Fairfax set to bite back after ‘smash and grab’ short attack

Fairfax set to bite back after ‘smash and grab’ short attack | Insurance Business Canada

Insurance News

Fairfax set to bite back after ‘smash and grab’ short attack

Short seller Muddy Waters’ ‘drive by shooting’ slammed by some (but not all) analysts

Insurance News

By

Jen Frost

Fairfax Financial Holdings (Fairfax) will be gearing up for a fight back on Friday, following a shock report from activist short seller Muddy Waters that spooked investors and sent the group’s share price plummeting.

Analysts and market watchers appeared split on the allegations, with some rushing to Fairfax’s defense.

Fairfax is the “GE [General Electric] of Canada”, Muddy Waters set out in the highly critical Thursday report in which it argued that the company’s book value has been inflated by as much as 18%. Fairfax has slammed allegations as “false and misleading”.

“We are neither Berkshire Hathaway, nor GE, as Muddy Waters suggests,” Prem Watsa, Fairfax chairman and CEO said in a Monday statement. “We are Fairfax, a strong and enduring company built over 38 years, committed to integrity, customer service, employee welfare and the communities we operate in.”

One source said that while the allegations come during the company’s pre-results quiet period, Fairfax should not be prevented from addressing historic matters before Friday. Other commentators, however, labeled the timing a low blow.

“We expect Fairfax will counter all of Muddy Waters claims on their conference call and this report will be forgotten as quickly as it emerged,” Trevor Scott, Tidefall Capital portfolio manager, told Insurance Business via email. “It will have zero effect on their insurance subsidiaries or ratings as the claims are so easily disproved.”

Scott labeled the report a “’smash and grab’ short attack” and took issue with its 18% book value allegation.

“Even if all of Muddy Waters points were true, it would not materially affect the company’s value or trajectory,” Scott said.

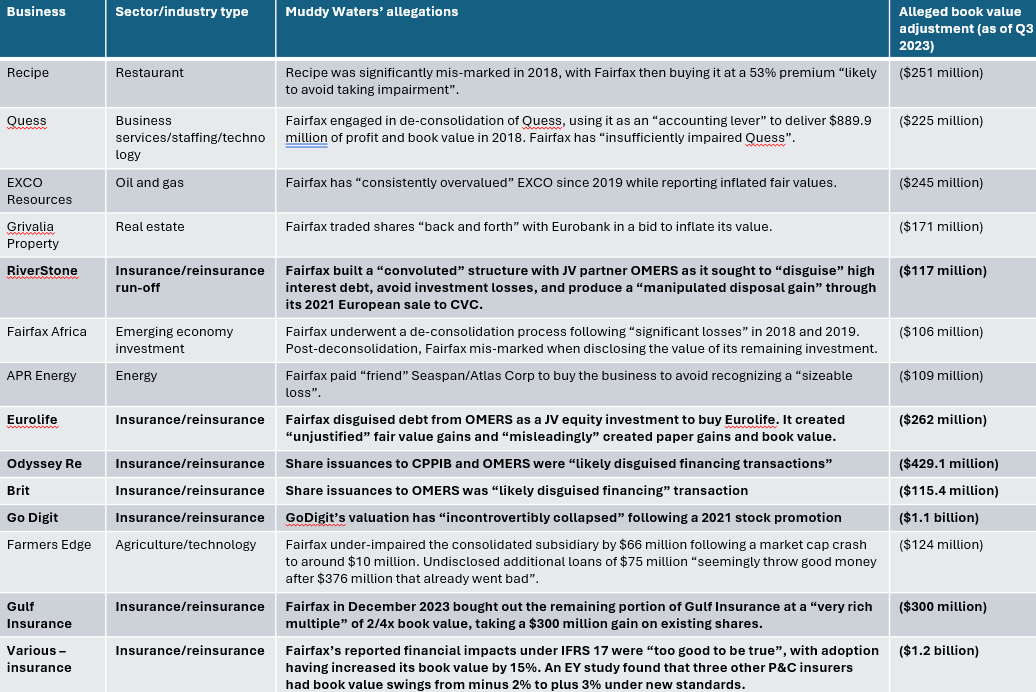

In its research brief, Muddy Waters argued that Fairfax’s Allied World acquisition put financial pressure on its insurance operations, leading to the holding company aggressively “pulling accounting levers” from 2018.

Among a tide of allegations, Fairfax’s IFRS 17 restatements were “too good to be true” to the tune of $1.24 billion, Muddy Waters claimed. It further pointed to “highly dubious” gains totaling $544.5 million from Odyssey Re and Brit share sales.

The activist research group also alleged that Indian insurance company Go Digit’s 2021 stock promotion led its valuation to “incontrovertibly” collapse.

Fairfax-owned insurance companies not subject to scrutiny in the Muddy Waters research include Crum & Forster and Canada’s Northbridge.

Digging into some of the insurance allegations, Scott pointed to the long tail nature of Fairfax’s insurance business and its “long history” of conservative reserving estimations as drivers for its IFRS 17 out-performance of others.

He further argued that rather than being overvalued, Go Digit has proved more profitable than peers and never achieved the “lofty valuation levels” seen by others in the public markets during the COVID-19 pandemic.

“In regards to the Odyssey and Brit Transactions in 2021, these did free up capital and slightly increase book value but these transactions were just acknowledging the economic value of the divisions that were understated on Fairfax’s book value,” Scott said.

Muddy Waters shorts Fairfax – what has the research firm alleged?

Analysts split on Muddy Waters’ Fairfax short and allegations

It is understood that at least one ratings agency was still considering the impact of the Muddy Waters report’s findings late last week.

The short seller’s findings drew mixed responses from analysts.

“At a high level, we don’t disagree with its take, and we do think the stock is materially overvalued right now,” Morningstar analyst Brett Horn said on Thursday. “In our opinion, Fairfax is a hit-and-miss investor, a relatively poor underwriter, and has an overly complicated structure.”

Others accused Muddy Waters of “quibbling” over value.

“Our take is that the short report encourages investors to entangle themselves in the minutiae of accounting treatment applied to past transactions, while overlooking the substantial build of earning power that has amassed over the last few years,” a CIBC analyst wrote in a Thursday note.

The Muddy Waters report “cherry-picks” an array of large and complicated transactions to “build a case that there is a pattern of aggressive accounting moves”, Cormark Securities analysts said in a note that labeled the research’s publication a “drive by shooting”.

Fairfax’s share price closed 12% down on Thursday but had started to eke up come Friday. Prior to the Muddy Waters allegations, the holding company had seen its share price more than double over five years.

Fairfax v short sellers – the Canadian insurance giant has been here before

While the news piqued some interest, insurance broker sources on the ground in Fairfax’s home country of Canada were either unaware of or unconcerned by unfolding events – as one pointed out, Fairfax has been here before.

The property & casualty (P&C) insurance holding company, led by Fairfax chairman and CEO Prem Watsa since 1985, is no stranger to short seller activity. It also has form for not taking it lying down.

Fairfax’s protracted 2006 $8 billion lawsuit against SAC Capital chugged along for more than a decade before being dismissed by a New Jersey court in 2018.

The insurance holding company had alleged that SAC Capital and boss Steven Cohen had in the early 2000s collaborated in a “racketeering scheme” to (in words said to have been said by defendants) “drive a stake” through the business.

Insurance companies have previously fallen foul of Muddy Waters

Muddy Waters is likely a familiar name to insurance readers.

The activist short seller took aim at US-headquartered personal lines insurtech Lemonade in 2021.

“Lemonade does not give a f*** about securing its customers’ sensitive information,” Muddy Waters founder Carson Block wrote to Lemonade CEO Daniel Schreiber in a May 2021 letter, in which the research firm appeared to detail what it claimed to be an “egregious” security breach at the insurer.

Lemonade co-founder Shai Wininger has denied that the alleged vulnerability existed.

Got a view on the Muddy Waters Fairfax Financial allegations? Leave a comment below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!