Catastrophe bond spreads hit all-time-high in 2023

The average spread across newly issued catastrophe bonds has now reached an all-time-high in 2023, as data recorded by Artemis now shows that both the average coupon and the average spread above expected loss of cat bonds entered in the Artemis Deal Directory this year are at record levels.

The good news for catastrophe bond and insurance-linked securities (ILS) investors is that the average expected loss of issued cat bonds has not risen, which means the average multiple-at-market of new cat bond issuance is also up considerably in 2023 so far.

Using some of our cat bond market charts and statistics, we can help you to visualise the significant moves in pricing seen and how they are playing into the much higher return potential of cat bond investments.

As well as tracking data on cat bond and related ILS issuance, the most prolific sponsors in the cat bond market, most active cat bond structuring and bookrunning banks and brokers, or which risk modellers feature in cat bonds most frequently, plus much more, we also track pricing data, in particular expected losses, coupons, spreads and multiples.

We now have a decent sample of newly issued catastrophe bonds in 2023, with five full 144a property cat bonds and the Vitality Re health cat bond, all having been issued and priced and incorporated fully into our charts and data.

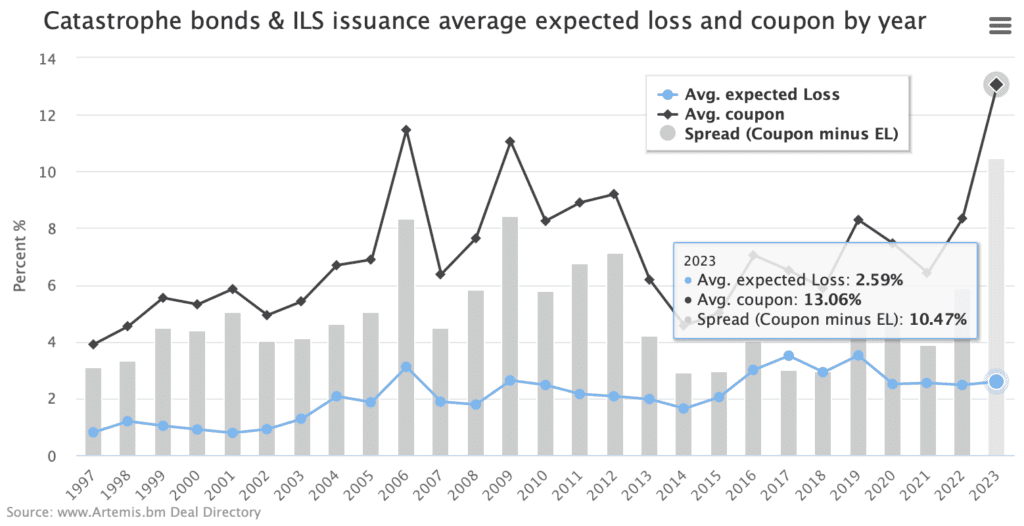

First, our chart displaying the average coupon, expected loss and spreads of cat bond & related ILS issuance by year. Click on the chart for an interactive version.

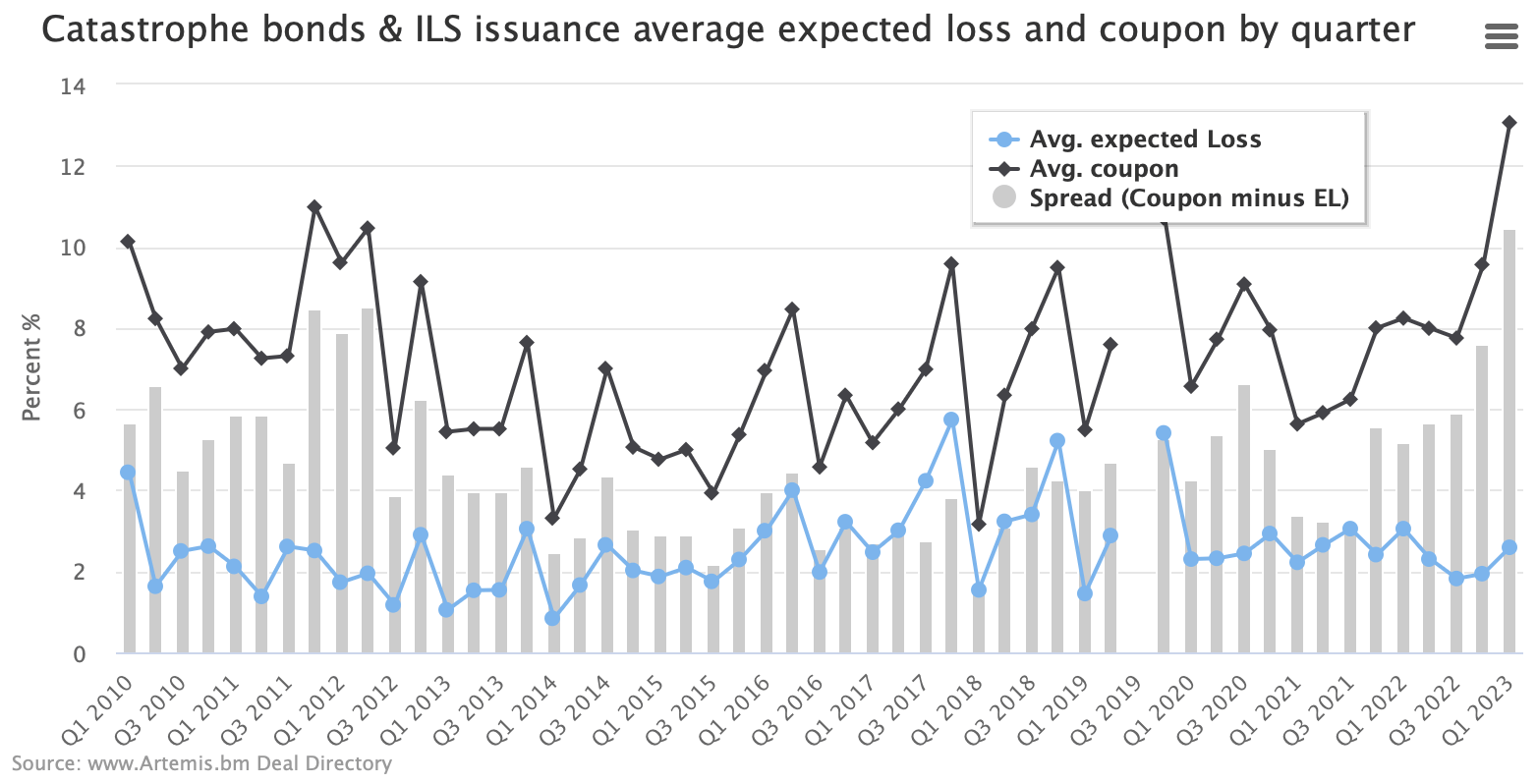

With only a few deals in, it might be more informative to look at this data by quarter, for a better comparison, which we provide on that same page and you can see below. Click on the chart for an interactive version.

The spread above expected loss currently averages nearly 10.5%, even with the inclusion of the lower-priced and risk Vitality deals. This is a record high for any quarter of issuance since 2010 and puts the 2023 average at an all-time-high so far.

This reflects the much higher reinsurance rates being paid by cedents in this hard market, while the expected loss level is down slightly from the prior year quarter, but may come up slightly with the addition of the other cat bonds slated to complete before the end of March.

While there does appear to be some moderation of spreads in the newer cat bonds that have yet to price, they are still elevated far above recent year levels and so these metrics should remain at or near record highs by the time the pipeline of currently marketed deals settles.

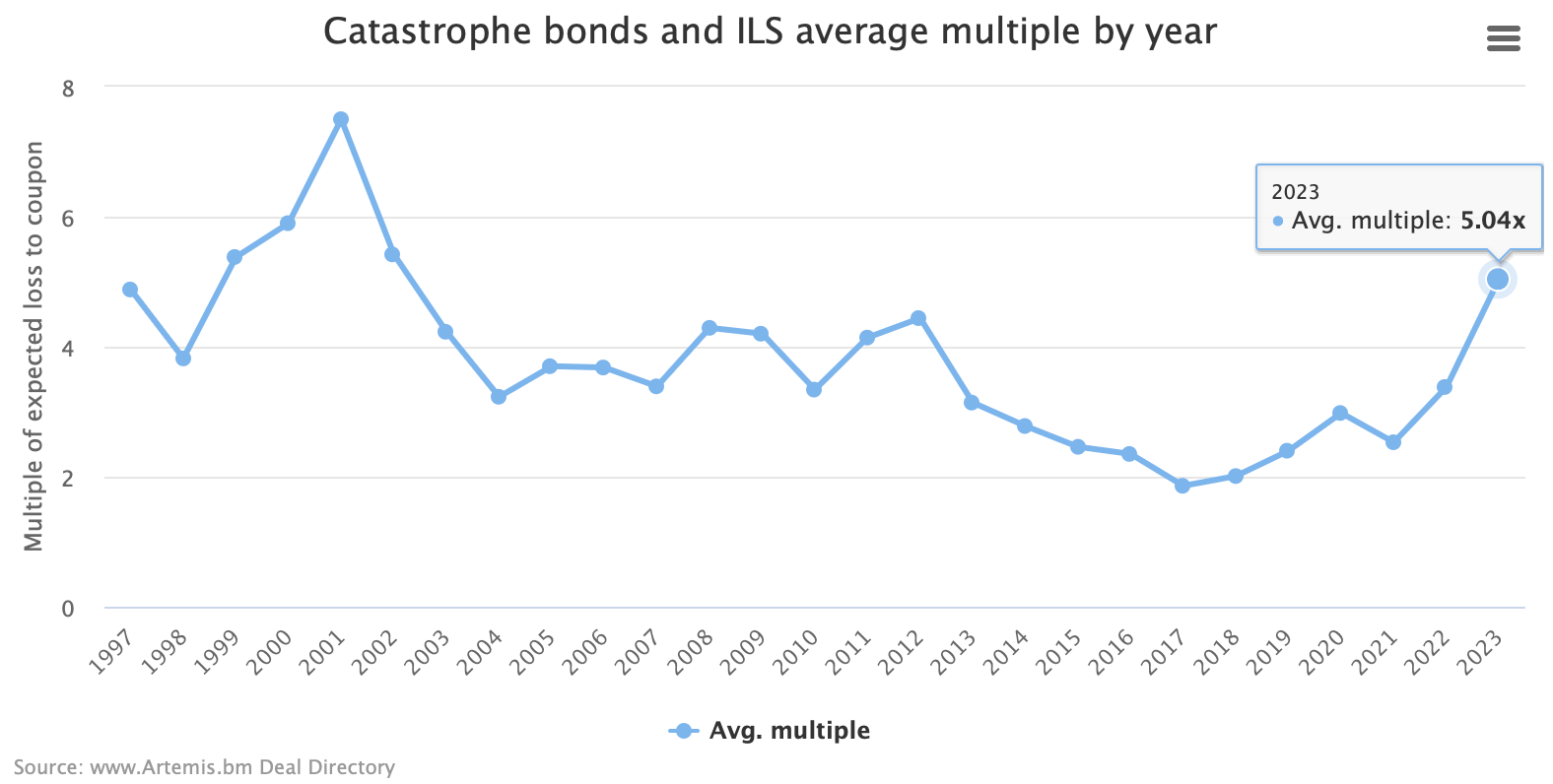

Secondly, we can also view the hard priced reinsurance environment using our chart displaying the average multiple (expected loss to coupon) of cat bond & related ILS issuance by year.

It shows the multiple-at-market of cat bond issuance in 2023 so far as having come down a little bit in recent weeks, as new deals are added and they moderate the data from the Vitality deals, but at over five times the expected loss and 4.92 times minus Vitality Re, the multiple-at-market of cat bonds issued in 2023 remains very high.

You can imagine the multiple might come down somewhat, as new catastrophe bonds settle and their data is included and as pricing peaks, or moderates slightly, as might be expected once inflows pick-up again through the coming weeks and months.

But, the chances of spreads and multiples getting back to the lows seen in the past are non-existent, based on our understanding of investor and manager needs and discipline.

An additional data source you will find useful is our ILW pricing data, which is a unique data set on the development of rates-on-line for industry-loss warranty (ILW) coverage over more than a decade.

With ILW prices at record highs, this is another valuable input to decision-making and helps in understanding the current reinsurance and ILS pricing environment.

Find all of our charts and data here, or via the Artemis Dashboard. All of these charts are updated as new catastrophe bond issues complete, or as older issuances mature.