Competitive ILW pricing drives considerable buyer interest at renewal: Howden Re

Competitive pricing for industry-loss warranty (ILW) protection has driven “considerable interest from a growing demographic of buyers” at the January 1st 2025 reinsurance renewals, according to broker Howden Re.

Industry-loss warranty (ILW) market activity has continued to be strong, as had been seen through the hard cycle, the reinsurance broker explained in its new renewals report.

Buyers have been seeking out well-priced retrocessional protection, in addition to which we have also seen some strategic industry-loss trigger structured protection purchases from a number of primary carriers, seeing the ILW product as well-priced in derivative and securitized catastrophe bond forms.

ILW trade size, count and limit transacted have all been increasing, Howden Re explained, as increasing numbers of buyers (reinsurers and insurers) opt to integrate this industry-loss index triggered product into their wider purchasing strategies.

Howden Re estimates that the market for industry-loss warranties (ILW’s) grew by around 10% to US $7.7 billion in terms of limits transacted from 2023 into 2024.

“The highly responsive nature of the market has seen it successfully navigate a period of market-moving losses (including Hurricane Ian), historically high pricing, fluid supply and demand dynamics and, most recently, a forecasted hyperactive 2024 hurricane season that ultimately resulted in limited ILW losses,” Howden Re explained.

Despite some uncertainty over the direction of travel in loss estimates related to 2024’s major hurricanes Helene and Milton, buyer behaviour was relatively unchanged, given most ILW’s trigger at higher levels of industry loss, Howden Re continued.

Some of the broker’s clients are reviewing their purchasing strategies, being motivated by earnings protection.

All of this explains significant movements in the industry-loss warranty (ILW) market since 2022, as following a period of constrained capacity, low losses and a more positive capital supply environment sets the scene for reduced pricing, Howden Re believes.

The broker noted that US peak peril ILW’s incepting at January 1st 2025 have been trading at lower rates-on-line as a result, reflecting the price environment across reinsurance, retrocession and, of course, the catastrophe bond market.

“Such flexibility, combined with more competitive pricing relative to competing products – US peak peril ILWs incepting at 1 January 2025 showed 20-30% nominal rate reductions from the mid-year 2024 trading period and 5-10% nominal rate reductions from January 2024 – has sparked considerable interest from a growing demographic of buyers,” Howden Re stated.

These ILW price movements closely resemble what we have been hearing from our market contacts.

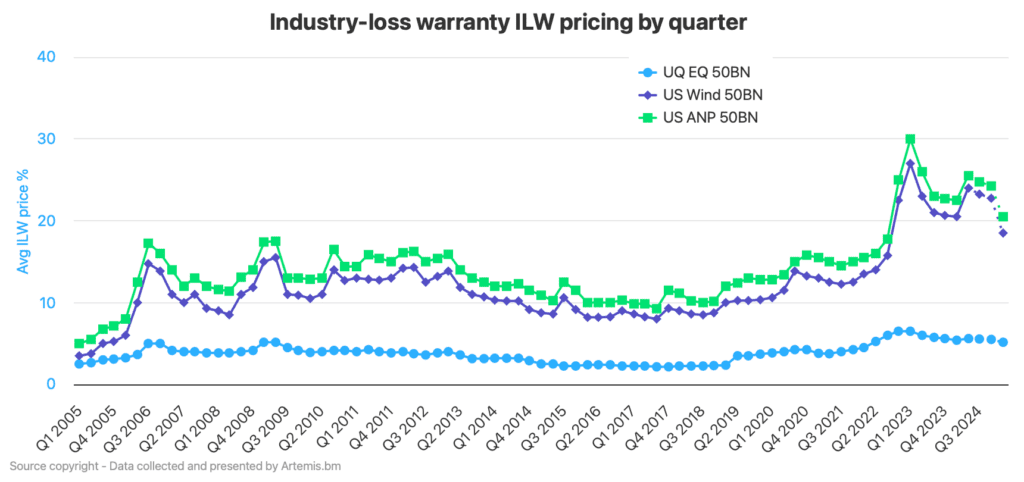

We’ve updated our industry-loss warranty (ILW) pricing data set using insights gathered over the last few weeks from a range of our market sources.

In the ILW pricing chart below (analyse an interactive version of here), the dotted-lines indicate projections for the forward-looking ILW rate environment.

Howden Re went on to explain that the ILW market is offering competitive pricing for a full-range of products, including aggregate covers, subsequent events, state- and county-weighted ILW’s, and multi-year contracts, all across a broad range of perils and geographies.

The reinsurance broker said, “2024 already stood out for increased trades in international ILW markets, predominantly for the perils of EU wind and flood (at a trigger level of ~US$10 billion). The market is also open to exploring the even more challenging issue of earnings protection from US severe convective storms, with client demand and executed transactions steadily increasing. Parametric solutions are also being explored, with limits likely to scale up rapidly with successful proofs of concept.”

Emphasising “flexibility” in the ILW market, Howden Re said that, “In addition to traditional retrocession purchasers (who are increasingly attracted by healthy supply, a broadening product suite and competitive pricing), interest from insurers is also growing as they become more confident in the management of basis risk.”

As a result, ILW market “Momentum persisted into 1 January 2025 renewals as strong demand and abundant supply drove high trading levels, portending well for further growth this year,” Howden Re concluded.

We hope you find our ILW pricing data useful, as another indicator of reinsurance and retrocession market appetite and rates-on-line.