Catastrophe industry losses seen below $10bn in Q4 2022: JPM

Analysts at J.P. Morgan have estimated that insurance and reinsurance market losses from catastrophe events that occurred during the fourth-quarter of 2022 will fall below $10 billion.

Because of this, the analysts feel that natural catastrophe claims reported by the industry for Q4 will prove to be below most assumptions (implying within budgets).

This is for the European cohort of insurance and reinsurance firms tracked, as we’ve already seen that major US insurers Allstate and Travelers are set to experience quite significant losses from Q4’s severe winter weather.

J.P. Morgan’s analysts note that winter storm Elliott in the US and hurricane Nicole are together the two largest industry loss events of Q4, between them driving an estimated roughly $7 billion of claims.

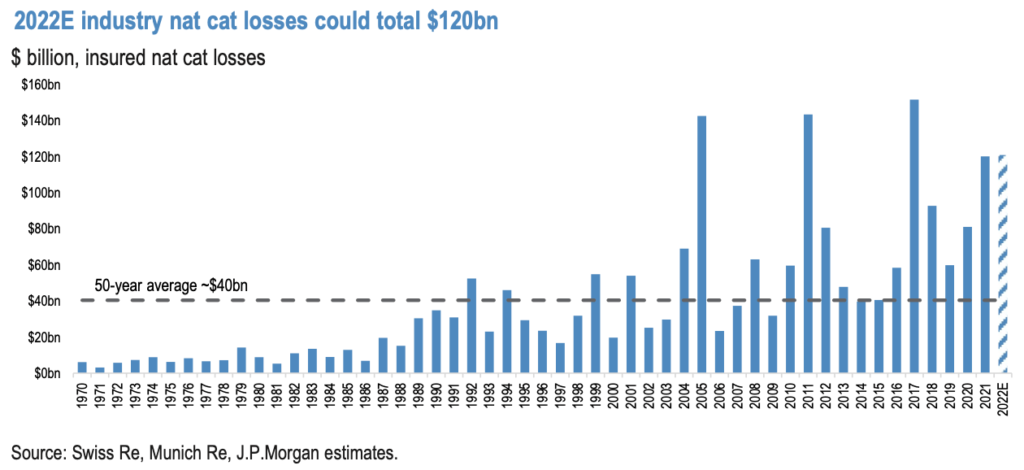

Including these Q4 loss events, J.P. Morgan’s tracker of major insured catastrophe events in 2022 has now reached $120 billion, which is in line with estimates from global reinsurance firms.

This will make 2022 as expensive as 2021, in terms of insured catastrophe losses and these two years will be the joint fourth most costly for the global insurance industry on record.

There will, of course, be other severe weather losses around the world that would add to the insured loss tally for Q4, but these are unlikely to tip the total above the $10 billion mark, it seems.

Also read:

– Munich Re sees climate change & La Niña in $120bn disaster insurance bill from 2022.

– Insured catastrophe losses hit $115bn year-to-date in 2022: Swiss Re.