As alternative capital hits $108bn record-high, Aon forecasts further growth

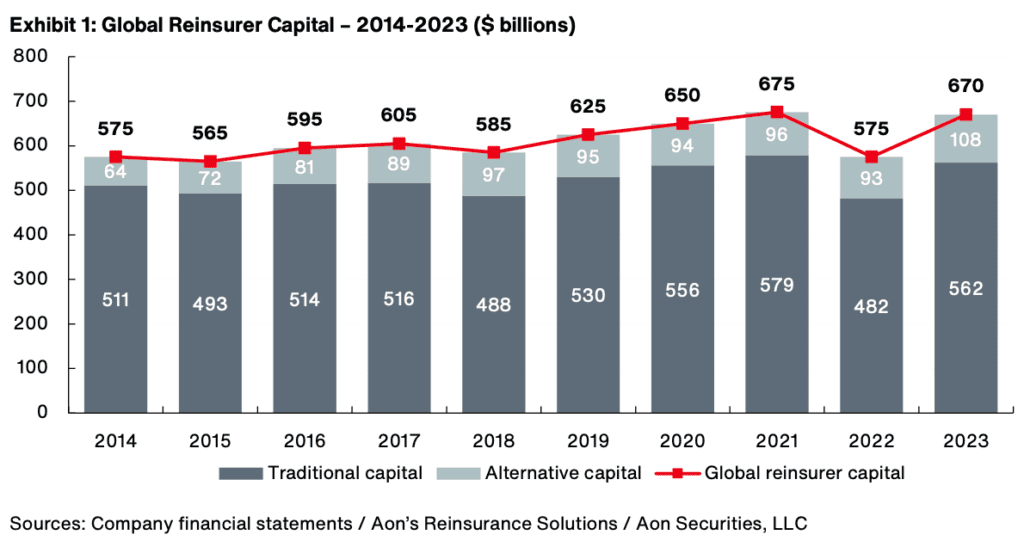

According to Aon Securities, the insurance-linked securities (ILS) and investment banking arm of Aon’s Reinsurance Solutions, the amount of alternative capital in the reinsurance industry ended 2023 at a new high of $108 billion, a figure the broker expects to grow as interest investor is growing across the range of ILS instruments.

Alternative capital levels in reinsurance grew particularly strongly in 2023, adding $15 billion over the course of the full-year, to take the total deployed in ILS structures from $93 billion at the end of 2022 to $108 billion at the end of last year.

Which means that 2023 saw the biggest growth year in dollar terms for the alternative capital and ILS market since 2011, when it grew by $16 billion over that year, according to Aon’s data on the reinsurance market.

Alternative and ILS capital grew by more than 16% over the course of 2023, with the majority of this growth coming from the catastrophe bond market, Aon noted.

Aon also highlights the important role that alternative capital and ILS has been playing, saying, “Of significance to the broader insurance and reinsurance markets, alternative capital has continued to grow at a time when Aon’s clients have targeted diversified sources of capital to help alleviate upward pricing pressure sustained in the reinsurance and retrocession markets.”

Traditional reinsurance capital slightly outpaced the alternative side of the market, growing by nearly 17% for the full-year 2023, while the overall total grew by 16%.

However, that growth in traditional reinsurance capital is down to retained earnings and balance-sheet investments recovering in value, but still, overall global reinsurance capital at $670 billion sits slightly below the record level it had reached at the end of 2021.

Aon notes that the swings in traditional capital seen over the last eight quarters are “highly unusual” so gives us another exhibit showing reinsurance capital developments over that period.

Which clearly shows how robustly the alternative and ILS capital side of the reinsurance market also recovered over the last year.

Aon’s Reinsurance Solutions notes that the strong results being reported in reinsurance are attracting investor interest.

But adds that, “The increased interest is encouraging, but it has not yet translated into new company formations, due largely to continuing concerns over the impact of climate change and social inflation on future loss costs.”

Going on to note, “Nevertheless, capital is building quickly, with established reinsurers expected to perform strongly again in 2024 (in the absence of very large primary peril losses) and the pull-to-par effect providing a further tailwind.

“To the extent that it is deployed into the reinsurance market, newly generated capital can be expected to exert downward pressure on pricing and other terms and conditions at future renewals.”

In the insurance-linked securities (ILS) market, Aon is also anticipating rising investor interest and allocations, it seems.

Encouragingly, Aon’s Reinsurance Solutions and Aon Securities teams believe that the interest is broader than just cat bonds as well.

“While catastrophe bonds remain a focus point for investors looking to grow assets, there is renewed interest in other product forms such as collateralized reinsurance, sidecars and industry loss warranties as 2024 promises to be a year with continued growth of ILS capacity,” the broker explained.