Collateralized / ILS take 66% of Florida Citizens reinsurance renewal, Nephila $587m

Collateralized capital markets backed reinsurance capacity and insurance-linked securities (ILS) fund managers have taken roughly two-thirds of Florida Citizens traditional reinsurance tower at the recent renewals, with Nephila Capital remaining the largest of those markets.

Florida’s Citizens Property Insurance Corporation has placed increasing reliance on the capital markets to support its catastrophe reinsurance needs in recent years and this renewal sees third-party and alternative sources of reinsurance capital playing a particularly significant role.

One reason for this is the absence of Berkshire Hathaway in the 2024 reinsurance tower of Florida Citizens, which is surprising after that company took a massive $1 billion line a year ago.

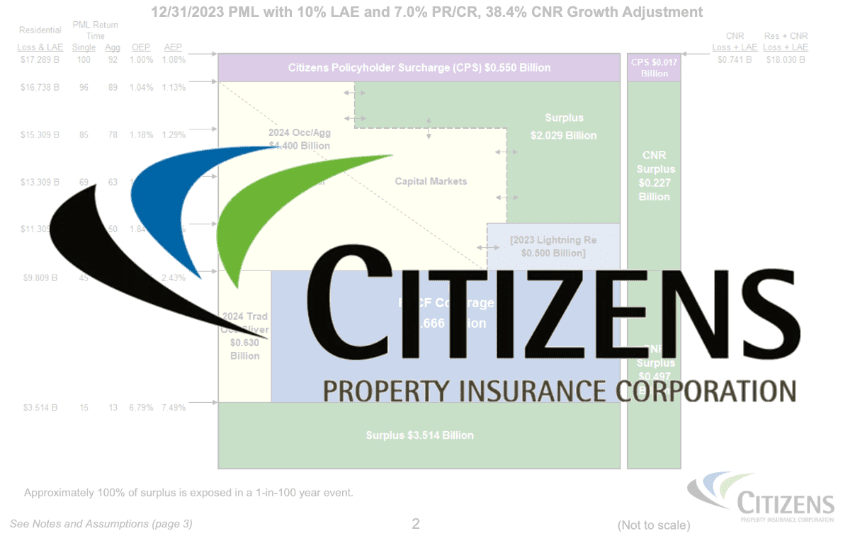

After last year’s reinsurance renewal and including its catastrophe bonds that were in-force at the time, Florida Citizens had a roughly $5.38 billion tower on place, with almost $3.6 billion of this total reinsurance protection for the hurricane season coming from the ILS market and collateralized sources.

That consisted of over $2.4 billion in cat bonds and $1.195 billion of the traditional tower for 2023 coming from ILS and capital market sources.

Now, for 2024, while Florida Citizens has bought much less reinsurance, at $3.564 billion, some $1.6 billion of it is in catastrophe bond form, while a further almost $1.3 billion is from ILS and collateralized participation in the traditional reinsurance tower.

Which means that the collateralized capital markets and ILS fund share of Florida Citizens total reinsurance arrangements for 2024 is now at 81%, up from 67% a year ago and demonstrating the importance of ILS markets to the insurer of last resort for Florida.

That’s the highest level of ILS and third-party capital support Florida Citizens has ever had in its reinsurance tower, we believe.

The traditional reinsurance tower of roughly $1.964 billion is now 66% or two-thirds supported by collateralized and ILS fund sources, together providing $1.3 billion of limit to support Citizens reinsurance needs this year.

This year, ILS investment manager Nephila Capital is the largest market overall for Florida Citizens traditional reinsurance arrangements.

Nephila Capital took $587 million, or almost 30%, of the overall traditional reinsurance tower this year, which is down slightly on last year when Nephila underwrote just over $756 million of the tower for 2023.

A year earlier, for 2022, Nephila took $450 million of Florida Citizens’ reinsurance program, which was a decline on the $600 million line Nephila wrote for Citizens’ program in 2021.

So this ILS market has been a critical and consistent supporter of Florida Citizens reinsurance needs for some years now, demonstrating the important role the capital markets has played.

After Nephila, on the collateralized and ILS side of the market, the next largest participant at Citizens reinsurance renewal was hedge fund D. E. Shaw who took $270 million of the tower, all underwritten through cells of D. E. Shaw Re in Bermuda.

Aeolus Capital Management was next, taking a $252.5 million line of the tower, underwritten by Aeolus Re Ltd.

Pillar Capital Management was next, taking a nearly $76.9 million participation and writing it via paper provided by global reinsurance firm Hannover Re.

LGT ILS Partners underwrote over $29.5 million of the tower via its rated reinsurer Lumen Re in Bermuda.

Stone Ridge Asset Management took almost $25.5 million, participating via Artex’s Axcell Re vehicle via a segregated account named Marigold.

Alternative investor Quantedge Capital took an almost $19.2 million share via two lines written with the fronting support of Arch Re and Hannover Re.

ILS manager Leadenhall Capital Partners took a nearly $15 million reinsurance line, fronted on its behalf by MS Amlin AG.

Alternative investor One William Street Capital has also participated this year, taking a nearly $10 million line of the reinsurance tower fronted via Artex Axcell Re.

Lastly, Eskatos Capital Management took a just over $3.5 million line, fronted on Hannover Re paper.

Which add up to the almost $1.3 billion of reinsurance limit, or 66% of the traditional placement and when added to the catastrophe bonds for Citizens, means roughly $2.9 billion or 81% of its $3.564 billion of reinsurance program for 2024 comes from capital markets and ILS fund sources.

Other notable participants, from the traditional side of the reinsurance market, include Swiss Re taking a $147.6 million line, Munich Re taking $115.7 million, Ariel Re taking $106.9 million, TransRe taking $78.8 million, Odyssey Re $60.6 million, Everest Re taking nearly $60 million, and PartnerRe just under $50 million.

Some of these could also have third-party capital backing, giving a number operate their own ILS structures and funds, or have specific backing from other semi-independent ILS fund managers.

So, the actual capital markets backing for Florida Citizens reinsurance arrangements for 2024 could actually be higher than 81%, reflecting the key role ILS and collateralized markets play for this insurer, for Florida and for peak zone natural catastrophe peril reinsurance.

Also read:

– Florida Citizens only buys $3.564bn of reinsurance for 2024, despite 7.9% drop in price.

– Florida Citizens budget for 2024 cat bonds & reinsurance lifts to $750m max.

– Florida Citizens expects slightly higher risk transfer rate-on-line for 2024.

– Florida Citizens secures $1.1bn of reinsurance with new Everglades Re cat bond.