and affordability?