Cyclone Gabrielle industry loss estimated NZ $1.543bn by PERILS

Cyclone Gabrielle’s impacts in New Zealand are estimated to have caused an insurance and reinsurance industry loss of NZ $1.543 billion by PERILS AG.

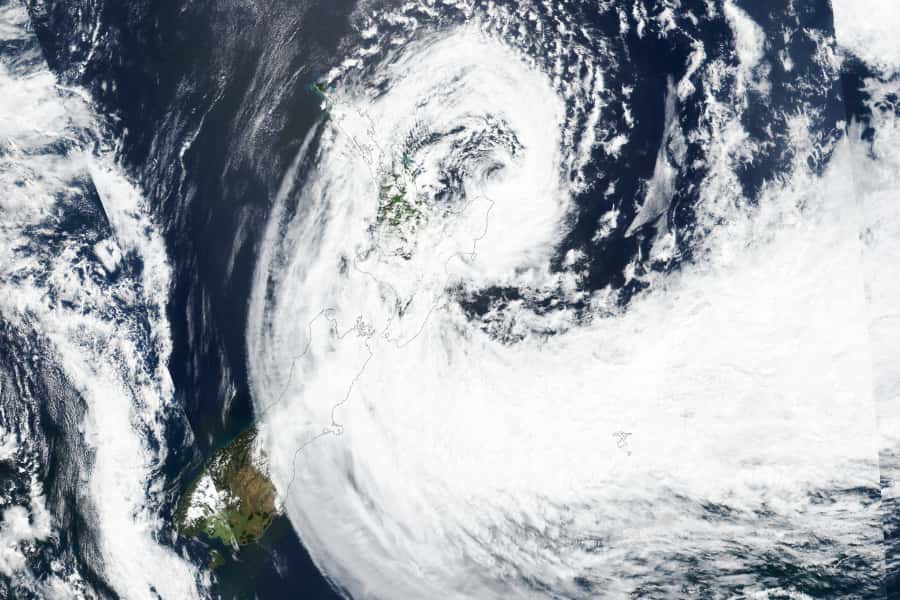

The catastrophe loss data aggregator has provided an initial industry loss estimate for Cyclone Gabrielle, which drove heavy rainfall and strong winds to the North Island of New Zealand between February 11th and 17th 2023.

PERILS initial estimate is based only on the property line of insurance business and is gathered from reporting insurers in the New Zealand market.

The loss from Cyclone Gabrielle comes on top of the recent severe flooding that affected Auckland and surrounding areas of New Zealand.

On that, PERILS placed an initial industry loss estimate of NZ $1.65 billion earlier this month, while even major reinsurance player Hannover Re acknowledged that the weather in New Zealand was going to erode its catastrophe budget.

Some insurers had said they anticipated making reinsurance recoveries after the flooding a cyclone, two of the worst weather disasters in New Zealand’s recent history.

Cyclone Gabrielle struck only two weeks after the severe floods had affected Auckland and surrounding areas on

the North Island of New Zealand.

The North Island experienced strong wind gusts of 90-110 km/h, with a peak of 141 km/h recorded, while rainfall exceeded 200 mm for a widespread area and the impact of Cyclone Gabrielle was magnified by the fact it struck when soil was already saturated after previous rains.

Storm surge and high tides also caused damage, with coastal inundation and landslides affecting property and critical

infrastructure, PERILS explained.

Darryl Pidcock, Head of PERILS Asia-Pacific, said, “New Zealand has largely been spared from catastrophic weather events in the past 50 years. This makes it all the more unusual that two billion-dollar weather events, first the North Island Floods and then Cyclone Gabrielle, should occur within weeks of each other. These catastrophes represent one of the most challenging periods for the insurance industry since the Canterbury earthquake sequence of 2010/11.”