Are reciprocal insurance exchanges an answer for hard Florida market?

Are reciprocal insurance exchanges an answer for hard Florida market? | Insurance Business America

Catastrophe & Flood

Are reciprocal insurance exchanges an answer for hard Florida market?

“It’s a practical solution,” says market analyst

Catastrophe & Flood

By

Mark Schoeff Jr.

Florida’s hardened insurance market is attracting new insurers who aren’t household names and may not have their financial wherewithal, generating some questions about their ability to respond to a hurricane or other severe weather event.

In early April, the Florida Office of Insurance Regulation approved eight new insurers for entry into the state market. Several of them are reciprocal exchanges – Ovation Home Insurance Exchange, Manatee Insurance Exchange, Condo Owners Reciprocal Exchange and Orange Insurance Exchange.

A reciprocal exchange is similar to a mutual insurer except that policyholders have an ownership stake in the association. They pay a premium as well as a separate contribution toward the surplus. Unlike a mutual insurer, a reciprocal is run by an outside manager.

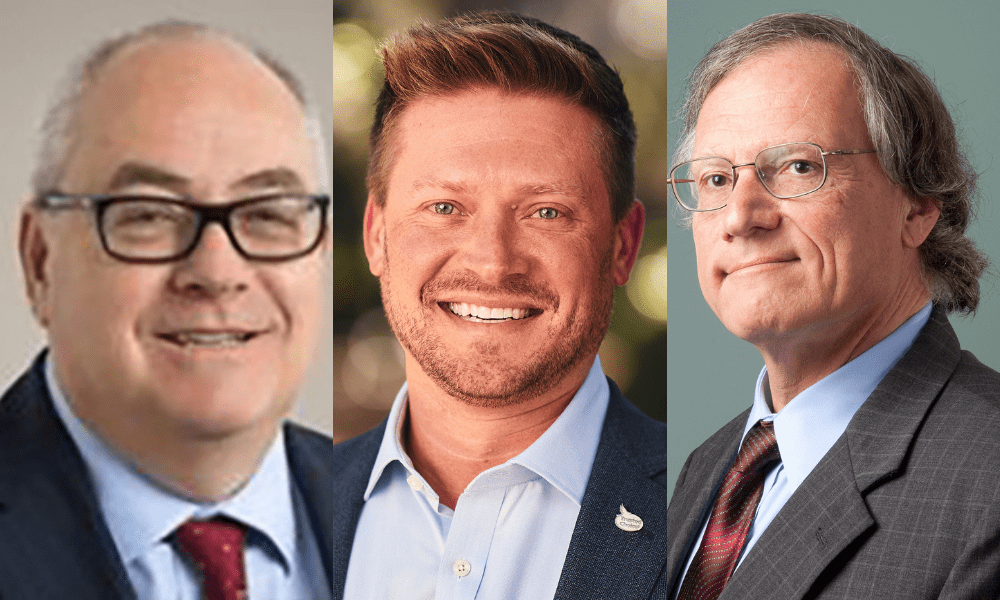

A reciprocal exchange is more likely to be found in a state like Florida, which has been buffeted by climate disasters over the last several years, than a more stable state like Ohio, said Paul Kneuer (pictured above left), managing director of Stonybrook Capital LLC.

“There’s a definite trend toward reciprocals and start ups in high-risk locations,” Kneuer said. “If it was easy, the big vanilla companies would be serving the market.”

Indeed, over the last two years, Farmers Insurance and three other carriers exited the Florida market. The new entrants usually aren’t as well capitalized as name-brand insurers, but they can offer similar coverage.

“You’ll be hearing more about reciprocals because there’s stress in the market, and it’s a practical solution,” Kneuer said.

Confidence in reciprocals’ ability to handle claims

Kyle Ulrich (pictured above center), CEO of the Florida Association of Insurance Agents, has confidence in the new reciprocals that are entering the state market. He said they would be able to cover their customers as well after a severe storm as a traditional carrier does.

“I don’t think it makes any difference that they’re a reciprocal in their ability to respond to claims,” Ulrich said. Insurance agents and brokers “don’t see any difference or distinction between a traditionally set up carrier and a reciprocal.”

The challenge for brokers in recommending coverage by a reciprocal is explaining their structure to a customer, who might be leery, for instance, of the extra contribution beyond the premium.

“It requires a little bit more education and explanation to put a client’s mind at ease,” Ulrich said. “Some policy holders aren’t comfortable with the arrangement.”

Ovation Home Insurance Exchange will begin writing home insurance policies next month. It was launched by Windward Risk Managers, which also manages Florida Peninsula and Edison Insurance.

“Ovation will be greatly beneficial for both homeowners and agents in Florida, by providing new dedicated capital, additional capacity and coverage options for Floridians at competitive prices,” Ovation CEO Paul Adkins said in a statement. “We believe subscribers having an alignment of interests in the exchange creates a sense of community that will lead to better result, which ultimately translates into more affordable premiums.”

Spokespersons for Ovation as well as the other recently admitted reciprocal exchanges did not respond to requests for comment.

Study questions quality of Florida insurance

The insurers are coming into Florida at a time when the state’s insurance commissioner, Michael Yaworsky, and others believe the market is improving. But questions about its strength have been raised by a recent paper by researchers at Harvard University, Columbia University and the Federal Reserve.

The draft study examines 130 insurers in Florida from 2009-18 and also includes data from more recent years. It raises a red flag about the quality of insurance being offered in Florida.

“[W]e show that traditional insurers are exiting high-risk areas, and new lower-quality insurers are entering and filling the gap,” an abstract of the study states. “These new insurers service the riskiest areas, are less diversified, hold less capital, and 20% of them become insolvent.”

The study also criticizes Demotech Inc., a ratings company, for giving weak insurers high financial stability scores.

Demotech President Joseph Petrelli (pictured above right) shot back at the study, slamming its methodology. He points to the researchers using a rating model to determine “counterfactual” ratings that AM Best would have given the firms. The modeled AM Best ratings were much lower than those they obtained from Demotech.

“They’re made-up ratings,” Petrelli said of the AM Best model in the study. “They’re not AM Best ratings. They never happened.”

One of the study’s authors defended the research.

Parinithia Sastry, an assistant professor of finance at the Columbia Business School, said the 12 variables they measured – including capital ratios, leverage, loss reserves and diversification – all came in much lower for the insurers under the AM Best model than in Demotech’s evaluation. She said the regression she and her colleagues used produced a result with high integrity.

“If there are additional variables we’re missing that capture insurers’ strength, we’d be happy to add those variables,” Sastry said.

The study was posted in January and first reported earlier this month by the Tampa Bay Times. AM Best declined to comment on the study.

‘Overall improvement’ in Florida market

Petrelli stands by his firm’s analysis of the market. “I reject the idea that smaller insurers in Florida are weak,” he said.

Barry Koestler (pictured, immediately above), Demotech’s chief ratings officer, said the latest reciprocal entrants are in good shape, too. Many are affiliated with larger firms. They are building surpluses and can take advantage of a reinsurance market where rates are “a little more palatable.”

“Everything is starting to move in the favor of these smaller entities at this time,” Koestler said.

Although AM Best didn’t comment on the Harvard-Columbia-Fed study, one of its analysts said he is “cautiously optimistic” about the Florida market.

“We are seeing some improvement overall,” said Chris Draghi, an AM Best director. “It remains to be seen if a storm came through of severe magnitude how reinsurance programs would respond given that that particular market has hardened.”

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!