Beazley hoping for continued cyber ILS growth: Richard Gray

At the 2025 Artemis insurance-linked securities (ILS) conference in New York City, Richard Gray, Head of Third-Party Capital at specialist insurer Beazley, spoke with AM Best about the rapid growth and potential of cyber catastrophe bonds.

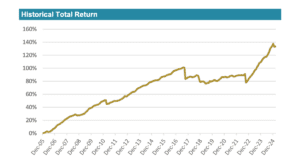

One of the notable trends in re/insurance today is the expansion of cyber risk coverage within the ILS market. Traditionally, ILS has been dominated by natural catastrophe risks, but the emergence of cyber cat bonds represented a significant shift.

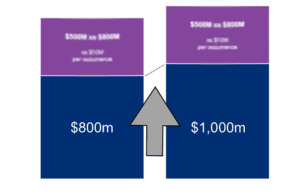

Beazley has been a pioneer in this space, issuing the first-ever cyber cat bonds in a number of private deals and later expanding to 144A bonds, which allow for broader investor participation.

“We’ve come a long way in our journey from the first ever cyber cat bonds, which were private, we’ve now got three 144A cat bonds out there covering the cyber risks,” Gray explained. “Obviously, we’re hoping to continue that growth in the market.”

View details of every catastrophe bond sponsored by Beazley in the Artemis Deal Directory.

Gray noted that as the cyber risk market continues to mature, it is essential for the cyber cat bond market to keep evolving. This maturation will allow more capital providers to become comfortable with the space, further stimulating growth.

The success of cyber cat bonds depends not only on issuers but also on the willingness of investors to deploy capital in this emerging sector. Gray highlighted that there has been increasing interest from new types of capital providers beyond traditional ILS investors. This diversification is key to sustaining market growth and ensuring that cyber risk is adequately covered.

“We’re hoping that others will join us. We’ve had a number of other sponsors of 144A bonds. We hope that continues,” Gray said. “We’re also seeing growth in interest from new types of investors, new types of capital providers.”

The willingness of investors to back these bonds will help sustain the market’s expansion. Gray pointed out that for growth to continue, additional providers of capital must become comfortable with cyber risk modelling and actively deploy capital into these bonds.

Despite the optimism surrounding cyber cat bonds, challenges remain. Investors need greater confidence in cyber risk models, and issuers must demonstrate consistent and transparent risk assessment.

Additionally, the industry must address concerns about the aggregation of cyber risks, as a single cyber event—such as a global ransomware attack—could impact multiple policies simultaneously.

Gray emphasised the need for further growth and exploration within the ILS space: “We want to continue to see that grow. We want to see what new risks investors are potentially looking at, and if there’s any changes that we can make to some of the tried and tested structures to continue to grow the market.”

As Gray and other industry leaders continue to push for growth, the question remains: Will the market embrace cyber risk as confidently as it has nat cat bonds? The coming years will determine just how far this sector can go.

The full AM Best interview with Beazley’s Gray at Artemis ILS NYC 2025 is embedded below.

.