Best Construction Insurance Companies, USA | 5-Star Construction

Jump to winners | Jump to methodology

Building a better America

Insurance Business America recognizes the best construction insurance companies of 2024.

Conducting nationwide research, the IBA team began by contacting a wide range of brokerages and then spoke to hundreds of brokers, who rated the construction insurance companies they had worked with over the past 12 months.

Leading expert Danette Beck, head of industry vertical and construction practice leader at USI Insurance Services, highlights a key development, which means insurance companies face more demands than ever before.

“There’s an increase in new killer verdicts. It’s no longer pharma companies or large manufacturing companies with product defects. It’s bleeding over into the construction space. We always had class action lawsuits with famous ones being Chinese drywall, but it could be anything and everything,” says Beck.

Fellow expert Jeffrey Benson, program manager at Victor US, also stresses how construction insurance companies are set to play a bigger role going forward.

“Most people are projecting the next year or two, depending on interest rates, should be a healthy environment. It might be a little geographic. We have Florida, Texas, and the Sunbelt really booming, but even in the northeast and the mid-Atlantic, we’re looking at a pretty sizable growth in the construction marketplace,” Benson explains.

Backing up this rise in the importance of construction insurance is the Bureau of Labor Statistics, which reports that construction employment will increase in 39 states.

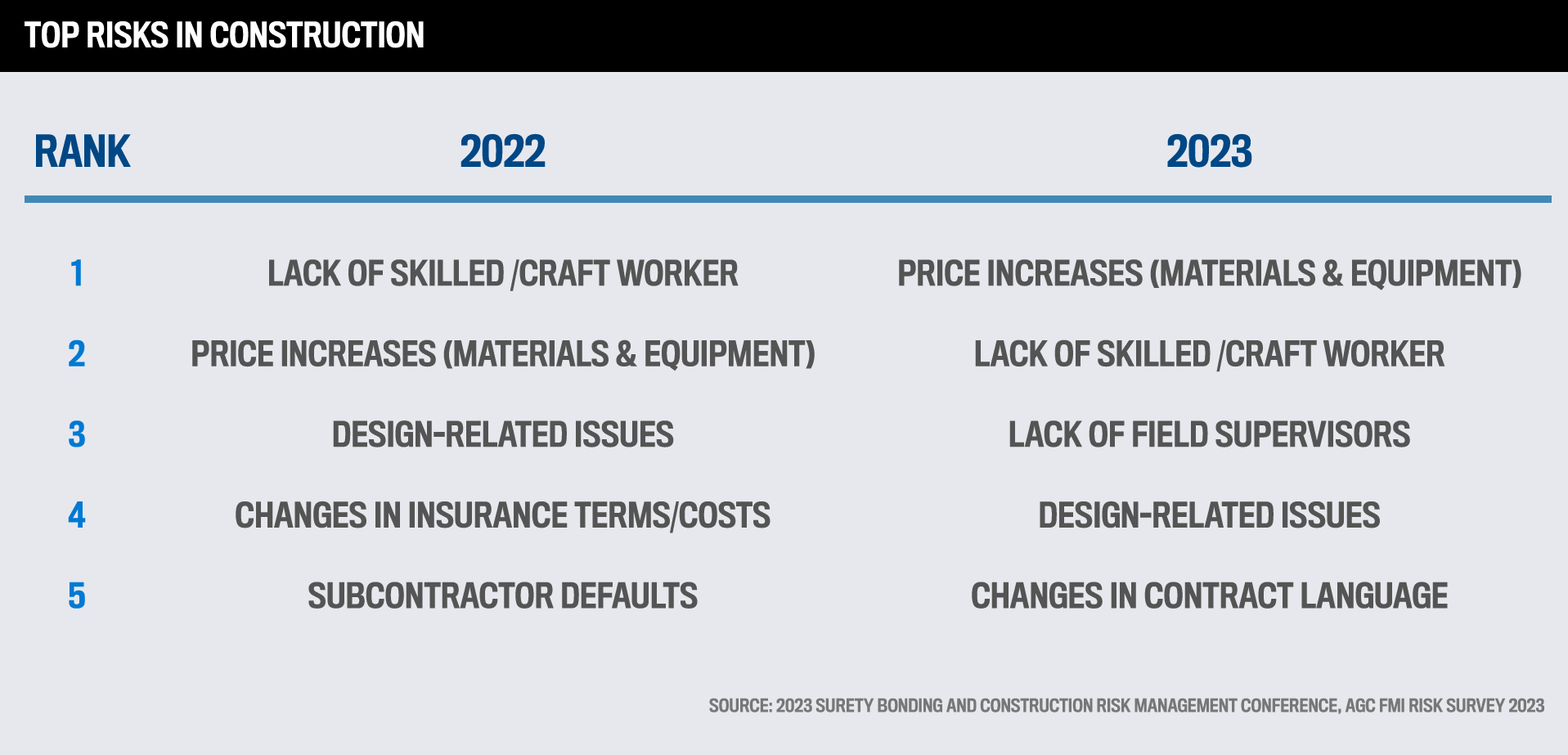

The change in risks also impacts construction providers as price increases borne by contractors means they will be looking for more cost-effective insurance.

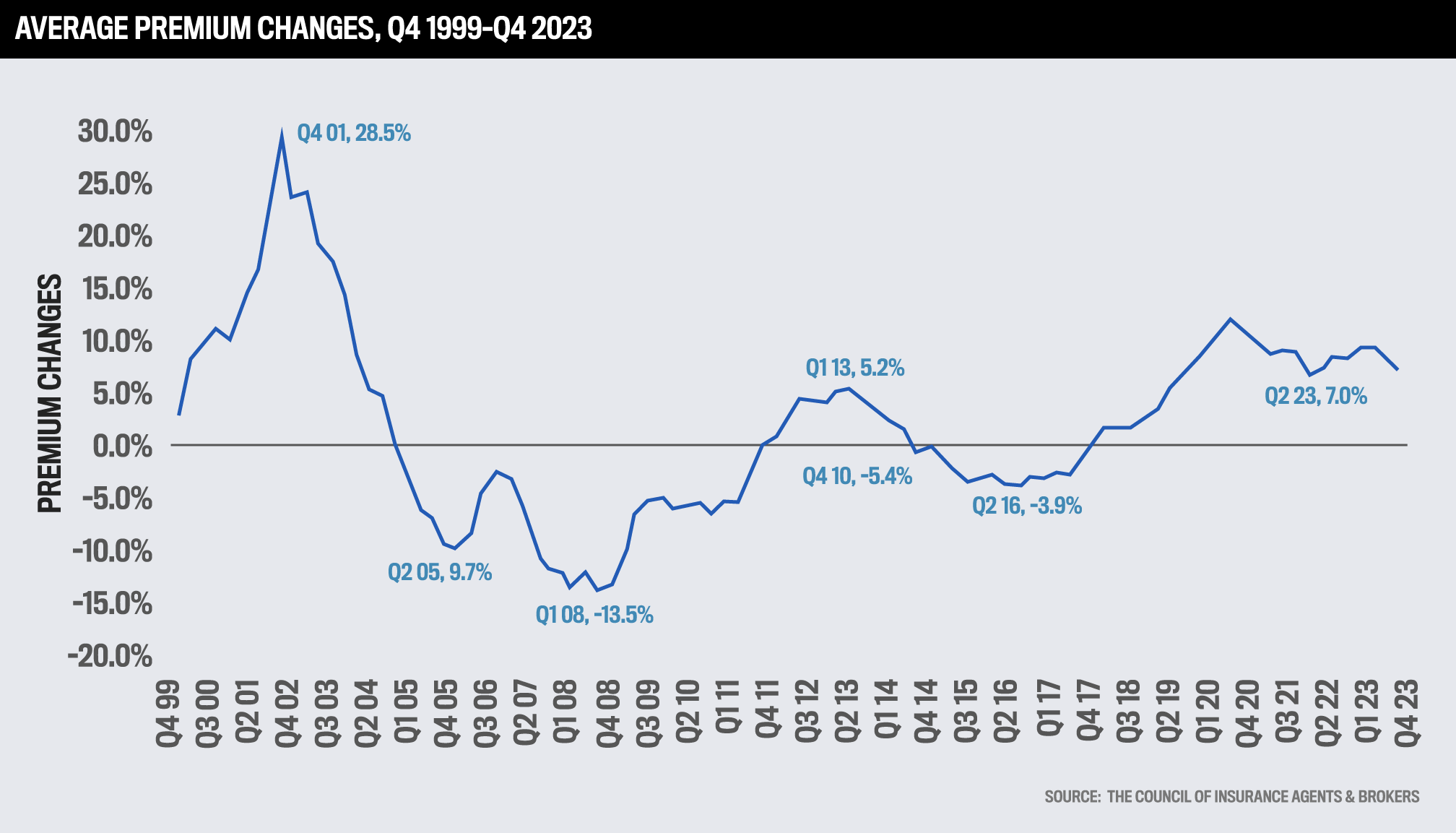

This is further compounded by the average premium increases (1999–2023) reported by The Council of Insurance Agents & Brokers, which translates into:

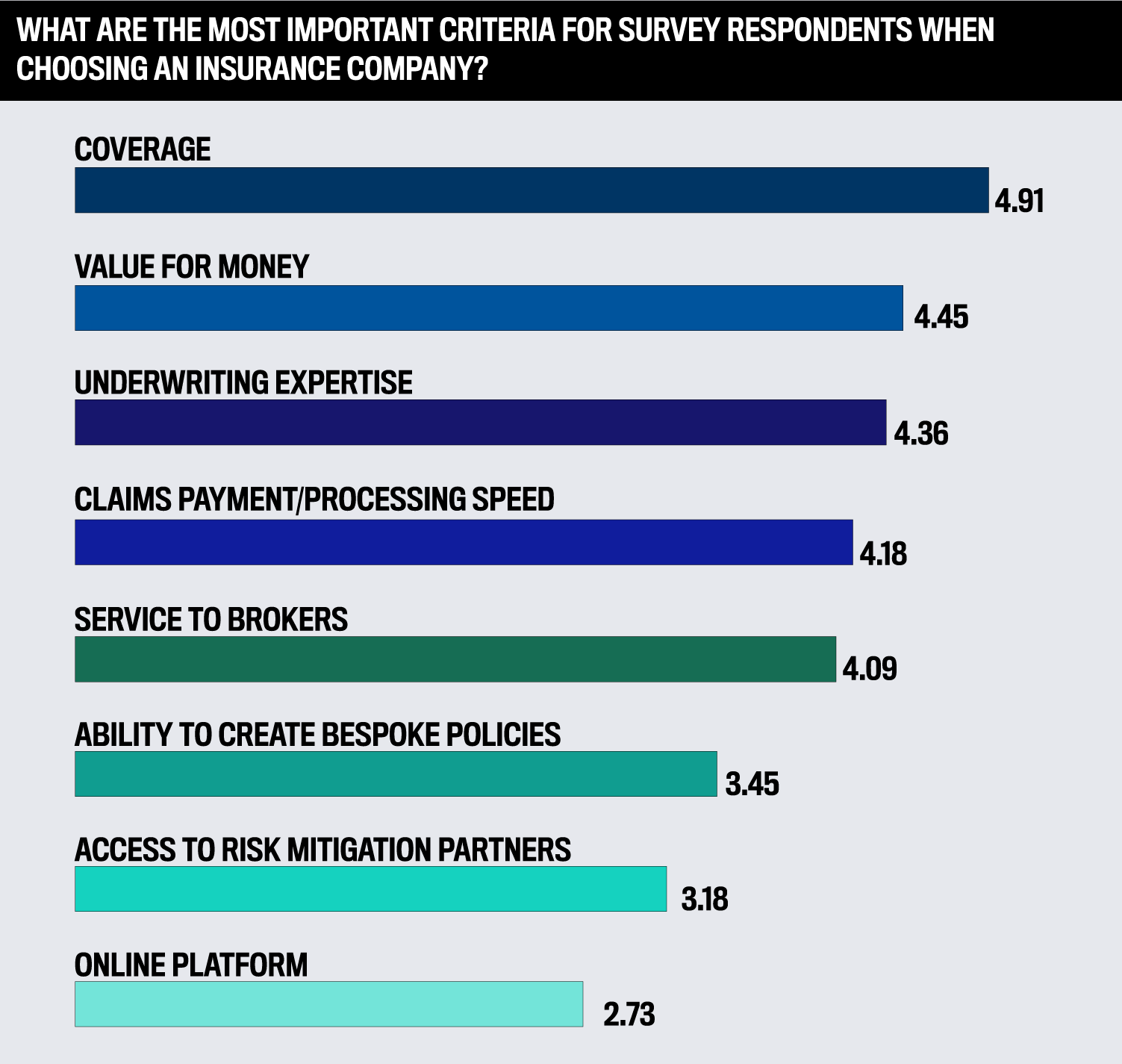

IBA’s criteria voted by brokers to determine the best construction insurance companies

Coverage

Clear explanations of coverage limits

Ability to narrow coverage gaps

Ensuring the client understands where coverage ends

Market-leading performance in this area is related to the increase in lawsuits.

Beck says, “As these nuclear verdicts are going up, the cost of insurance is going up. Customers have to make decisions based on a finite amount of money to buy insurance, so do they forego limits?”

She highlights how some residential contractors even have resident contractor exclusions in their policies because of this.

“Ultimately, when there’s a claim, that’s when you find out if there’s adequate coverage. The adequacy is making sure that we dovetail policies in a manner that narrows coverage gaps,” adds Beck.

An example of gaps could be a contractor utilizing technology but then being opened up to cyberattacks, which are outside the scope of typical construction coverage.

Another issue is how recent legalization means that normal domestic policies only cover resultant damage, not the fault.

Beck comments, “If you look at the adequacy from builders’ risk of just the size of the claims that are happening, especially in wood frame, it’s becoming increasingly more difficult to buy wood frame insurance.”

Claims payment/processing speed

“The better a carrier can partner with their customers to make sure that there is a level setting and transparency around claims payments, then the process is much smoother,” says Beck. “If you feel like the insurance company isn’t advocating for you as the customer, that doesn’t feel good.”

The key is creating two-way communication.

Beck adds, “When customers don’t have that, it’s a sterile relationship. There is no incentive to sit down and say, ‘How are we going to resolve this, so everyone can come away maybe not feeling great, but good about how the process is moving.’”

And Benson comments, “There are a few contact points that an insured has with an insurance company. That’s really the differentiator for brokers. When they evaluate a carrier or our program like ours, it should be based on how quickly do the claims people respond and how do they work with the contractor? It’s about speed and communication.”

Both experts agree on a timeline guide of:

Underwriting expertise

Employ specialized underwriters, not generalists

Adopt a segmented mindset

The difference maker here is appreciating that construction is no longer single-faceted.

Beck explains, “It may have a transportation angle because they’ve got 350 vehicles with 50 heavy trucks, but that’s more of a transportation risk, not necessarily a construction risk. If you have an underwriter that doesn’t understand the different nuances, they may paint them with one brush. That could potentially negatively impact the cost of the insurance and/or the coverage.”

She adds, “They must be really pushing to understand all the nuances and to not paint a customer with that one brush. They have to look at all the different risks and make sure it’s articulated correctly.”

Value for money

Benson qualifies this category in relation to coverage.

He says, “It’s always the best premium dollar for the coverage. You start with adequate coverages and then you evaluate the different carriers based on how much all of those coverages cost.”

Part of creating value is delivering for clients and standing behind coverage, and if this isn’t happening, then it harms the reputation and as an effect, the value an insurer brings.

Benson adds, “Brokers know that over time when they deal with a carrier as they build a book of business. Hopefully, they’re happy with the claim settlement because you can get a reputation at a company level for being a poor claim-settling company. The builders talk to each other a lot through their association, so that’s not a good thing.”

Access to risk mitigation partners

Underlining market-leading initiatives, Beck comments on the need to embrace risk mitigation.

“You can’t just rely on training because training is something you constantly do. We have launched USI PATH, which is a curated list of vendors by the major types of claims by industry vertical. The client can read through all the different technology partners that are out there to identify partners that can help proactively mitigate risk from happening, because the best claim is the one that doesn’t happen.”

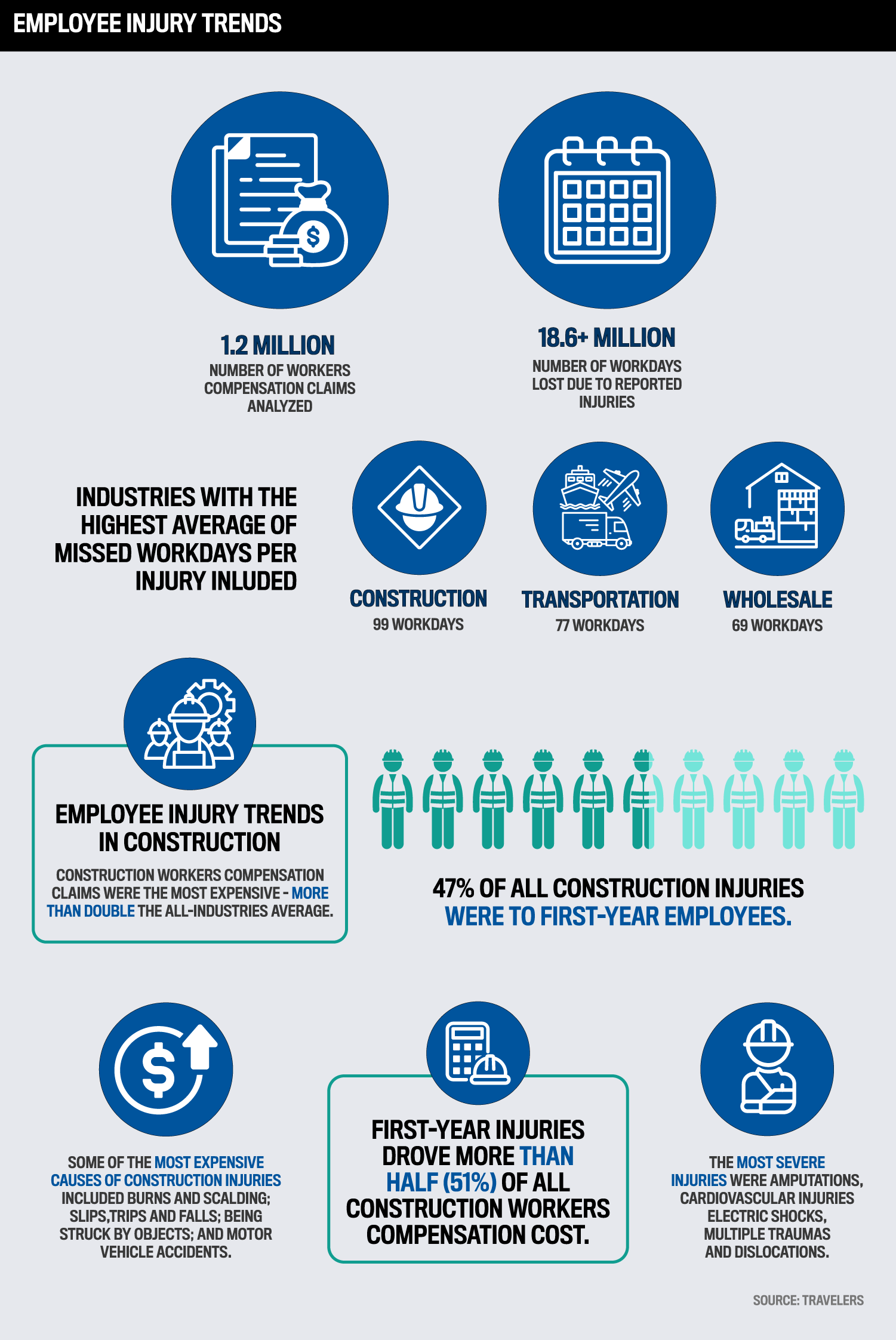

Risk mitigation is particularly important in avoiding injury, which data published by Travelers shows:

These bold statistics on injury indicate that risk mitigation is a growing priority for the leading construction providers.

Some leading insurers are now offering discounted premiums for insureds who embed technology to mitigate risk by allowing their providers access to the data.

“I think it’s going to really resonate with clients because they’re already adopting the technology from an operational standpoint. And if they can see the value in and return on the investment right away, it’s a no brainer,” comments Beck.

Ability to create bespoke polices

Benson reveals how his firm provides options ready to be assembled to create a custom offering for an insured.

“We have automatic coverages built in, but then we also have optional coverages that a broker can select. For example, for things like flood, earthquake, and delay of completion,” explains Benson. “That’s how you tailor the individual coverages. That’s critical particularly for the more complex risks.”

Service to brokers

Quick turnaround

Availability

Supportive mindset

Not responding to emails or phone calls is a recipe for disaster.

“It’s about having a partnership to service our customers in a manner that is about sitting at a round table instead of a square table,” comments Beck. “It facilitates things for us because we have to rely on them to execute on what we’re providing to our clients. Insurance companies have to make sure that relationship is not only there, but that it’s a cornerstone for the execution of what we need to do for our clients.”

Online platform

Beck says, “We are still a people business. Having tools and resources available to clients so that they can find insurance policies, order a certificate of insurance or look at claims – that’s great. But the advisory work and what we do with our clients face to face is still something I think they value.”

As Benson deals with construction firms working at the part of the market with the smaller-scale projects, he highlights the case for effective online tools.

“The brokers that are writing all the small business out there, those are the ones that almost demand a portal now, because they get the answer quick. They hit a button, get a quote and policy, then it’s on to the next one.”

Scroll down to see the list of the USA’s best insurance construction companies this year.

AXA XL

Berkley

Chubb

CNA

Colony

Crum & Forster

FCCI Insurance Group

Liberty Mutual

Starr

The Hartford

Travelers

Westchester

Zurich