Bermuda ESG journey progressing, but trails on protection gap: Report

While the overall Bermudian reinsurance and insurance-linked securities (ILS) market is still in the early stages of its environmental, social and governance (ESG) journey but making steady progress, there is work to do on protection gap related issues, as the Bermuda market lags behind competitors, a new report suggests.

This rather surprising finding suggests Bermuda’s reinsurance and ILS fund market participants are not yet as engaged in areas of insurance and reinsurance market expansion that we’d typically refer to as attempts to narrow or close the protection gap.

The report from management consultancy Oxbow Partners and the Bermuda Business Development Agency (BDA), has assessed the maturity of ESG in the Bermuda re/insurance market.

Oxbow interviewed 20 Bermuda based re/insurers and ILS funds, which between them represent gross written premium of over $100 billion and an investment portfolio over $550 billion, the company explained.

Out of the report comes an assessment that Bermuda’s insurance and reinsurance industry “genuinely wants to make an impact on ESG matters rather than just ticking the boxes or responding to outside pressures.”

However, there is a long way to go, as, “The overall Bermudian market is at an early stage in its ESG journey,” Oxbow found.

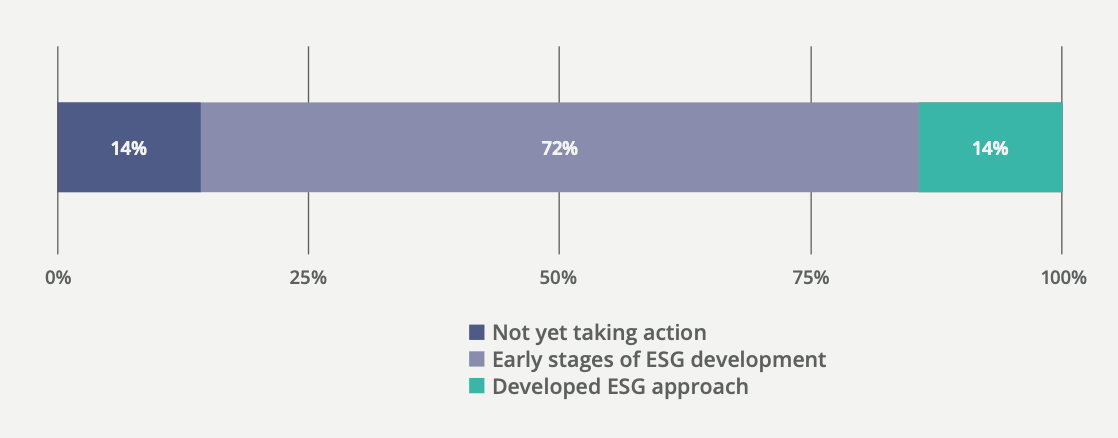

Some 72% of companies spoken with have already started engaging with ESG topics, but at this time remain at the early stages of their ESG journey.

Just 14% of companies spoken to already have a developed ESG approach, while another 14% had not taken any formal action on ESG to-date.

“This is not unusual internationally,” Oxbow explained, adding that, “Most participants saw Bermuda as being ahead of much of the globe, including the US – even if perhaps trailing some parts of Europe.”

As you’d expect, capital providers are the main driver of the Bermuda insurance and reinsurance market’s ESG goals.

Investors and shareholders were cited as the main driver of ESG, being mentioned by some 86% of participants, closely followed by employees at 81%.

“Understanding the current and future ESG needs of investors will be essential for any (re)insurer or ILS fund in the future,” Oxbow explained.

Resource is seen as the main limiting factor in ESG journeys so far, as evidenced by 67% of those with dedicated ESG resources having less than two FTE’s dedicated to the topic.

Perhaps the most surprising finding, is that Oxbow believes the Bermuda re/insurance and ILS market is lagging behind on issues we’d commonly refer to as related to covering protection gaps.

“On insuring more of the world’s risks, Bermuda was trailing the global leaders in Europe,” Oxbow said, explaining that its research found that, “Only a limited number of Bermudian market players have thus far been prominent players in working actively on solutions for developing markets, including microinsurance and parametric triggers.”

To which they add, “Despite being the global leader in ILS funds, the Bermuda market risks falling further behind without more comprehensive participation.”

We believe there’s a good reason for Bermuda lagging behind some of the major global reinsurance firms on this topic, as Bermuda is far more focused on property and specialty lines, with less global or life related diversification available to them.

But it’s also nuanced, as many of these initiatives related to protection gaps are loss-leaders, given they don’t garner significant premiums and are often subsidised to a degree.

Therefore, the biggest reinsurers in the world can spend resource on helping to build out livestock programs in Africa, for example, while Bermuda’s reinsurers and ILS funds are still more focused on providing peak-zone protection, or critical casualty and specialty re/insurance products.

“Internationally, parametric insurance and microinsurance are currently areas of focus,” Oxbow wrote. Adding, “Our analysis suggests that this is an area where Bermuda is significantly behind some markets.”

However, respondents also point out another good reason Bermuda’s market may not be as readily diving into relatively small premium opportunities related to protection gap issues and trying to grow parametric covers, as these are sometimes seen as market segments where early-movers can lose money before they make any.

Of course, we regularly highlight Bermuda market players efforts in the realm of parametric triggers and the protection gap, especially ILS funds and those reinsurance firms with third-party capital activities.

Importantly, we at Artemis would suggest practically every dollar of capacity deployed by a Bermuda based reinsurance or ILS entity into protection for a peak natural catastrophe zone has a degree of ESG alignment from the start, while it is structural market issues that make growing the niche parametric and protection gap opportunities more challenging sometimes.

Peak catastrophe zones also have protection gaps, as a significant proportion of damage often goes uncovered by insurance and reinsurance, so every dollar deployed to regions where disasters occur is helping to prevent those gaps becoming wider, Artemis believes.

Oxbow reflect this in their report, writing, “This does not mean that companies who had not yet taken action are not doing anything to support the global ESG agenda. As one participant said, “Reinsurance and climate change are inextricably linked” and any property cat activity could be argued to be ESG-relevant. Rather, these companies had not yet pulled their activities into a dedicated strategy and had not actively engaged in embedding ESG across their activities.”

On the underwriting side, Oxbow found that, in the main, “Bermudian carriers are yet to develop sophisticated approaches to incorporating ESG into underwriting.”

Adding that, “Whilst some carriers (32%) have an element of ESG incorporated into underwriting processes (mainly a simple exclusion to risk appetite), only a very small number were starting to develop more holistic approaches such as net-zero underwriting. Many were wary of blanket exclusions and preferred supporting a transition. 92% of participants who had not done so already said they intended to integrate ESG into their underwriting approaches in the future.”

ESG is more developed on the investment side of traditional insurance and reinsurance still, but the underwriting side is attempting to catch up and we expect significant strides will be made here in time.

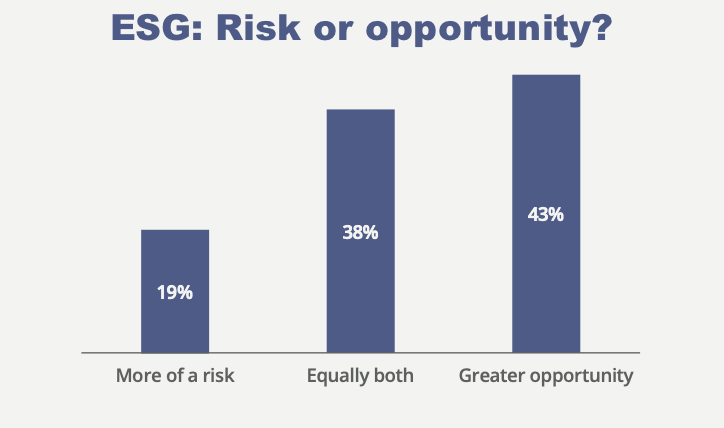

It’s also interesting to note that the report found that while 43% of respondents said ESG is an opportunity, 19% believe it to be more of a risk, while 38% said it is equally risk and opportunity at the same time.

It’s also interesting to note that the report found that while 43% of respondents said ESG is an opportunity, 19% believe it to be more of a risk, while 38% said it is equally risk and opportunity at the same time.

Miqdaad Versi, author of the report and head of ESG for Oxbow Partners, commented, “Many of the ESG scoring tools and polls of ESG adoption have only scratched the surface of how (re)insurers are engaging with ESG. For example, on the environment, they often simplistically prioritise blanket exclusions rather than recognising the value of supporting a transition. We are hopeful this extensively researched report across the key elements of our ESG framework provides the nuance required to better understand (re)insurers’ strategies, the trade-offs they are facing, and the next steps needed. ESG is no longer an optional side project for large companies’ sustainability teams. Every (re)insurer on the island needs to consider how they will better embed ESG across all parts of their business.”

Stephen Weinstein, chair of the Bermuda Business Development Agency, also said, “As the Bermuda market continues its aspirations as a centre of excellence and advocacy for climate resilience, climate finance and ESG-branded business and investment strategies, this report is both a useful accelerant tool and valuable future reference point. As the survey reflects, while both challenges and opportunities lie ahead, Bermuda as a jurisdiction has much to be proud of in terms of ESG values and implementation.”