Catastrophe bond funds UCITS average 16% return for 2023

Catastrophe bond fund strategies in the UCITS format have delivered an impressive almost 16% average return for the full-year 2023, rising every single month during the period and setting a new record for this popular segment of the cat bond fund space.

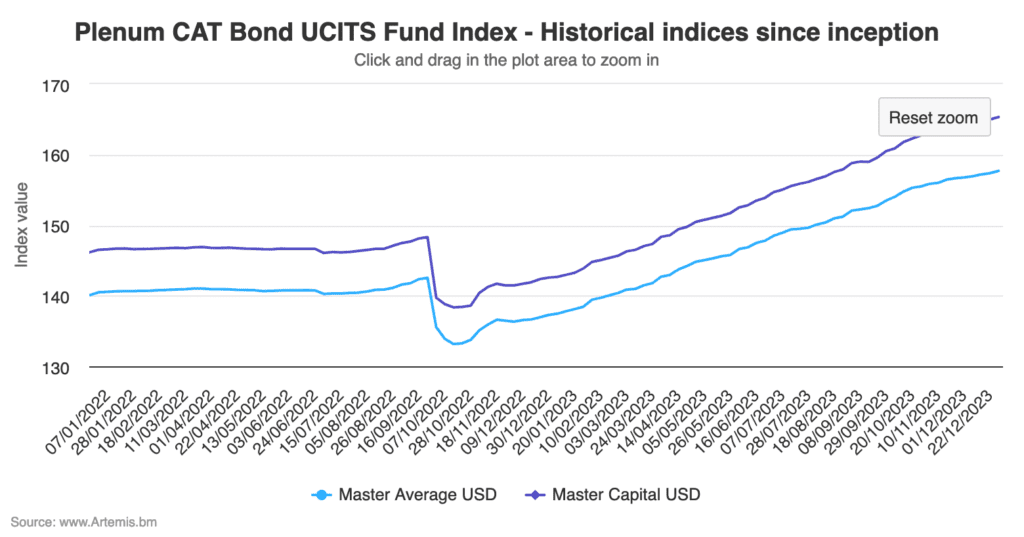

The Plenum Investments Index that tracks the returns of catastrophe bond funds in the UCITS format, the Plenum CAT Bond UCITS Fund Indices, has risen strongly right through the year.

The year ended with December seeing the UCITS cat bond fund cohort averaging a 0.67% return for the month, which it turns out was one of the weakest of the year.

But it took the capital-weighted average return for USD share classes of the group of UCITS catastrophe bond funds tracked by Plenum Investments to a very impressive just under 16% (15.96% to be precise) return for the full-year, as of the last Index pricing of 2023 on December 29th.

You can analyse the performance using the Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format, provides a broad benchmark for the performance of cat bond investment strategies.

The lower risk group of UCITS cat bond funds returned 14.55% on average for full-year 2023, while the higher risk group of UCITS catastrophe bond funds was up by 15.12% for the year.

You can analyse interactive charts for these UCITS cat bond fund indices here, or by clicking on the image below.

The gap between the lower and higher risk groupings of cat bond funds is relatively narrow this year, which is largely due to the fact there was no major catastrophe losses for the cat bond market to pay in 2023.

It’s also important to remember that this Index is inclusive of the fund costs an investor would pay, so this is reflective of the average annual return an investor in UCITS cat bond funds would have taken home for 2023.

This cohort of UCITS structured cat bond funds have now set a high annual return record that will be challenging to beat going forwards, given there is an element of the value that was recovered after hurricane Ian incorporated and that new cat bond issue pricing has come slightly off its high from earlier in the year.

The spread of returns is wide though, with some UCITS cat bond funds in single-digits for the year, others nearing annual returns of 20%.

As we reported last week, the Swiss Re cat bond index, the most widely used benchmark for the cat bond investing space, hit 19.69% for the full-year 2023.

Earlier this morning we reported that the Eurekahedge ILS Advisers Index has also set a new record high annual return in 2023, as the average return of the insurance-linked securities (ILS) funds tracked rose to 13.33% after November.

2024 is going to be interesting to watch, as returns should remain elevated over years prior to 2023, but are unlikely to match last year for all funds.

In fact, there could be even more of a spread between performers, given some cat bond funds will have invested in the recent cyber cat bond issues that offer higher-yielding opportunities, where as other cat bond funds will likely stay true to their original natural catastrophe exposure-only mandates.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.