Australia flooding claims rise to 6,853, as impacts move north

Insurance claims filed from the recent July severe flooding in the New South Wales region of Australia have climbed more than 57% to 6,853 overnight, while the impacts of flooding are now being most felt further north of Sydney.

As we reported last Sunday, parts of eastern Australia have been flooding again after an East coast low brought torrential rains and strong winds to the country.

Sydney and its suburbs were particularly badly impacted this time, with households evacuated and flood warnings in place, as well as property damage being reported.

The Insurance Council of Australia (ICA) declared a ‘significant event’ on Tuesday for the still developing severe flooding in Sydney and the surrounding region of the country, with over 50,000 people under evacuation orders at the time.

Yesterday, the ICA said that insurance claims from the Australian flooding in July had reached 4,160 since July 1st, in terms of filed claims.

While evacuation orders covered 85,000 people as of Wednesday morning.

Now, as of Thursday morning, the number of insurance claims has risen further to 6,853 as of early this morning, a 57% increase.

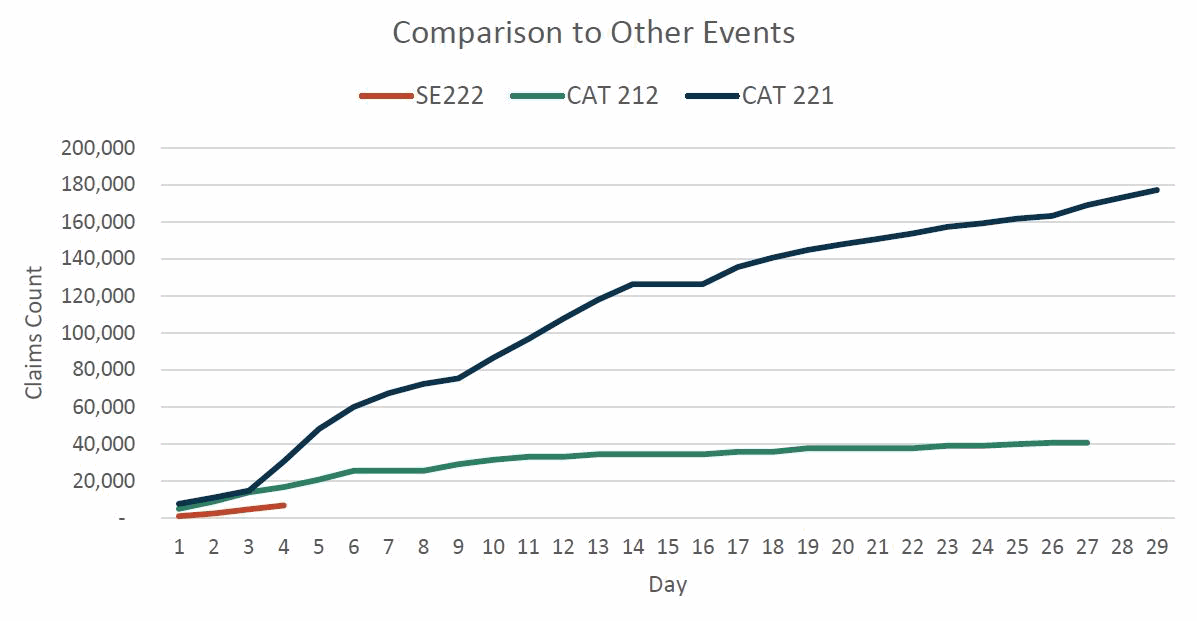

But, the good news for insurance and reinsurance interests is that claims are currently climbing much slower than with other recent flood events in Australia, which may suggest the ultimate industry loss does not come close to levels recently seen.

However, the claims are going to continue to pour in from these floods, as there are severe impacts continuing further north of Sydney.

The weather system that brought all of the rainfall has moved up the coast and now towns to the north are seeing flood levels rising, with additional properties inundated.

It’s also worth noting that some commercial insurance claims have now been filed as well, which can tend to be more expensive per-claim than a household recovery.

The ICA said this morning that of the now 6,853 claims filed, 84% are for property damage, 14% for motor and now 2% for commercial insurance claims.

The number of people subject to evacuation orders has now declined somewhat to 60,000, as of Thursday morning.

The July 2022 flooding in Australia comes as parts of the eastern and southeast coastal areas of the country are still recovering from a number of flood events that occurred earlier in the year.

The East Coast Flood from February and March 2022 now holds the record as the costliest flood in Australian history and the third most costly natural catastrophe event, according to the Insurance Council.

That event is now counted as the third most costly extreme weather event ever recorded in the country, as the insurance and reinsurance industry loss estimate has been raised to AU $4.8 billion.

Reinsurance costs are rising for Australian property and casualty insurers, as natural catastrophe industry loss costs in the country have escalated significantly in recent years, S&P Global Ratings said recently and this flood episode will not instil any more confidence in reinsurers writing business in the country.

This latest flood event comes as Australian insurers have renewed some of their reinsurance arrangements.

As we reported on Tuesday, Suncorp renewed its towers, but its aggregate attachment point has raised significantly, while today IAG announced its renewal, again with a higher aggregate attachment point.