Catastrophe bond issuance already on-track for biggest Q1 ever

See updates in this article for the latest outlook for the quarter. Catastrophe bond issuance recorded by Artemis so far in 2024 has already surpassed $2.8 billion and when we include all the remaining cat bonds that are still being marketed and are scheduled to settle before the end of March, the first-quarter 2024 total is on-track to set a new record for the period.

In fact, when we originally published this article, we only needed to see roughly $161 million of additional cat bond deals, or upsizing of those still in the market (of which there are seven currently), for the Q1 2024 cat bond issuance total to set a new record.

Update: Within 48 hours of publishing this article one new $100m transaction had been launched for Allied Trust Insurance and another $100m transaction for Brookfield, which are both targeted to settle in March, while another transaction for the NCIUA had upsized by $200m, so easily taking the first-quarter of 2024 into record territory (if all these deals complete on time and at current offering sizes).

Track the issuance of every catastrophe bond using the Artemis Deal Directory.

Today sees $880 million of new risk capital added to issuance so far for 2024, with the completion of the latest $575 million FloodSmart Re Ltd. (Series 2024-1) cat bond for the NFIP and $305 million Integrity Re Ltd. (Series 2024-1) for American Integrity Insurance.

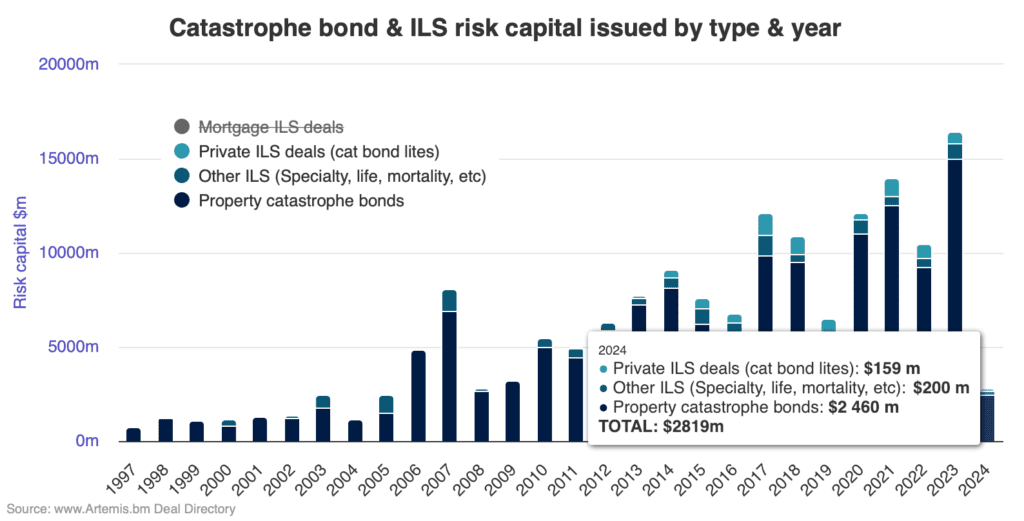

It takes the current total tracked in our Deal Directory for 2024 so far to just over $2.8 billion, consisting of $2.46 billion of 144A property cat bonds, $200 million of 144A cat bonds covering non-property risks (in this case health), and $159 million of private cat bonds.

The chart below shows catastrophe bond issuance by year and type of transaction, click here or on the chart to analyse the data:

Right now there are an additional seven 144A property catastrophe bonds that are being marketed to investors and are scheduled for completion before the end of March, so should fall into the first-quarter data if all goes to plan for the issuers and sponsors.

They currently add up to roughly $1.085 billion, should they settle at their current maximum sizes.

As a result, adding this to the just over $2.8 billion of cat bonds already settled and tracked by Artemis this year so far, would give a first-quarter total of just over $3.9 billion of new issuance. Update, this could now be just over $4.3 billion based on inclusion of the latest deals and sizes.

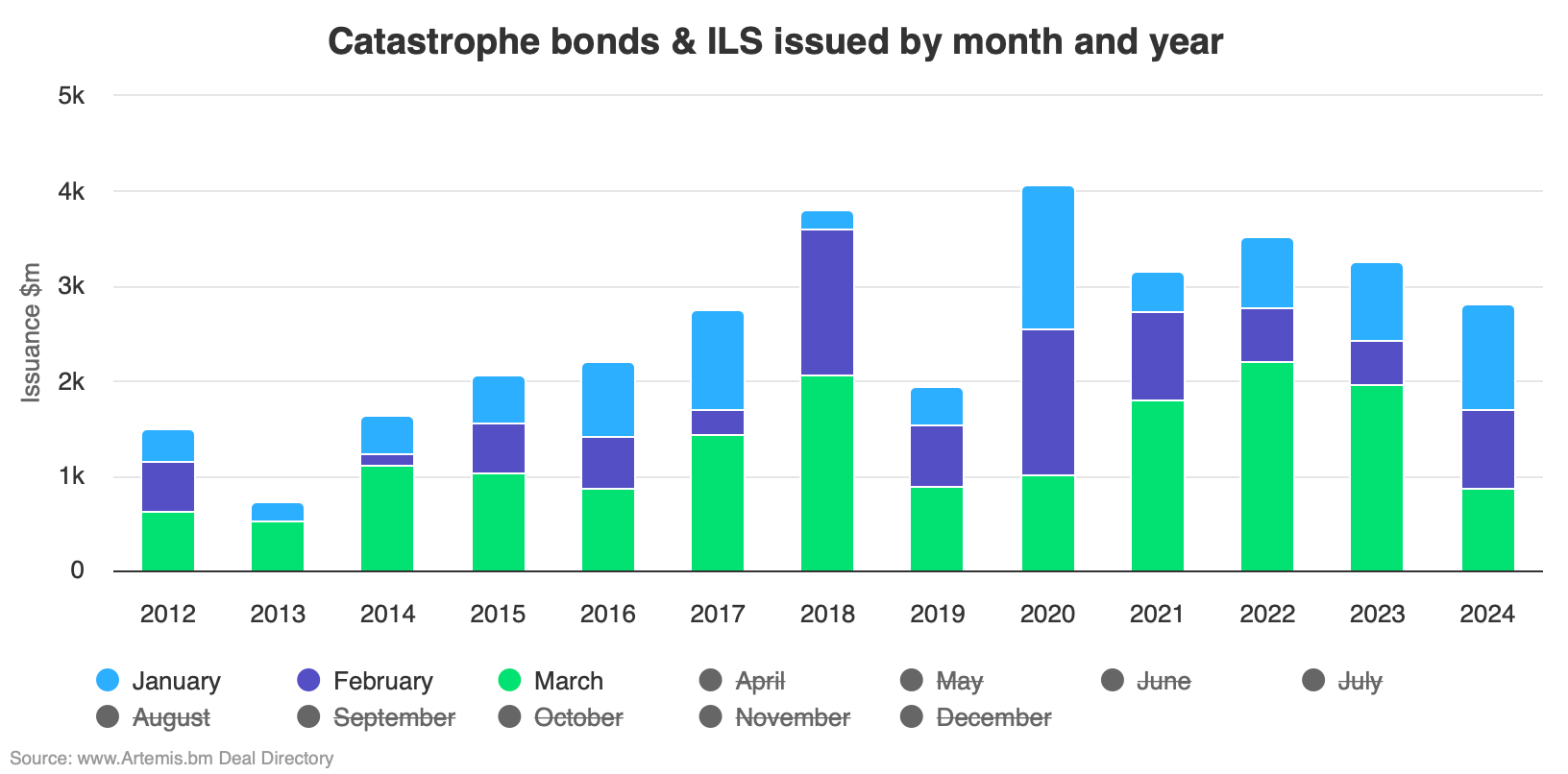

Using another of Artemis’ charts we can analyse catastrophe bond issuance by quarter, to see where we currently stand versus previous years. Click on the image below or here to analyse the data. By clicking on each month below the chart, you can select which periods to include, or not, for your analysis.

Right now, 2024 to-date is running in 6th place for full first-quarter cat bond issuance.

But, once the additional just over $1 billion of deals that are being marketed get added, the total of over $3.9 billion of Q1 cat bond issuance could move 2024 into second place, behind only 2020 when just over $4.06 billion were issued.

Update, the Q1 2024 total could now be just over $4.3 billion based on inclusion of the latest deals and sizes.

As said, it would only take an additional $161 million of risk capital to be issued, through the upsizing of any of the seven deals still being marketed, or the emergence of another Q1 deal, for the first-quarter issuance record to be beaten. We’ve now seen more than double that within 48 hours of publishing this article.

All of which helps to underscore the continued strong activity in the catastrophe bond market, with issuance maintaining a near-record pace already.

Our sources say that the pipeline continues to grow, with strong interest in catastrophe bonds as a source of reinsurance being shown by both repeat and new sponsors.

All of which continues to set up 2024 to be another very strong year for new catastrophe bond issuance, with a good chance that at least some records are broken again before this year is over.

The Artemis Deal Directory lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s. The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

Analyse the catastrophe bond market using our charts and visualisations, which are kept up-to-date as every new transaction settles.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.