CFC welcomes two new non-executive directors

CFC welcomes two new non-executive directors | Insurance Business New Zealand

Cyber

CFC welcomes two new non-executive directors

They will both provide substantial industry experience in their new capacities

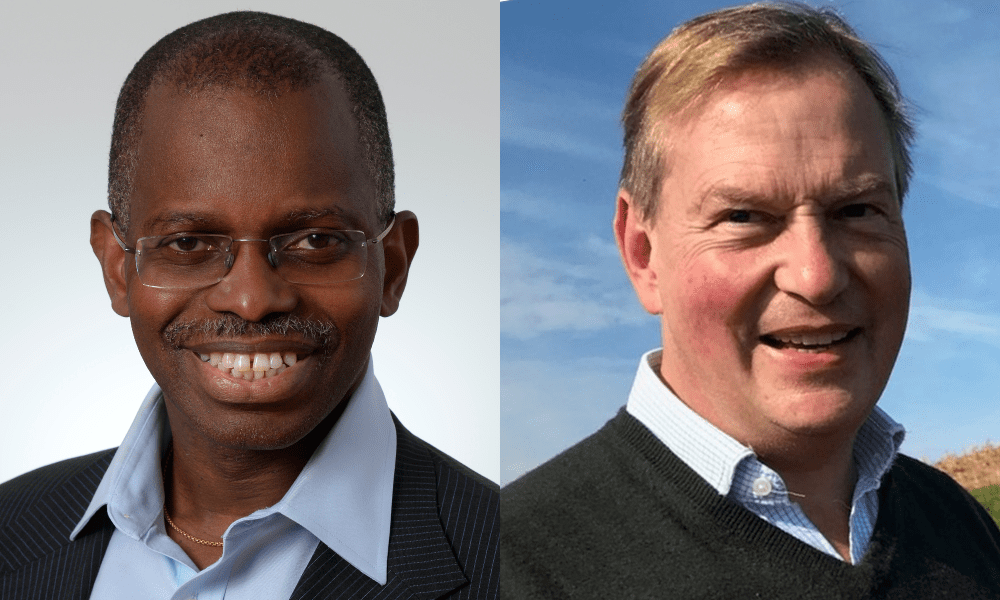

Specialist insurance provider CFC has announced the appointments of Bryan Joseph (pictured above, left) and Oliver Corbett (pictured above, right) to its board of directors as independent non-executive directors.

Corbett brings extensive experience in financial services. He is a founder and strategic advisor at McGill and Partners, a boutique specialist insurance and reinsurance broker, and serves as a non-executive director of HSBC UK and Allianz UK.

“I am delighted to join the board of CFC. It has been an incredibly successful business and I look forward to joining at this next phase of its story, protecting the things that make CFC special and leveraging its advantages as it expands its international coverage and product set,” Corbett said.

Joseph has over 40 years of industry experience, having worked in senior actuarial roles internationally. He is currently a partner at Vario Partners LLP, a non-executive director of Lancashire Holdings Limited and its Managing Agency Lancashire Syndicates Limited, and the senior independent director and chair of the risk committee at Sabre Insurance Group.

“I am delighted to join the board of CFC as it transitions into its next phase of growth in the UK and internationally. I look forward to supporting its new and dynamic management team as they build upon the successes that have been achieved to date,” Joseph said.

“Both Bryan and Oliver understand the challenges of taking thriving businesses forward to become truly global-spanning organizations, while preserving the unique aspects of the company,” CFC group CEO Louise O’Shea said. “That’s the trajectory that the team here at CFC is on, and I’m excited to tap into their experience as we aim to serve more customers with more solutions in innovative ways across more territories.”

Since its establishment in 1999, CFC has since expanded its offerings to include more than 50 products across 20 different classes of insurance, focusing on emerging risks for SME businesses influenced by the intersection of technology and industry. The company’s capabilities span underwriting, claims, technology and innovation, cyber security, and incident response.

What are your thoughts on this story? Please feel free to share your comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!