"Attractive rhetoric isn’t enough" – FMA executive on sidestepping greenwashing dangers

“Attractive rhetoric isn’t enough” – FMA executive on sidestepping greenwashing dangers | Insurance Business New Zealand

Environmental

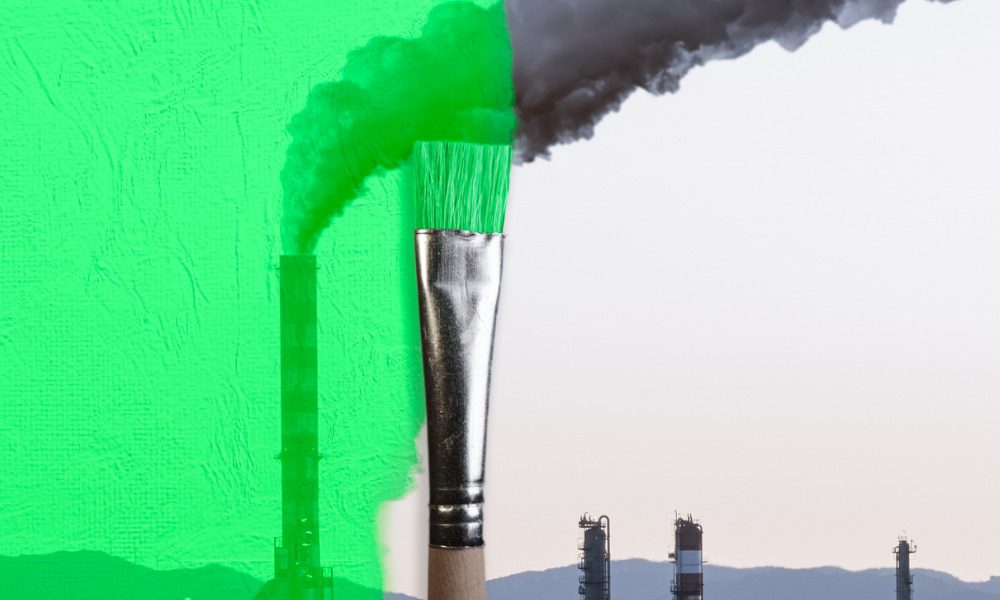

“Attractive rhetoric isn’t enough” – FMA executive on sidestepping greenwashing dangers

“The claim must come with sufficient detail to articulate and substantiate that story”

Environmental

By

Kenneth Araullo

Financial Markets Authority – Te Mana Tātai Hokohoko (FMA) executive director Paul Gregory is challenging the market to substantiate its green claims properly to avoid the pitfalls of greenwashing, a term referring to false or misleading statements about environmental claims.

In an opinion piece on the FMA website, the director for response and enforcement said that with more investors looking to invest in funds aligned with their values, managed funds marketed as ethical or responsible are more attractive.

“Regulators don’t decide ethics. From a regulatory perspective – and pending mandatory climate reporting requirements aside – it is acceptable for managed funds to do very little on environmental, social and governance (ESG) and sustainability provided they don’t pretend (or advertise) otherwise,” Gregory said in his opinion piece.

However, Gregory stressed that “attractive rhetoric isn’t enough,” and that providers using terms like ethical and responsible must ensure that there is substance to their claims, especially in how they design, market, advertise, and manage those products.

“That’s because while we’re familiar with harm from unexpectedly poor returns, poor risk management and poor value for money over an investment horizon, we can’t – because it is so personal and because persistent demand for such products is relatively new – fathom the harm to investors from finding out their investments have compromised their values for 10, 15, 20 or more years. That they have been contributing to harming people, animals, or the environment over decades,” he said.

“Greenwashing matters”

With investors choosing funds based on marketing, Gregory said that providing misleading or false claims about ESG benefits or impact will go straight to the heart of fair dealing.

“Acknowledging that risk of harm was why, in 2020, the FMA published guidance saying if a fund is claiming green or sustainable credentials, that claim must come with sufficient detail to articulate and substantiate that story. And the detail must be high-quality, lucid, and easy to find,” Gregory said.

As a result, the FMA looked at the take-up of managed funds over a year later and found that it had an “immature approach to their disclosure,” with Gregory saying that it was “vague, loose, and inconsistent.”

Gregory also pointed out that investors that invest according to their values made these decisions not from an internal value system but mostly driven by generalised unease, or by finding out something about their current investment which surprises them. This leads to poor upkeep with their investments, and with reliance on advice from friends and family, as well as taking a ‘leap of faith’ on claims made by funds. This leads to immature disclosures that represents an “ethical shock” for many NZ investors.

Overall, Gregory said that while some investors never bother to look for underlying detail, instead trusting a fund’s claims, the FMA will always be looking. IHe said that since the 2022 review, the FMA has seen several managed funds improve their disclosure, with some attempting to explain in-person how they invest according to ethical or sustainable claims,

“The FMA is sharpening its focus in this area and there are broader policy and consumer tailwinds for claims to be articulate, accurate and meaningful. Mandatory climate-reporting standards are here, broader sustainability standards are in the wings. Consumer expectation is growing. Fund managers can add substance to support their claims and labels and disclose accordingly, or stop using the claims and labels. Marketing without underlying substance won’t wash, green or otherwise,” Gregory said.

What are your thoughts on this story? Please feel free to share your comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!