Committed assets in ILS dropped an estimated 3% in 2022: Aon

Broker Aon’s latest reinsurance market report shows that global reinsurance capital declined by 7% during just the third-quarter of 2022, but also notes that committed assets in insurance-linked securities (ILS) had fallen by an estimated 3%.

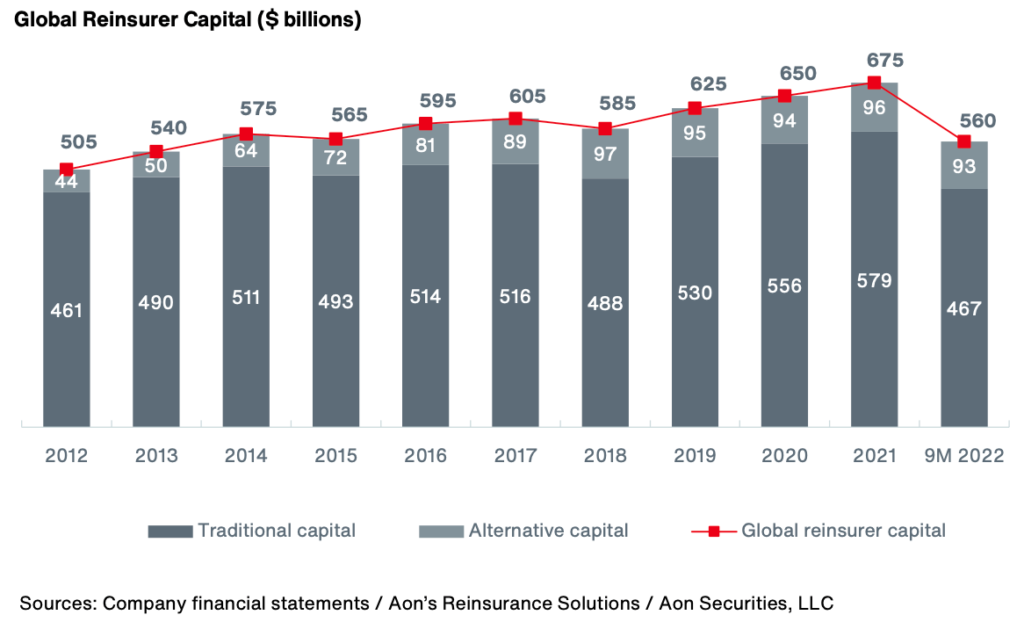

In fact, the contraction of the global reinsurance market is abundantly clear in Aon’s latest data, with the size of the capital base shrinking back to near 2015 levels.

Aon explained that global reinsurer capital declined by 17%, or $115 billion, to $560 billion over the nine months to September 30th 2022.

Traditional reinsurance capital declined by more than 19%, while alternative capital, so that deployed in ILS, catastrophe bonds and related structures, fell more slowly by just 3%.

However, it’s always hard to know where trapped collateral sits within these estimates, so how much of that $93 billion of alternative reinsurance capital was actually available to deploy at September 30th.

Alternative capital had rebounded to its previous high-level of $97 billion by the end of Q1 2022, but then fell to $95 billion by the middle of the year, before declining again to September 30th.

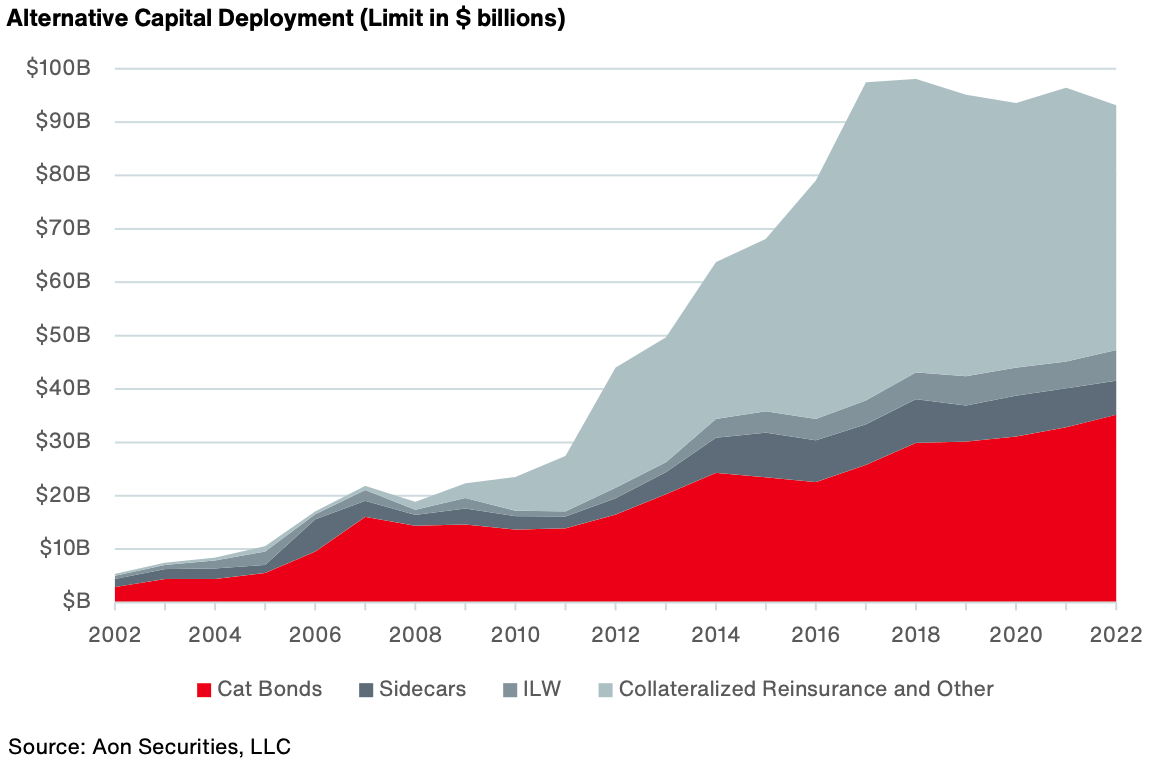

Aon notes that, “Gross committed assets in ILS declined by an estimated 3 percent in 2022. The combination of Hurricane Ian and redemptions throughout the year put a strain on existing investor capital, while inflows were constrained partly due to macroeconomic factors and concerns around the severity of Hurricane Ian in the fourth quarter.”

It seems these figures are to the end of September, so it will be interesting to see how they adjust once the fourth-quarter is included, along with any recoveries in valuations of hurricane Ian exposed positions, plus any fresh capital raises in time for the renewals.

Investor preference for catastrophe bonds remained evident and Aon’s data shows that it was the collateralized reinsurance and retrocession market that shrank, while cat bonds appear to have grown fastest.

Aon said that alternative capital could now be poised for strong market growth, given the better returns available and the prospects of improved underwriting performance for reinsurance as a whole after the renewals.