Cat bond issuance breaks all records in 2024. Market grows 10% to $49.44bn

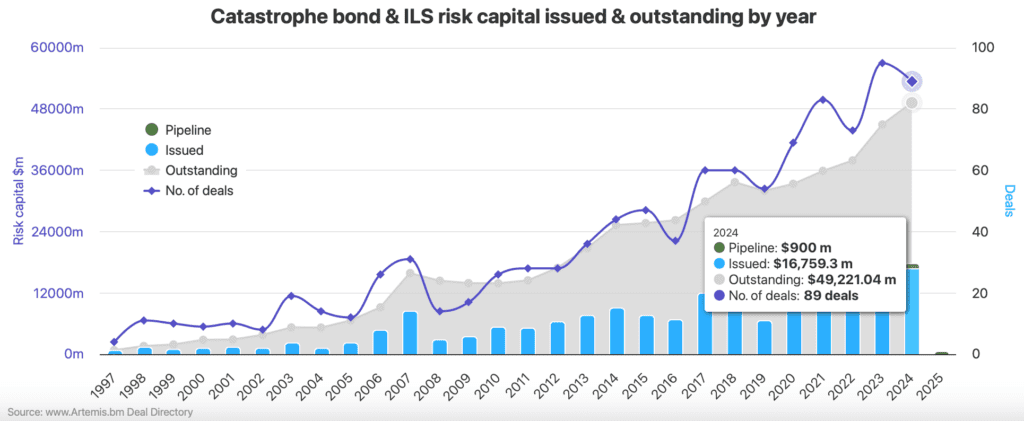

Catastrophe bond market records are falling in 2024 and set to be beaten on most fronts, with overall issuance recorded in the Artemis Deal Directory reaching a new high of almost $17.7 billion for the year, including a record $17.24 billion of Rule 144A cat bonds, driving a new end-of-year outstanding market record and cat bond market growth of 10%.

The outstanding market, across 144A property catastrophe bonds, 144A cat bonds covering other lines of insurance and reinsurance business such as cyber, and also the private cat bonds that we track, is now projected to reach over $49.44 billion.

That represents more than 10% growth of catastrophe bond risk capital outstanding since the end of 2023, across those categories of deals.

We’ve been tracking catastrophe bond issuance since 1996 and this year has been one of the busiest ever seen.

While the number of deals issued and tracked by Artemis is set to fall just slightly behind last year’s 95, reaching 92 once the three yet-to-settle issuances are included, 2024 has seen the second highest number of new bond issues in all the time we’ve analysed the catastrophe bond marketplace.

At this stage of the year, there remains $900 million in risk capital in the pipeline, from three cat bonds scheduled to settle next week (one more settles today which is included in our figures, as of today).

With no sign of any other new deals coming for settlement before year-end, we can now give firmer projections for the end of 2024 annual cat bond issuance and market size totals.

Total issuance tracked by Artemis, across 144A property cat and other line of business cat bonds, as well as private cat bonds we’ve seen, is set to reach a new record of almost $17.7 billion for 2024, which is a 7.4% increase on the previous record set a year ago.

Artemis’ chart that tracks catastrophe bond issuance, the size of the outstanding market and the number of new cat bond deals by year (below) shows this projected total of nearly $17.7 billion if you add together the settled issuance so far and the pipeline of new deals that all settle and come into the market next week.

Looking only at the 144A catastrophe bonds that were issued in 2024, the total is set to reach almost $17.24 billion by the end of this year, which is a 9% increase on the previous record amount of annual issuance set in 2023.

This is reflective of the strong demand for new investment paper from the cat bond investor community and its fund managers, as well as strong demand from repeat sponsors for protection, plus growing interest from new market entrants sponsoring their first cat bond deals.

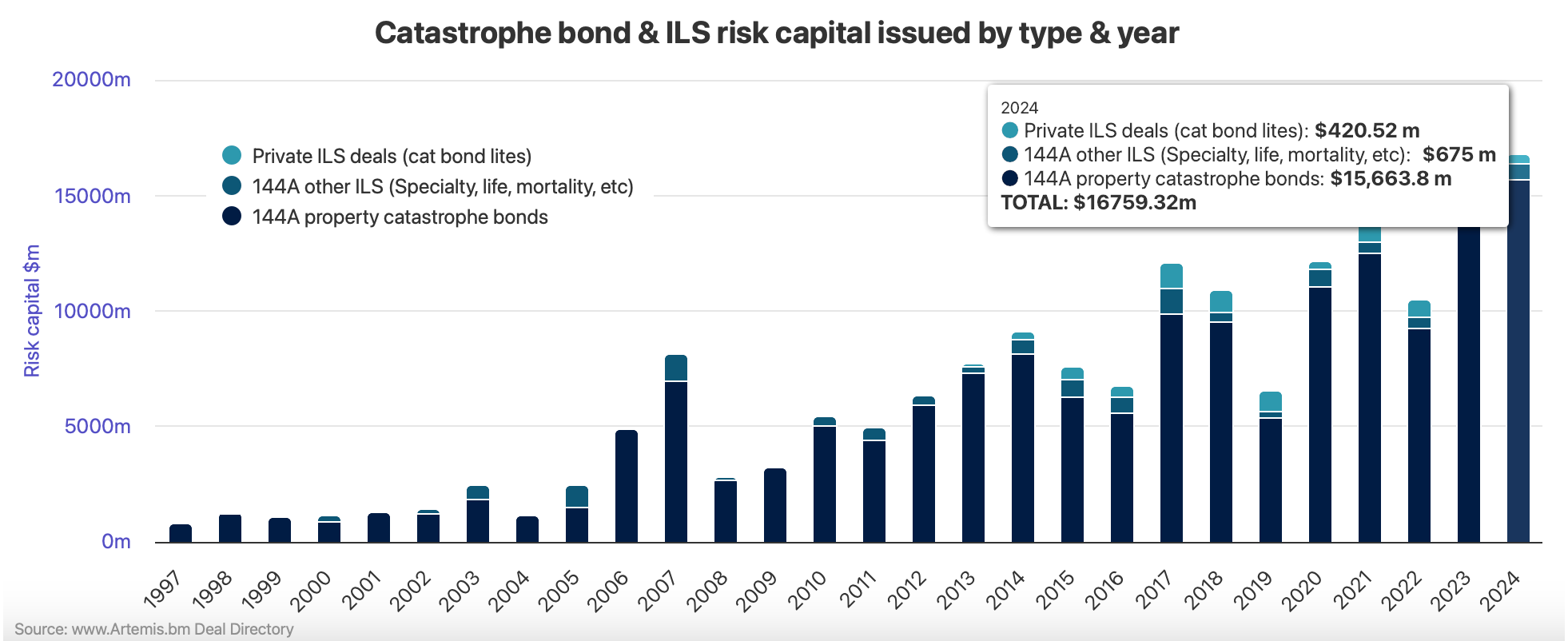

The core of the market remains Rule 144A property catastrophe bonds though and here the record set in 2024 is even more impressive.

144A property cat bond issuance for 2024 is now set to reach a very impressive almost $16.6 billion, which is almost 11% up on the previous record from 2023.

It’s possible to track the different segments of the cat bond market that we analyse here at Artemis using this chart that breaks down annual cat bond issuance by type of deal (note, this chart does not feature the pipeline).

With that core of the cat bond market (144A property cat deals) still expanding, thanks to more larger issues, increasing numbers of new cat bond sponsors and increasing investor interest, as well as new cat bond funds having been launched to increase the capital supply, it bodes well for another strong year in 2025.

Even without the pipeline of $900 million of new cat bond risk capital that isn’t due to settle until next week, the market has already broken all of these records we’ve mentioned, as of today.

One notable fact about 2024 catastrophe bond issuance though, is that the second-half of the year and the third and fourth quarters in isolation, have not broken issuance records.

All of the growth of the market came in the first-half of the year, with H1 issuance tracked by Artemis reaching over $12.6 billion. However, the second-half of 2024 will be only the second time H2 has seen more than $5 billion of new cat bonds issued, so it is still very notable.

You can track issuance by month using this interactive chart, where you can deselect months to exclude them from your analysis to just look at halves and quarters of issuance years (remember this is minus the pipeline of deals left to settle).

Our regular readers know that our range of catastrophe bond market charts can keep you up-to-date on the state of the market at any point in time, while also aiding in projecting issuance and helping them analyse market trends in real-time on any day of the year.

One of the key data points that can define market dynamics is the volume of maturing catastrophe bonds and the schedule for those maturities to occur, which you can now also analyse with Artemis.

With more than $10 billion of catastrophe bonds maturing in the first-half of 2025, the market is going to have a significant amount of cash and liquidity coming back that will ideally need recycling into new cat bond investment opportunities.

This is a strong signal for sponsors (and potential cat bond sponsors) that execution in the catastrophe bond market is likely to continue to be favourable for protection buyers, with investors and fund managers able to support large deal sizes over the coming months.

All of which should make for another busy first-half to next year. Although, looking at full-year 2025 maturities, it suggests the market will also need to see new capital inflows coming in, if it is to get near to, or beat, the new catastrophe bond market records that have now been set in 2024.

Our full report on the fourth-quarter and full-year of 2024 will be available early in January and, of course, you can keep up to date on the catastrophe bond market in real-time using our Deal Directory and interactive charts every single day.

We’ll keep you updated as we move into 2025 and the new year progresses. So stay tuned to Artemis.

The Artemis Deal Directory lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s. The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

Analyse the catastrophe bond market using our charts and visualisations, which are kept up-to-date as every new transaction settles.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.

All of our catastrophe bond market charts and visualisations are up-to-date and include data on new cat bond transactions as they settle.