Earnix unveils underwriting solution, Underwrite-It

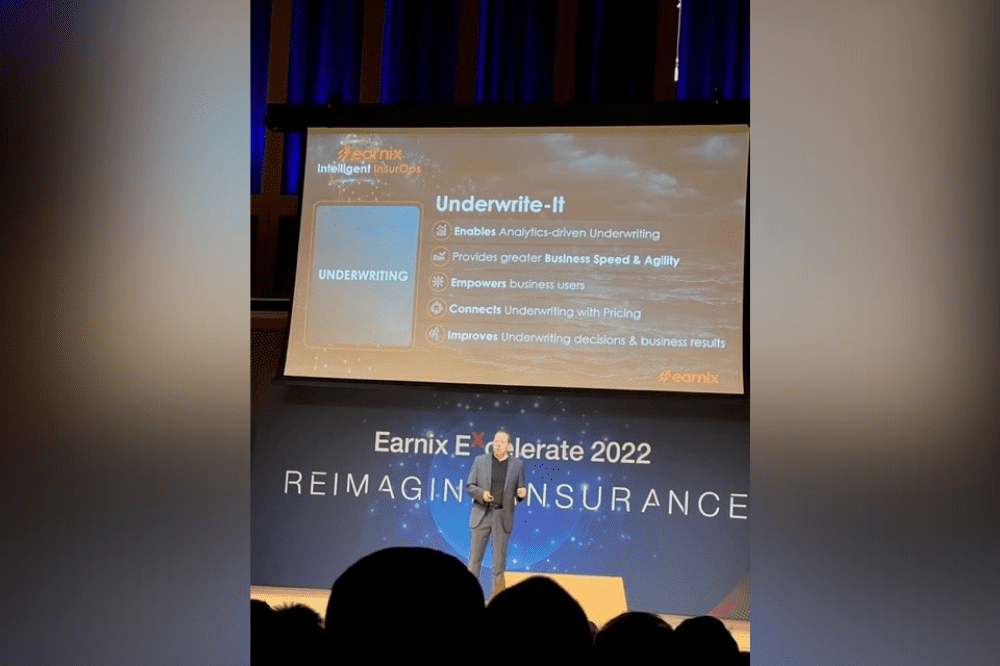

To address this challenge, Earnix has expanded its suite of intelligent insurance operations with a new underwriting solution, which it unveiled at its Excelerate 2022 conference in London.

Read more: What’s the most promising insurance technology in the market?

“Underwrite-It” fully automates underwriting decisions and manages all rules in one place, enabling underwriters to update rules and models without burdening IT. Combining the standard rules-based approach of underwriting with advanced machine learning and simulation, the solution aims to improve time-to-market on underwriting changes.

Integration with pricing

Another significant challenge underwriting teams face is the lack of cross-collaboration with other insurance areas.

“It feels very natural for underwriting and pricing to fully cooperate, but because the tools they use are so different, that cooperation is inefficient if it happens at all,” Ziv said.

With the new underwriting solution, Earnix said insurers can bridge the gap between underwriting and pricing. “Underwrite-It” allows users to share loss cost and demand models with pricing and rating teams using Earnix’s pricing solution, “Price-It,” for seamless integration.

“Because [Underwrite-It] is sitting on the same technology foundation of Earnix’s intelligence insurance operations, customers will enjoy full cooperation between underwriting and pricing,” added Ziv.

Yaron Lavie, Earnix’s VP of product, said that the average time-to-market for underwriting changes is weeks or months; amid a challenging and volatile market for insurance, this is simply not agile enough.

The lifecycle of an underwriting rule can be shortened by AI and machine learning. A traditional underwriting process might start from inception, move on to the definition of rule requirements, then to rule engine configuration or coding, before staging and production. Automated simulations cut out the middle steps and allow underwriters to be as agile as other parts of the insurance business.

“If you want to make a change to an underwriting strategy or introduce a new underwriting model, you also need to understand it’s impact on your portfolio. There’s strong interplay between changing underwriting and pricing strategies,” Lavie added.

Analytics-based underwriting

What makes Earnix’s solution different from other underwriting tools is that it helps insurers build rules rather than just managing the process.

“All the underwriting tools in the market focus on the underwriting workbench. We are providing a tool to manage the rules and models for underwriters,” Dror Pockard, chief strategy officer at Earnix, told Insurance Business.

“Today, most of the underwriting solutions are rules-based. We see that companies are looking for ways to start embedding analytical models into their underwriting process, and that’s where we’re supporting them.”

Read more: How the insurance industry can leave behind the burden of legacy technology

Earnix said its new solution can integrate advanced analytics into underwriting to help underwriters make better decisions. Self-learning algorithms adjust rules automatically, allowing real-time changes.

“Underwrite-It” was also created to reduce the burden of data scientists and IT teams supporting underwriters. The solution uses an easy-to-use interface that helps users manage rules, algorithms, and other aspects of underwriting decision logic without coding or IT expertise.

Innovation roadmap

“Underwrite-It” was unveiled as part of Earnix’s broader innovation strategy. Earnix is a global provider of artificial intelligence-driven rating, dynamic pricing, product personalization, and telematics solutions for insurance. The Israel-based firm has offices in the US, UK, Germany, France, Italy, and Australia.

At Excelerate 2022, Lavie highlighted the firm’s push to enable more business agility through machine-learning solutions and faster integration through a partnership with property & casualty (P&C) insurance platform Guidewire. The partnership will allow two-way, real-time quotes and product updates between Earnix and Guidewire using no-code, cloud-to-cloud integration.

Earnix is also improving its telematics offering. “Drive-It” will integrate with “Price-It” so that behavioural data collected from the telematics app seamlessly flows into the pricing solution for modelling, risk pricing, and rating.

Lavie cited a volatile and dynamic market, rapid AI and machine learning adoption growth, and a new generation of talent in the insurance industry as top factors driving Earnix’s innovation.

“The changing environment requires us to be much more agile in running our business. This agility is relevant to both the people in the analytical space and decision makers that need to act on those changes,” he said.