Data shows industry loss warranty price trends. AM Best says ILW capacity rising

We’ve developed an industry-loss warranty (ILW) pricing data set from information we’ve gathered over the years, as well as recent input from our market sources that helped validate this new Artemis data service.

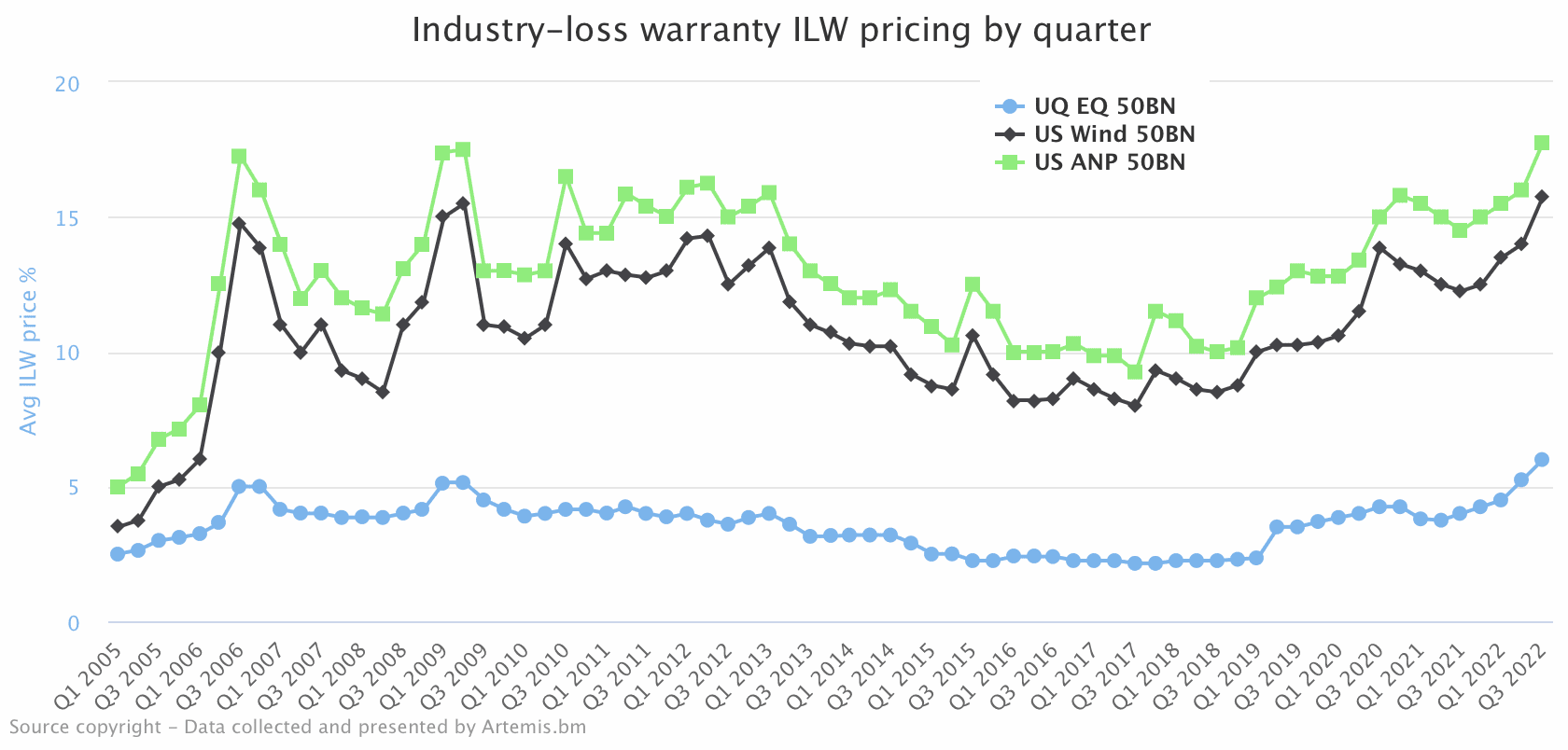

For the moment, we have pricing on three specific triggers for industry-loss warranties (ILW’s), $50bn industry loss attachments for US earthquake, US wind and US All natural perils.

While all natural perils coverage is pretty much considered to be unavailable, or very hard to secure at the advertised market pricing, we felt it’s worth including to provide a picture of where ILW rates have moved over-time.

Hopefully this data set of ILW rates-on-line over time will provide another useful way to track pricing trends in the catastrophe reinsurance and retrocession markets.

Through our industry sources we’ll endeavour to keep these up to date, to provide another way to analyse reinsurance market pricing trends.

The chart below shows our industry-loss warranty pricing data set. Click on the chart to visit the interactive version:

In a recent report, rating agency AM Best noted the rise in industry-loss warranty (ILW) rates-on-line and pricing, which is clearly reflected in our ILW pricing date set.

You may find it useful to compare with our other data indices, such as the global property catastrophe reinsurance pricing from Guy Carpenter, as well perhaps as catastrophe bond fund return indices from Plenum, and data on broader ILS fund strategy returns from ILS Advisers.

AM Best noted that ILW market capacity is estimated at anywhere between US $3 billion to $7 billion, but said this is currently rising because of the capacity constraints in the retrocession market, as well as demand for ILW protection from reinsurance firms and challenges some have faced in getting catastrophe bonds placed.

“By some estimates, ILW capacity is up 20% to 25% over last year,” the rating agency explained.

Adding that, “ILWs are relatively less expensive forms of coverage cedents use to fill gaps when they cannot buy retro cover in the traditional market or place cat bonds.”

On pricing of ILW coverage, AM Best said that rates are estimated to have increased 40% to 50%, presumably over the year to middle of 2022, although the rating agency doesn’t specify a time-frame for the rate increases.

By our data, the US earthquake ILW price has risen around 50% in a year, while the US wind ILS price is up almost 30% and US all natural perils is up around 22%.

Of course, these are indicative prices that we’ve gathered from market sources, so represent a starting point for broker negotiations on ILW placements, not necessarily where the pricing clears.

We’d also expect a US ANP ILW price would be significantly higher at this time, if it could clear at all, as appetite for these structures has diminished considerably among investors and ILS funds.

In fact, appetite has resurged for weighted ILW structures, something that had gone out of fashion a little over recent years, but has been seeing increasing demand as traditional retro capacity levels cratered.

We hope you find our new ILW pricing data set useful, as another indicator of reinsurance and retrocession market appetite and rates-on-line.