Bermuda market’s use of catastrophe bonds and ILS expanded in 2022

Last year, Bermuda-based insurance and reinsurance company use of insurance-linked securities (ILS) such as catastrophe bonds increased, according to survey data collected by the Bermuda Monetary Authority (BMA).

The Bermuda financial market regulator has published the results of its latest stress test and assessment of catastrophe risk exposure, which show some changing dynamics affecting the islands re/insurers.

Perhaps most notable is a decline in catastrophe risk exposure assumed by Bermuda based reinsurers in 2022.

The BMA notes that this is likely a reaction to a number of factors, from pressures faced due to inflation, the resulting pricing challenges, and tightened global monetary policy, which drove an elevated cost-of-capital across the islands re/insurance market.

As well as this, with catastrophe losses remaining high and secondary peril losses driving attrition, rates have hardened and insurers have increased their retentions, restricted coverage and restructured programs to control their budgets.

This drove the decrease in natural catastrophe exposure across Bermuda’s re/insurance industry, but at the same time the sector remains very well-protected by reinsurance and ILS instruments, the BMA’s stress test results show.

Overall, the BMA explained that, “The gross loss exposure assumed by Bermuda insurers decreased by 11.51% (from $225.02 billion in 2021 to $199.11 billion in 2022). Furthermore, the value of global gross estimated potential loss assumed by Bermuda insurers on the major Catastrophe (Cat) perils (combined) has also decreased from $209.47 billion in 2021 to $180.14 billion in 2022; this represents a decrease from 26% to 23% of the global market share. The decrease in the Cat exposure assumed by Bermuda can be attributed to the hardening market.”

Ceded losses fell a little faster than exposure as well, likely reflecting the changes to reinsurance and retrocession structures.

As a result, the BMA said that, “Observing the aggregate loss impact, the results shows that the level of reinsurance reliance (gross loss ceded) has decreased by about 13.77% compared to last year and varies across each peril.”

Adding, “This is in line with the decrease in the level of exposure assumed by Bermuda entities.”

The BMA’s data shows insurers ceded about 61.11% of gross losses in 2022, compared to 62.71% in 2022.

There were changes in how Bermuda’s insurance and reinsurance firms used risk capital for protection, with a notable increase again for the use of insurance-linked securities (ILS) such as catastrophe bonds.

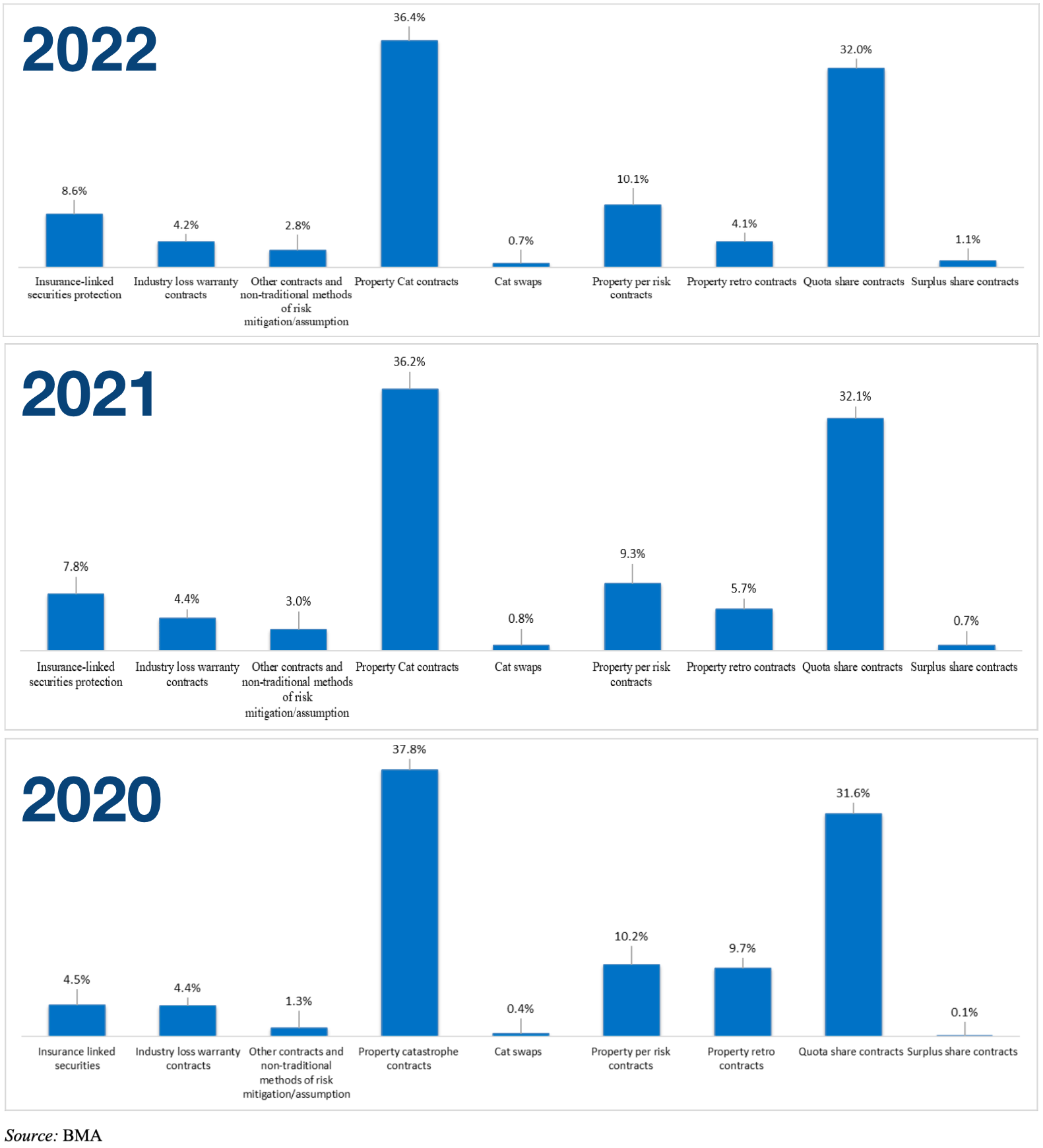

We’ve included charts from prior years below with the most recent from the BMA’s stress test report, so you can see the development of each risk transfer category.

It’s perhaps notable that, while ILS such as cat bonds have increased in usage, industry-loss warranty (ILW) contracts and property retrocession have declined.

Given the surge in industry-loss based cat bonds, some coming from Bermuda based players seeking retrocession, this could explain these trends, at least to a degree, as companies switch to full 144A cat bonds over other arrangements.

The dip in retrocession use, over the last few years, is most pronounced though and also reflects the generally lower availability of catastrophe retrocession, especially in aggregate form.