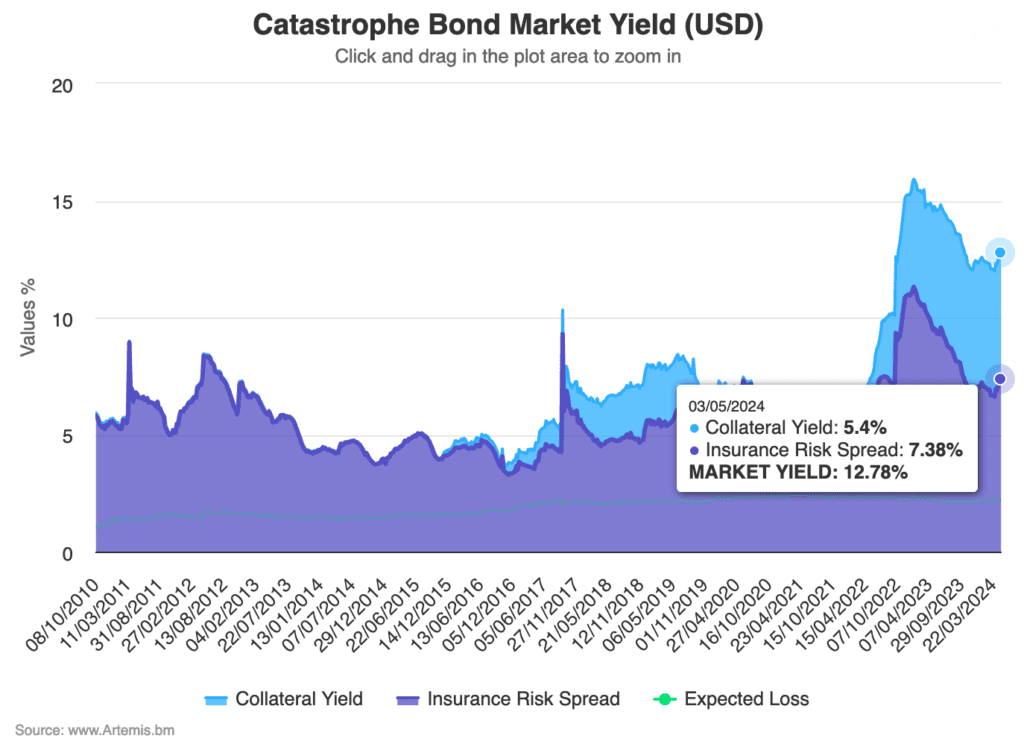

Catastrophe bond market yield jumps 7% in April, to reach 12.8%

The total yield of the catastrophe bond market in US dollars has risen by roughly 7% during the month of April, to reach a level of 12.8%, with slightly higher collateral yields plus an 11.5% recovery in insurance risk spreads the key drivers.

You can analyse this in our chart that displays the yield of the catastrophe bond market over time.

At the end of March 2024, the total yield of the catastrophe bond market in US dollars had declined to 12%, with the insurance risk spread component dropping to 6.62%.

Fast-forward just a few weeks and the total yield has recovered by 7% to reach 12.8%, as of May 3rd, while the insurance risk spread component rose at a faster pace of 11.5% to reach 7.38%.

Analyse the yield of the catastrophe bond market and its constituent parts in Artemis’ chart (click the image below to access an interactive version):

Cat bond market yields had peaked in early January this year, when the total yield of the cat bond market reached a record (for this data set) of 15.91%, driven largely by a very high insurance risk spread component of 11.31%.

Insurance risk spreads then steadily declined through the first-quarter of the year, aligned with the spread tightening seen across the secondary cat bond market and the lower pricing that was evident in primary issues, driven by supply-demand imbalance related factors.

But, April saw a turnaround of sorts, as the market became more balanced and spread widening became the defacto trend in the secondary market for cat bonds.

While there is also some evidence of a pricing floor having been reached for primary cat bond issues, especially for aggregate and industry loss index cat bond deals, as well as for some perils such as Florida wind.

All of which has contributed to the rise in cat bond market yield through the month of April, something that suggests a level of stability has been achieved at or slightly above the 12% cat bond market yield level.

As we reported yesterday, recent cat bond spread widening is also being partially attributed to the introduction of a new Atlantic hurricane model, which has adjusted risk appetites and return requirements for some fund managers in the market, we understand.

The catastrophe bond market has become far more dynamic in recent years, with pricing and therefore yields in the market adjusting based on supply of capital, demand for risk-linked investments, conditions in the global capital markets, as well as investor and manager perception of risk.

Over the last 12 months or so, we’ve seen all four of these dynamics having an effect on the catastrophe bond market, driving a response in cat bond yields and this can deliver investment and trading opportunities for those able to work with this cycle of supply, demand and pricing.

Analyse catastrophe bond market yields over time using our new chart.