Cat bond fund index starts post-Ian recovery. More significant gains to come?

Catastrophe bond funds, as measured by the Plenum CAT Bond UCITS Fund Indices, appear to have hit the bottom of their hurricane Ian related decline, with a slight gain in the last week reported and we believe more gains to come according to other market signals.

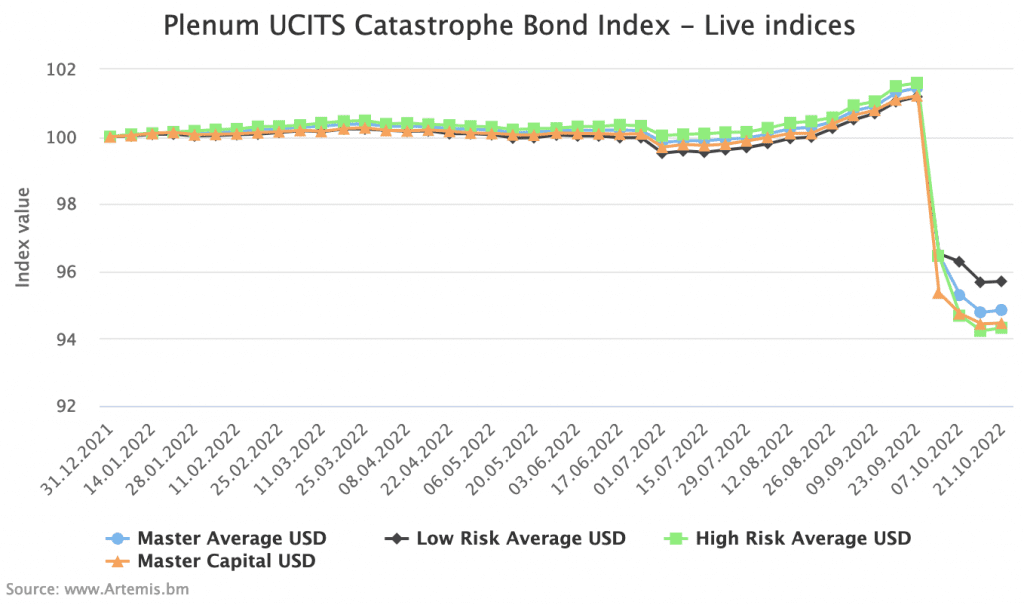

The UCITS cat bond fund indices have now settled down roughly 6.5% on average since hurricane Ian struck Florida.

These catastrophe bond fund indices, calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a valuable source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.

The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

Immediately after hurricane Ian, these UCITS cat bond fund indices suffered their biggest declines in history due to the expected market impacts.

The underlying basket of 14 UCITS cat bond funds experienced a wide performance spread from negative -1.5% to -9% before the index data was calculated for September 30th.

On that date, the cat bond fund index saw an average decline of just over -5%, the biggest single decline in their history.

Then, as of October 7th, the indices fell further, with the average decline across the cat bond indices since before hurricane Ian struck, increasing to -6.04%.

As of October 14th, the indices declined slightly again, as prices continued to move around in the secondary cat bond market and cat bond fund managers adjusted their portfolios to allow for pricing expectations, as well as loss expectations, after hurricane Ian.

At that point, the average decline across these UCITS catastrophe bond funds since hurricane Ian was almost 6.58%, with the high-risk cat bond fund index down 7.25% since Ian and the low-risk down 5.46%.

In the last week of record, to October 21st, the UCITS cat bond fund Index calculated by Plenum Investments gained slightly, with all measures rising a little, perhaps an indication of the cat bond fund market bottoming-out after Ian.

So now, as of October 21st, the average decline across these UCITS catastrophe bond funds since hurricane Ian was almost 6.51%, with the high-risk cat bond fund index down 7.17% since Ian and the low-risk down 5.43%.

Two indicators suggest that a bigger gain is likely to be seen in this UCITS cat bond fund index at the next calculation date.

As we reported yesterday, a number of hurricane Ian-exposed catastrophe bonds saw relatively significant price gains as of October 28th marking of sheets, while as we also reported the Swiss Re cat bond index also saw a relatively significant recovery as of the same date.

Those recoveries in secondary marks and cat bond market values should flow through to the way these UCITS cat bond fund managers mark their books for October 28th, or at least for month end.

As a result, we anticipate seeing all these UCITS cat bond fund indices recovering more of the post-hurricane Ian decline when we next report on them.

Analyse the UCITS catastrophe bond fund index here.