Cat bonds recover from hurricane Ian, deliver 10.9% total return since: Tenax

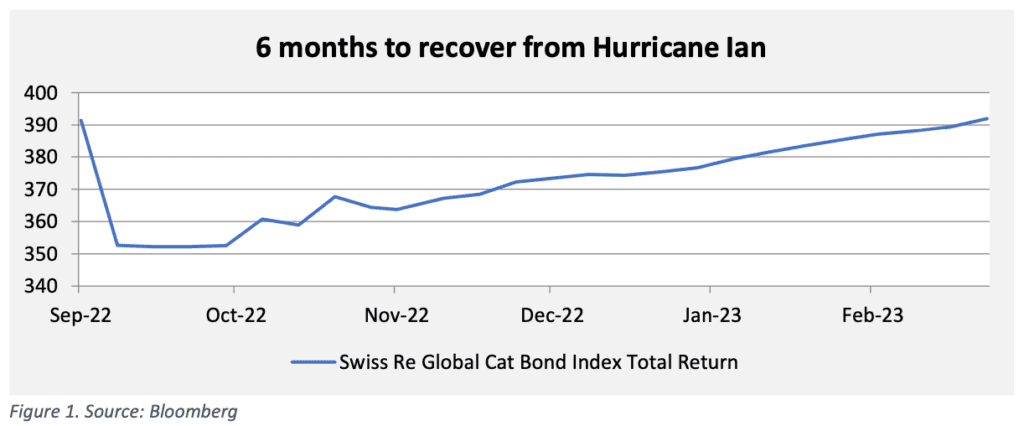

The catastrophe bond market has delivered a robust 10.9% total return since hurricane Ian hit, helping the main market index to recover back to pre-Ian levels in just over 6-months, Tenax Capital has highlighted.

Tenax Capital, the London based hedge fund that was founded by its CEO Massimo Figna and offers a UCITS catastrophe bond fund to its investor clients, highlights that catastrophe bonds have been one of the best performing asset classes for the month of March 2023.

Tenax had previously predicted that the catastrophe bond market could recover its hurricane Ian impacts within six months of the event.

As we reported recently, some catastrophe bond and insurance-linked securities (ILS) funds are anticipated to recover to levels seen before Ian by the end of this month.

Some of the UCITS cat bond funds are now approaching such levels and Tenax Capital highlights that one of the cat bond market benchmarks, the Swiss Re Index, has now already recovered back to its pre-Ian level.

The 10.9% total return delivered by the cat bond market since hurricane Ian eclipses global bonds (-1.3%), European high-yield (6.5%) and even surpasses the S&P 500 (10.1%), Tenax Capital states.

In addition, Tenax Capital also points out that recent financial market volatility caused by the banking crisis has had no effect on catastrophe bonds.

“It is no surprise to ILS professionals, however, to witness the market’s resilience to recent volatility events, SVB and Credit Suisse,” the investment manager explained.

Adding, “At the time of writing, cat bonds are the best performing asset class among US and European credit and equity for the month of March 2023.”

The Tenax Capital ILS team continued, “It is important to emphasize the exceptional quality of ILS, specifically its inherent lack of correlation with other financial markets. In recent years, events such as the Covid-19 pandemic, the Russian invasion of Ukraine, the end of QE, and rising interest rates have caused turbulence in equity and credit markets, resulting in extended periods of low liquidity, abrupt sell-offs, and increased volatility.

“In contrast, cat bonds have consistently provided a safe haven, generating high returns with minimal volatility and strong liquidity.”

Volatility appears set to continue in global capital markets, but catastrophe bonds are conversely set to deliver “double-digit returns in its characteristic low-volatility manner, with the added opportunity to diversify across an expanding landscape of issuers making their debut in the market.”

Compared to asset classes such as AT1’s, that have hit the news in the wake of the forced sale of Credit Suisse to UBS, Tenax Capital’s ILS team notes, “ILS offers superior returns on a volatility-adjusted basis over the long term.”

They highlight the “exceptional quality” of catastrophe bonds and other insurance-linked securities (ILS), which should come to the fore during periods of volatility like this.