ASIC launches unfair insurance contract case impacting Qantas and Virgin

For the first time, Australia’s financial services regulator has alleged unfair insurance contract terms. In a media release, ASIC (Australian Securities and Investments Commission) said it has started proceedings against Auto & General Insurance Company Limited (Auto & General).

The case involves standard form home and contents insurance contracts and appears in products issued by companies including Budget Direct, ING Home & Contents, Virgin Insurance and Qantas Insurance.

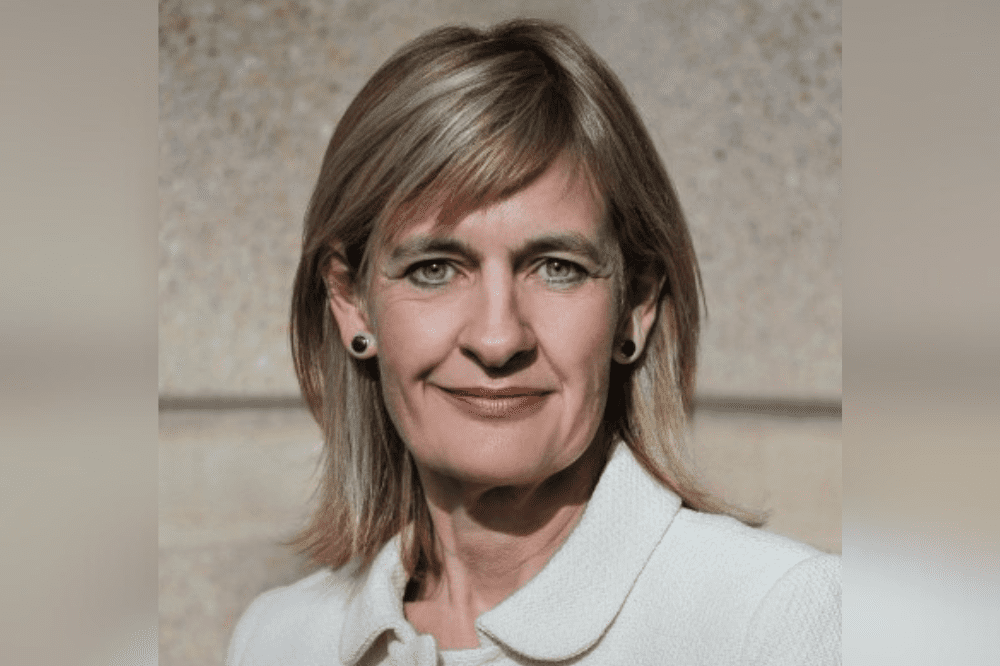

“ASIC is concerned that the broad notification obligation in these contracts is unfair because it is unclear what policy holders are required to do to comply with such a broad obligation,” said ASIC deputy chair Sarah Court (pictured above).

Court also said it is unclear what a policy holder’s rights are when making a claim.

The case concerns a contract term requiring customers of Auto & General to notify the firm “if anything changes about your home or contents.”