Dental insurance: Everything you need to know

In this article, Insurance Business explains how dental insurance works to help consumers find the best policies that suit their budget and oral health needs. This can serve as a useful guide that insurance professionals can share with their clients.

As the name suggests, dental insurance is a type of policy designed to pay for the cost of dental care. Policyholders generally pay premiums to access coverage unless it is offered to them for free often through employer-based plans.

There are three common ways to access dental health policies:

As part of a medical insurance plan

As a stand-alone policy

As riders attached to health insurance policies

Just like in other types of insurance, dental plan holders need to pay premiums to continue getting coverage. This may be done in a monthly, quarterly, semi-annually, or yearly basis. For company-sponsored policies, payments may be taken directly from employee checks.

However, these are not the only out-of-pocket expenses that policyholders are responsible for. These are the different costs that plan holders are often required to shell out to access dental coverage:

Deductible

This is the amount the policyholder agrees to pay out of pocket before the dental insurance provider shoulders the cost of coverage. A deductible has an inverse relationship with the premiums they pay for. This means as one increases, the other decreases – so, generally the higher the deductible, the lower the premium, and vice versa.

One thing to take note of is that preventive procedures such as routine checkups and teeth cleanings do not usually require a deductible.

Copayment

Also called copay, this refers to a flat fee that the policyholder pays for certain dental services, with the rest covered by the insurance provider. This may be required at the time of the procedure.

The table below sums up the different out-of-pocket costs the policyholder needs to pay before dental insurance kicks in.

Coinsurance

After maxing out on the deductibles, the policyholder and the insurer split the cost in a system called coinsurance. Most dental insurance plans follow the 100/80/50 payment structure, which means:

100% coverage for preventative care

80% coverage for basic services

50% coverage for major restorative dental procedures

Annual maximum

This refers to the maximum amount the dental insurance plan covers within the year. Once this is reached, the policyholder will be responsible for the costs of any dental services. Annual coverage maximums usually range between $1,000 and $2,000. Plan holders have the option to use policies with higher limits, with a corresponding impact on premiums.

Most dental insurance plans have waiting periods, which range between six and 12 months before coverage starts. The wait times, however, can be as short as three months for some routine services, while those for major procedures can last up to two years. Preventive services typically do not have waiting periods, unlike basic and major procedures such as root canals and crowns.

Insurance companies impose these wait times to discourage customers from taking out policies just to cover impending procedures.

Dental policies come in several forms aimed at meeting the varying oral care needs of policyholders, just like standard health insurance plans. These are:

Dental Preferred Provider Organization (DPPO)

This type of plan, also called a PPO, allows policyholders to pay less for dental care if they choose to get treatment from providers in the plan’s network. However, they can also access dentists, clinics, and dental service providers outside of the network without a referral for an additional cost.

Dental Health Maintenance Organization (DHMO)

This form of dental insurance, commonly called an HMO, often limits coverage to dentists who work for or are contracted with the DHMO. These professionals provide cover for a set copayment and for no fee at all. Policies, however, do not cover out-of-network specialists. Some plans may require that a policyholder live or work in its service area to be eligible for coverage.

Discount or referral dental plans

These policies offer discounts for dental services provided by a select group of participating dentists. The fees are paid directly to these professionals at the time of treatment.

Indemnity or fee-for-service plans

In this type of coverage, also sometimes called Managed Care, plan holders are allowed to choose any dentist as there is no dental network similar to a DPPO and a DHMO. The plan typically pays a portion of each service, with the patient covering the rest. It also lacks the discounted fees that other plans offer.

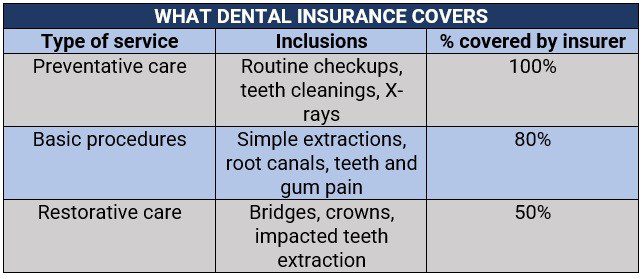

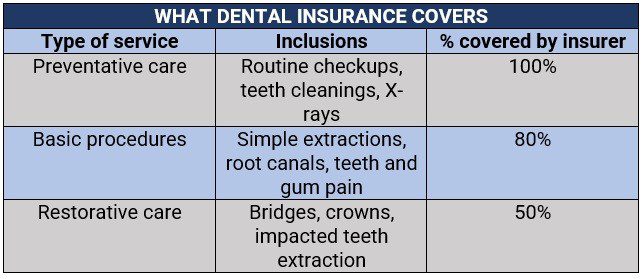

Dental insurance policies typically provide three levels of coverage. These are:

Preventive care: Includes routine oral exams, X-rays, cleanings, sealants, and fluoride treatments

Basic services: Includes diagnostic X-rays, fillings, simple extractions, teeth and gum pain emergency care, root planing, periodontal scaling, and root canals (considered a major procedure in some policies)

Major restorative procedures: Includes bridges, crowns, implants, impacted teeth extraction, anesthesia or sedation, complex oral surgery, and denture work

Orthodontic procedures, such as braces, are also covered in some policies, although a lifetime maximum and age restrictions – usually 18-years-old and younger – apply.

Here’s a summary of what each category covers and how much is covered by dental insurance.

Experts advise those searching for dental insurance to choose plans that at least partially cover crowns, root canals, oral surgery, diagnostic X-rays, and periodontitis treatment, which are features of a good dental plan.

While some policies cover orthodontic treatments such as braces, these are subject to limits. Here are some other services not covered under a standard dental insurance policy:

Cosmetic procedures such as teeth whitening

Composite or tooth-colored fillings, although amalgam fillings are covered

Dental care related to a pre-existing condition

One thing to remember is that the exclusions vary between insurers, so it is still best for policyholders to check their coverage limits with their insurance providers.

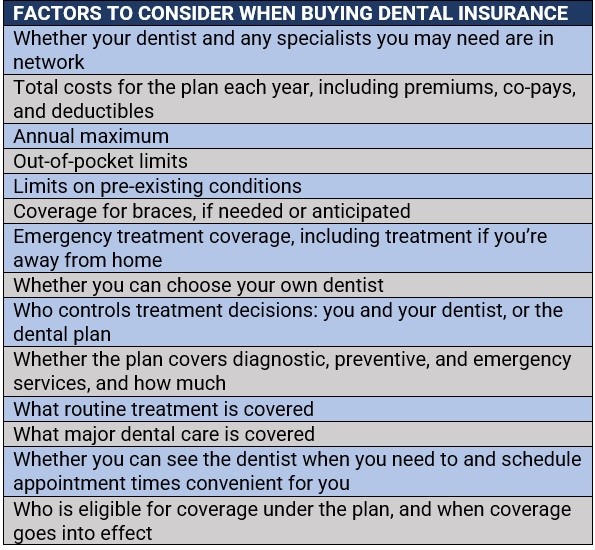

When picking a dental insurance policy, it can be tempting to look solely at the premiums and settle for the cheapest one. But as industry experts always say, “cheaper does not necessarily mean better.” Apart from fitting in their budget, the right dental coverage plan should match the policyholder’s oral health needs.

Here is a list of factors that consumers should consider when purchasing dental insurance:

Because not all medical plans provide coverage for dental care, it may be beneficial for certain individuals to take out dental insurance – but it all depends on their oral health needs. For those who need to see a dentist regularly and anticipate undergoing several dental procedures, getting coverage may be worth it.

But one important factor to take into account is that dental policies have annual limits and coinsurance, which will dictate how much they have to pay out of pocket. The key is finding a low-premium plan with shorter or no waiting periods and high annual benefits.

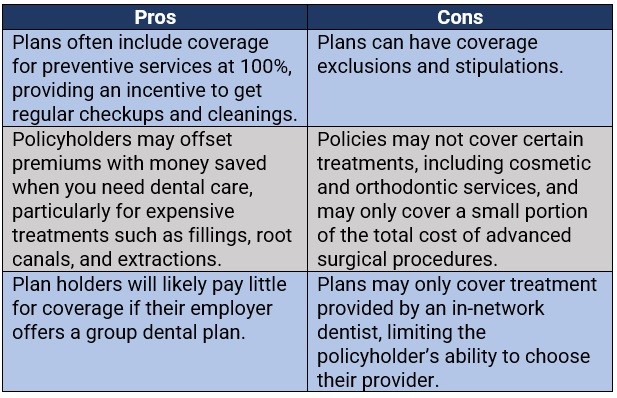

It is also advisable that consumers carefully weigh the advantages and drawbacks of dental insurance before purchasing one. These are the pros and cons of getting coverage.

Is dental insurance something you think is worth getting? Are there any benefits and disadvantages of getting coverage that you want to share? Feel free to share your thoughts in the comments section below.