Education Can Overcome Doubts on Credit-Based Insurance Scores,IRC Survey Suggests

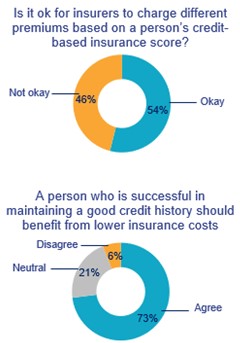

Consumer skepticism about the connection between credit history and future insurance claims appears to decline when the predictive power of credit-based insurance scores is explained to them, a recent study by the Insurance Research Council (IRC) suggests.

This is just one of the IRC’s encouraging findings. Others include:

Consumers are generally knowledgeable about credit, credit histories, and credit scores.Nearly all believe it’s important to maintain good credit history, and most believe it would be easy to improve their credit score.Among nearly all demographic groups, paying for auto insurance is not considered a burden for most households.

Concerns have been raised about the use of credit-based scores and certain other metrics in setting home and car insurance premium rates. Critics say it can lead to “proxy discrimination,” with people of color – who are more likely to have less-than-stellar credit histories – sometimes being charged more than their neighbors for the same coverage.

Confusion around insurance rating is understandable, given the complex models used to assess and price risk, and insurers are well aware of the history of unfair discrimination in financial services. To navigate this complexity, they hire teams of actuaries and data scientists to quantify and differentiate among a range of risk variables while avoiding unfair discrimination.

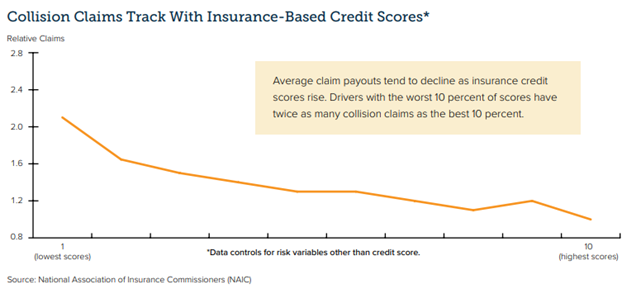

As the chart below shows, insurance claims tend to decline as credit scores improve. The fact that race frequently correlates with lower credit scores highlights societal problems that must be addressed through public policy, including financial literacy education. If anything, apparent racial disparities in insurance availability or affordability related to credit quality lend force to arguments for policy change.

In a study published last year, nearly half of respondents said financial literacy education would have helped them manage their money better through the pandemic. The study, which surveyed 1,047 U.S. adults, found that 21 percent felt insurance was the subject they understood least.

While the IRC study found non-Hispanic Black respondents were more likely than other groups to say their credit scores were below average and that it was important to improve their scores and would be easy to do so, they also were less likely to believe credit is a reliable indicator of paying bills or filing claims. Similarly, they were less likely to say it was okay to use credit history in lending, renting, or insurance settings.

All ethnic and racial groups, however, agreed that a person who has maintained good credit should benefit in the form of lower insurance rates.

“Many studies have shown that credit-based insurance scores are predictive of claims behavior,” the IRC report says, adding that recent studies using driving data from telematics devices “show a link between specific driving behaviors, such as hard braking, and variations in credit-based insurance scores.”

Any rating factor that can predict losses and claims helps insurers fairly price insurance by charging individual drivers rates that closely align with their risk. In the absence of these factors, less risky drivers would pay higher rates to subsidize the insurance of more risky drivers.

Learn More

Triple-I Issues Brief: Risk-Based Pricing of Insurance

Triple-I Issues Brief: Race and Insurance Pricing