Eclipse Re issues $76m of private catastrophe bond notes

Eclipse Re Ltd., a private syndicated collateralised reinsurance note, private catastrophe bond issuance and reinsurance transformer platform owned and operated by Artex Capital Solutions, has completed two more issuances of private cat bond notes, totalling $76 million of new risk capital issued.

The first of these new private ILS deals from the Artex vehicle to come to light, is a much larger $65 million Eclipse Re Ltd. (Series 2022-3A) private cat bond issuance, while the second is a smaller just slightly over $11 million Eclipse Re Ltd. (Series 2022-6A) transaction.

It’s important to note that we do not know the actual issuance dates, we are just including these new private cat bonds in our data as of the time we discovered them, so they will be classed as September deals and feature in our upcoming third-quarter catastrophe bond market report.

Eclipse Re Ltd. is a Bermuda domiciled special purpose insurer (SPI) and segregated account company that is managed by insurance-linked securities (ILS) market facilitator and service provider Artex Capital Solutions.

It’s possible this pair of deals are mid-year reinsurance or retrocession arrangements that have been put through the Eclipse Re structure in order to create series of investable, securitized catastrophe bond notes, potentially for a fund managers portfolio.

Eclipse Re Ltd. has issued $65 million of Series 2022-03A notes, which correspond to Segregated Account EC45 of the vehicle, with the notes having a final maturity date, of May 31st 2023.

Eclipse Re Ltd. has also issued just slightly over $11 million ($11.0152m to be precise) of Series 2022-06A notes, which correspond to Segregated Account EC48 of the vehicle, with these notes having a final maturity date, of June 1st 2023.

The proceeds from the sale of the roughly $76 million of private cat bond notes issued by Eclipse Re will have been used as collateral to underpin a related reinsurance or retrocession contract, held in a trust.

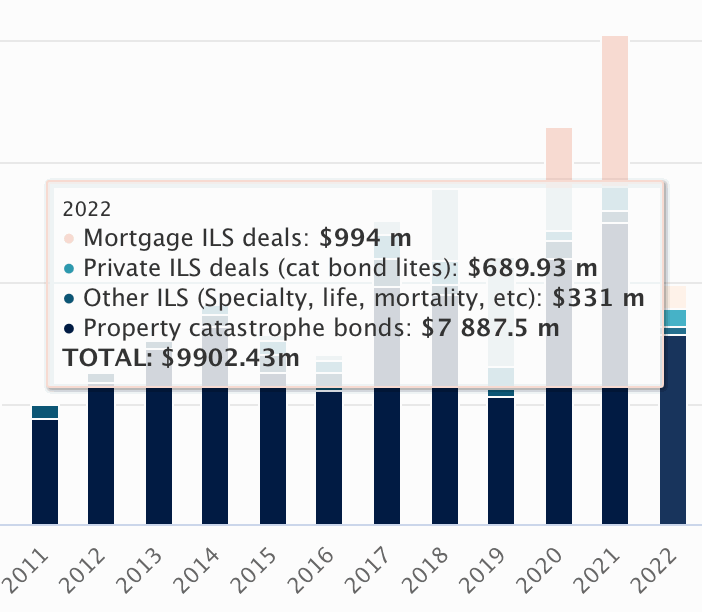

Both of these new issues are now listed in our Deal Directory and add to 2022 private catastrophe bond issuance, which now stands at almost $690 million for the year so far.

Both of these new issues are now listed in our Deal Directory and add to 2022 private catastrophe bond issuance, which now stands at almost $690 million for the year so far.

You can analyse private catastrophe bond issuance by year using our interactive chart.

In 2021, private catastrophe bond issuance that we recorded in our Deal Directory surpassed $1 billion for the first time.

Eclipse Re is normally used for the issuance of insurance-linked securities (ILS) notes, via the transformation, securitisation and ultimately transfer to one, or syndication to a group of investors, of reinsurance or retrocession arrangements.

The main use-cases are issuance of privately syndicated collateralised reinsurance notes, or private catastrophe bonds, with an ability to cover a wide range of underlying structures and perils, or lines of insurance business.

Eclipse Re private cat bonds aren’t always broadly syndicated though, with the structure often used as a transformer for an ILS fund manager, to help them securitize a risk and make it investable for a catastrophe bond strategy.

ILS and reinsurance market service provider and facilitator Artex Capital Solutions takes a lead role as the manager for these Eclipse Re Ltd. transactions, with this special purpose vehicle one key part of its ILS infrastructure offering to clients.

You can track cat bond and related ILS issuance by year and type of transaction in this chart.

You can also view details of every private cat bond we’ve tracked by filtering our Deal Directory to see private ILS transactions only.