Digital marketplace for index-based longevity risk to open in Bermuda

A world-first digital marketplace for trading in index-based longevity risk is set to open in Bermuda, insurtech Longitude Exchange announced today.

Longitude Exchange aims to create a longevity risk focused asset class, so potential markets would not just be the typical reinsurance firms and insurance-linked securities (ILS) funds that already trade in life and longevity risks, but also a wider audience of hedge funds and investors.

Longitude Exchange was recently set up in Bermuda and will soon launch its digital marketplace for trading longevity risk in index-based format.

The digital platform is designed to connect longevity risk hedgers with investors on a web-based ecosystem that’s purpose-built for longevity risk.

The company expects that, through facilitating trading, transactional efficiency and enhanced liquidity can be brought to a marketplace that continues to see a growing demand for capital.

We’ve been covering longevity risk transfer for well over a decade, always with a view to longevity risk becoming a class of business where more of it is ceded into the capital markets.

But longevity risk transfer markets have always been dominated by major reinsurance firms and, while that’s likely to continue, opening up a new index-based marketplace for longevity risk hedging is a very positive step.

It will also put index-based longevity risk transfer up against indemnity, while the marketplace liquidity could see the index-based format able to exert some capital efficiencies, that might make hedging longevity risks there compelling to those holding it.

It’s certain to be an attractive proposition for the ILS funds and investors that appreciate longevity risks, as well as for other classes of investor for who longevity investments and asset class exposure might be appealing additions to their portfolios.

“Globally, pensions and insurers hold an enormous amount of longevity risk from retirement obligations. Longitude Exchange will connect them with a broad range of institutional investors who seek uncorrelated risk premia in insurance linked securities,” explained Avery Michaelson, the Co-Founder and CEO of Longitude Exchange.

Adding, “We’re turning longevity risk into an asset class.”

Longevity risk exposure can cause earnings volatility and high capital charges for pensions and insurers that are managing retirement-related liabilities.

These burdens can be alleviated through risk hedging, but the cost and complexity of entering into such transactions means there has been limited innovation in this market to date, Longitude Exchange believes.

But, importantly, the size of longevity risk globally dwarfs traditional insurance and reinsurance capacity providers, which means that in order to provide markets for all the anticipated risk transfer, capital markets investors must get involved.

“This market lacks a marketplace. Presently, transactions are brokered in an opaque process that has limited capital markets participation. Accessing risk taking capacity from a broader set of institutional investors is the best way to fulfill the longevity risk market’s potential. Longitude Exchange is this marketplace,” Michaelson added.

Longitude Exchange aims to drive down frictional costs and timelines through standardisation, while also providing price transparency and presenting an option for secondary liquidity.

The company believes that this will ultimately lead to more transaction volume and are precursors for broader capital markets involvement.

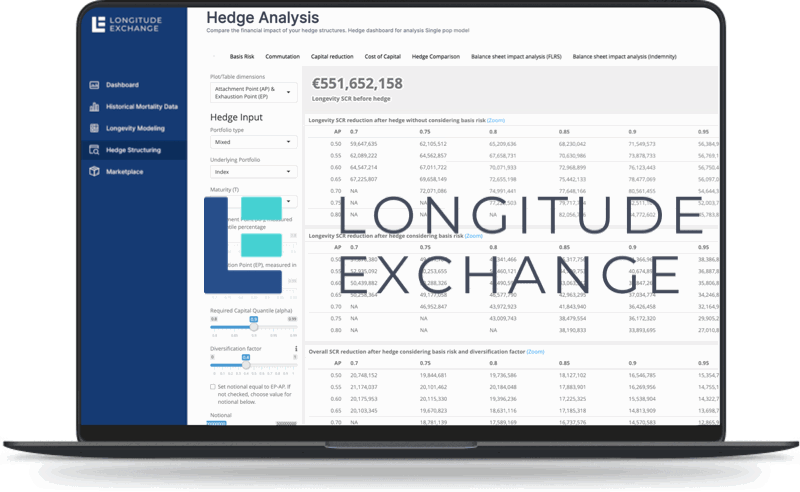

David Schrager, the CFO and Co-Founder of the company added, “By using Longitude Exchange, longevity risk hedgers can efficiently manage their longevity risk and capital charges. Our platform provides hedgers with tools to analyze, structure and place their longevity risk hedges at a price that’s typically lower than other forms of capital. Our goal is to provide hedgers of longevity risk with greater capacity, faster execution, and better pricing.”

Longitude Exchange will operate as a central counterparty for index-based longevity risk transfer transactions, providing enhanced credit support to large, long-duration transactions.

The platform will also handle transaction structuring, trade documentation, structural set-up, primary issuance, managing collateral, and provide on-going valuations, all with the goal of greatly reducing transaction costs and timelines.

“The technology we offer, for free, through the platform is capable of analyzing the risk and capital aspects of index-based longevity risk transactions, which will streamline the process of transacting longevity risk for both sides of the trade,” Diederick Venekamp, CTO and Co-Founder of Longitude Exchange said. “Longitude Exchange will provide unprecedented access to the longevity risk market through an easy-to-use digital interface and standardized transaction formats.”

The team comes with significant experience in the sector, with CEO Michaelson having previously been the Head of Longevity at Société Générale, where he was part of a team that led some of the first index-based longevity hedges.

Michaelson subsequently founded Longitude Solutions to operate as a transaction-oriented advisor in the longevity risk transfer market, where he led the 2017 hedging transaction between NN Life and Hannover Re.

Michaelson and Schrager collaborated on the transaction, as Schrager was the Director of Pricing & Hedging at NN Life. They joined forces in 2018, with Schrager becoming a Senior Partner at Longitude Solutions, as well as forming a separate financial and management consultancy, named Adjacent.

Completing the circle, Schrager then collaborated with Venekamp, the Managing Quantitative Consultant and a founder of VB Risk Advisory, a consultancy firm consisting of a select group of experienced quantitative advisors with expertise in actuarial science and technology development.

Longitude Exchange aims to fulfil the longevity risk hedging needs of pensions, insurers, and reinsurers on a global basis, but will initially focus on North American and European markets.

The company invites rated and un-rated institutional investors to participate on the exchange platform as risk takers, using customised longevity derivative contracts and collateral mechanisms to transfer risk and ensure payment obligations are met.

In addition, Longitude Exchange sees itself as a platform for other service providers including mortality data providers, risk modeling firms, and reinsurance brokers and consultants.

The launch of Longitude Exchange is a much-needed development in a marketplace where options have been too limited for risk transfer, while it has proved challenging for the capital markets to get meaningfully involved so far.

Democratising access to longevity risk in index-based form, using collateralised derivatives and a marketplace paradigm for trading and liquidity, could be precisely what the longevity risk transfer market needs to both grow its capital base and also broaden its offering to new types of pensions and insurers around the world.