Combined Helene and Milton private insured losses to exceed $35bn: Moody’s RMS

Moody’s RMS Event Response has estimated that the total U.S. private market insured losses from the recent Hurricanes Helene and Milton will likely range between $35 billion and $55 billion.

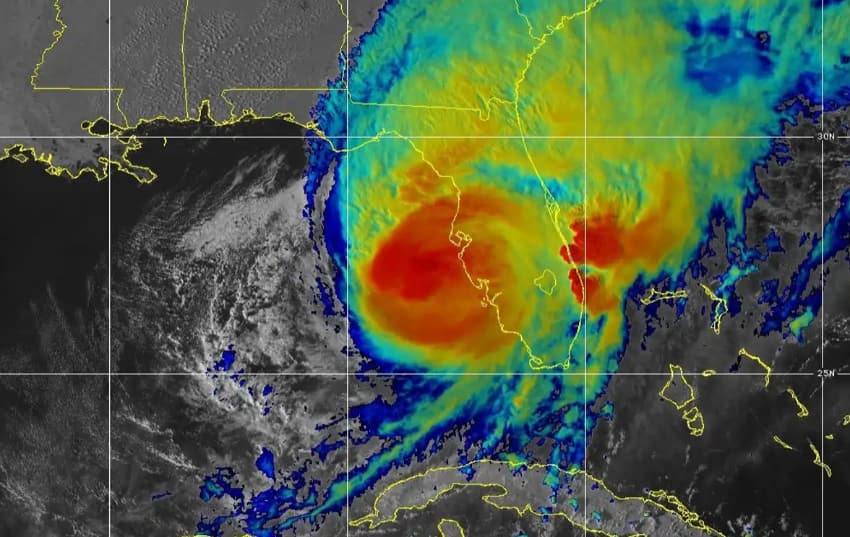

Milton made landfall on the 9th of October in Sarasota county (Siesta Key) on the west coast of Florida as a Category 3 hurricane, bringing strong winds, heavy rainfall, tornadoes, and storm surges, resulting in loss of life, damage to property and infrastructure, and power outages.

Meanwhile, Helene made landfall along the Big Bend region of Florida two weeks earlier, affecting many of the same areas.

According to Moody’s RMS, its insured loss figures are associated with wind, storm surge, and precipitation-induced flooding from the two events.

Mohsen Rahnama, Chief Risk Modeling Officer at Moody’s, commented, “This initial combined loss estimate is informed by Moody’s RMS Event Response’s rigorous approach to event insured loss estimation and includes a combination of observational data, detailed field reconnaissance so far spanning more than 2,000 miles, and aerial imagery analyses from both storms in the affected region.

“Our reconnaissance teams are in Florida right now, and continue to survey the impacted areas. Estimating losses in these events is challenging and it is important to consider all associated complexities and uncertainties, especially in the overlapping regions affected by both hurricanes.”

Last week, Moody’s RMS placed insured losses from Helene at between $8 billion and $14 billion and estimated that losses to the National Flood Insurance Program (NFIP) could surpass $2 billion.

The firm noted it will release its industry loss estimate for just Milton by the end of this week and also its final loss estimate for Helene.