Eclipse Re issues $100m Series 2024-1A private catastrophe bond

A new private catastrophe bond arrangement has come to light, as the Artex Capital Solutions managed Eclipse Re structure has issued a $100 million Eclipse Re Ltd. (Series 2024-1A) deal.

It’s the first private catastrophe bond issuance, or cat bond lite, from the Eclipse Re platform in 2024.

Last year, for full-year 2023, the Eclipse Re platform issued just under $210 million of private cat bond notes, remaining one of the most used structures for these listed private cat bond note issuances.

Eclipse Re Ltd. is a special purpose insurance (SPI) company and segregated account platform domiciled in Bermuda, that is owned and managed by insurance-linked securities (ILS) market facilitator and service provider Artex Capital Solutions.

Eclipse Re typically plays a role as a risk transformation vehicle, working for ILS fund managers and investors, converting collateralized reinsurance or retrocession arrangements into investable notes with features more like a catastrophe bond, so fully securitized and with secondary transferability as an option.

Eclipse Re Ltd. has issued $100 million of Series 2024-1A notes, on behalf of Segregated Account EC61, with these notes having a final maturity date of December 31st 2025.

The $100 million of Series 2024-1A notes issued by Eclipse Re have been privately placed with qualified investors.

We assume this latest private cat bond issuance features a reinsurance or retrocession transaction that has been transformed utilising the Eclipse Re structure, in order to create and issue a series of investable, securitized catastrophe bond notes, typically for an ILS fund manager or investor portfolio.

We don’t know what the trigger or peril(s) underling this private catastrophe bond deal are, but assume they will be some kind of property catastrophe reinsurance or retrocession risk.

The proceeds from the sale of the $100 million of Series 2024-1A private cat bond notes issued by Eclipse Re will be used as collateral to underpin the related reinsurance or retrocession contract, held in a trust, enabling the risk transfer and the creation of investable catastrophe-linked securities.

Given the maturity date of this private cat bond is for the end of December 2025, it is possible this deal represents the securitization of a two year reinsurance or retrocession arrangement.

This new Eclipse Re deal takes private catastrophe bond issuance tracked by Artemis to $159 million for 2024.

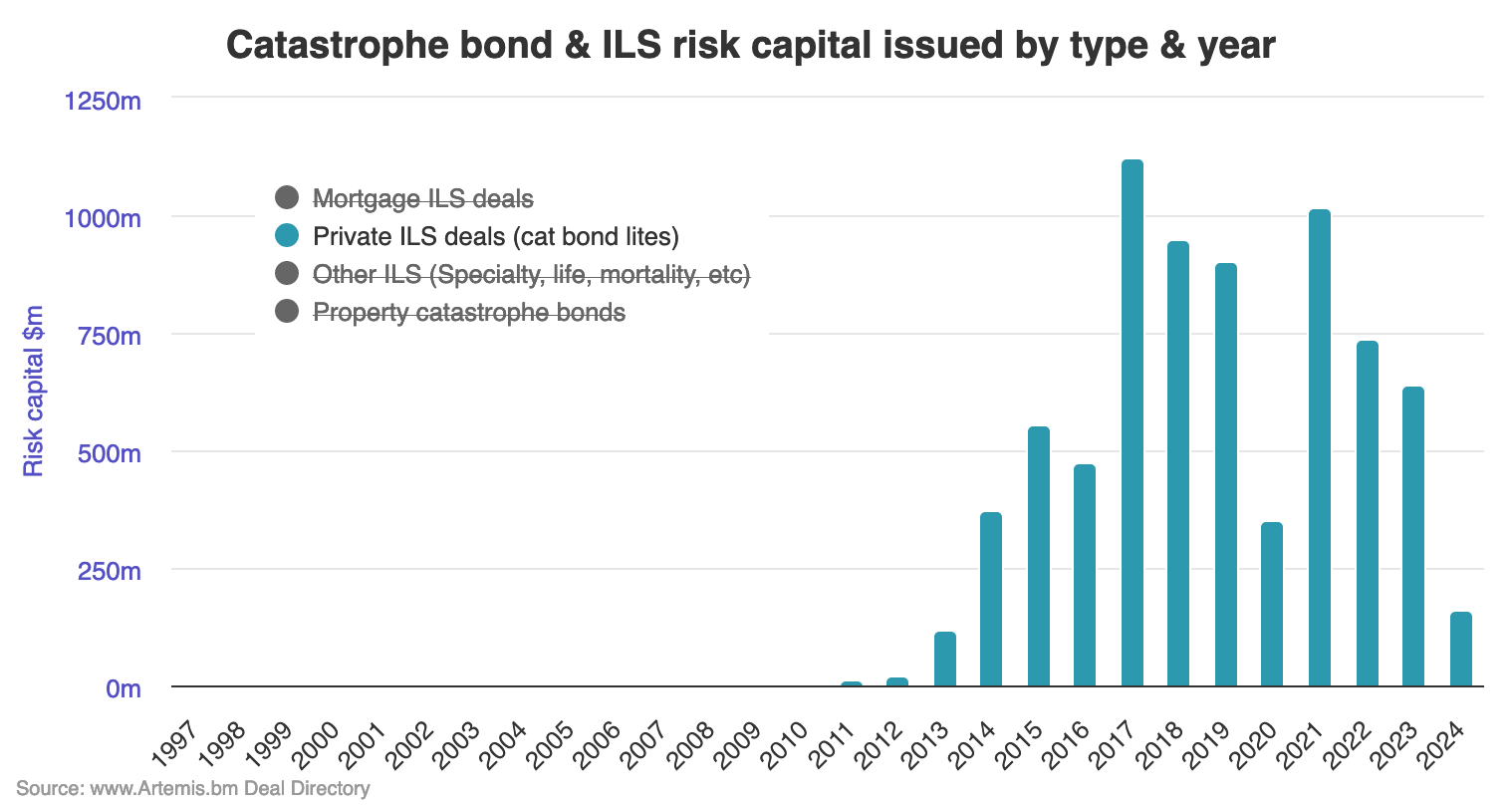

You can analyse private cat bond issuance by accessing this chart, where you can split our tracked catastrophe bond and related ILS issuance by type of arrangement, using the key.

Issuance of private catastrophe bonds reached almost $642 million in 2023, falling short of the prior year and well below the record set back in 2017 when over $1.12 billion of private cat bond notes were tracked by Artemis.

But, private cat bonds remain a structure that is supportive of cat bond market growth, helping cedents try out the market, either at lower-cost, or with fewer investors, while also providing a mechanism for ILS managers to securitize excess-of-loss risks for their funds.

Analyse private catastrophe bond issuance by year using our interactive chart.

You can view details of every private cat bond we’ve tracked by filtering our Deal Directory to see private ILS transactions only.