Aon Reinsurance appoints new CEO for Bermuda unit

Aon Reinsurance appoints new CEO for Bermuda unit | Insurance Business Asia

Reinsurance

Aon Reinsurance appoints new CEO for Bermuda unit

His predecessor will retain his role as chairman for the division

Reinsurance

By

Kenneth Araullo

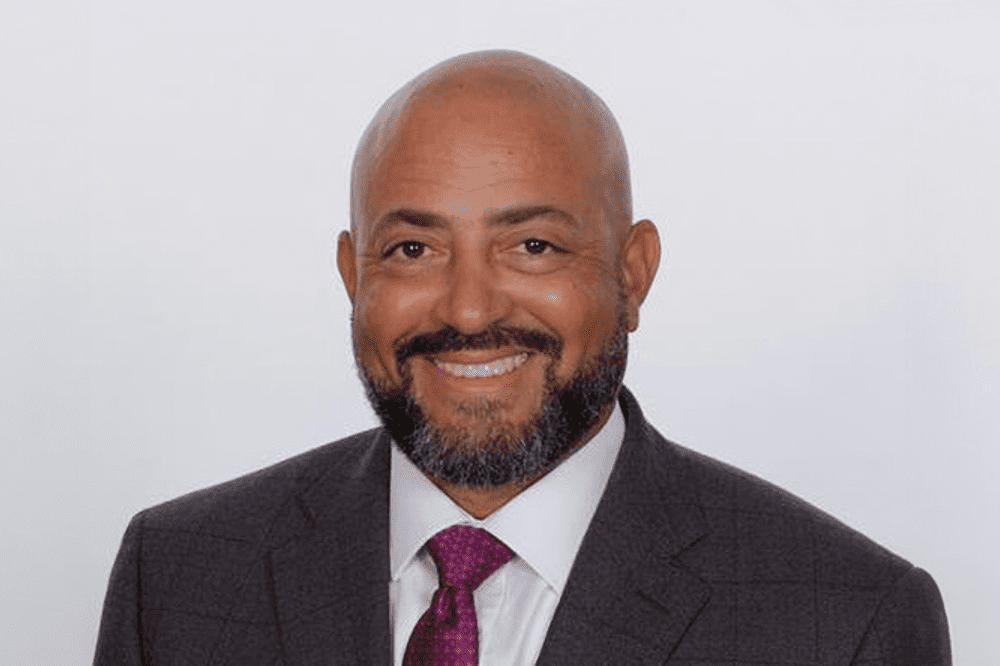

Global broker Aon has announced the appointment of Roman Romeo (pictured) as the new chief executive officer of its Reinsurance Solutions Bermuda division, set to take effect on April 1.

Romeo is set to head up Aon’s reinsurance operations in Bermuda, focusing on fostering leveraging the expertise of the broker’s worldwide network. Having become part of Aon in 2022, he brings to the table over two decades of industry experience. His professional background includes a tenure of six years at AXIS Capital, where he was the president and head of property at AXIS Specialty Ltd, as well as an eight-year stint at PartnerRe, serving as a senior underwriter for property catastrophe.

Prior to that, Romeo held roles at Flagstone Reinsurance Holdings and XL Group plc.

While Tony Fox, who currently holds the roles of chief executive and chairman of Reinsurance Solutions Bermuda, will continue in his position as chairman, Romeo will take on his new role based in Bermuda, directly reporting to him.

“Roman brings a fantastic track record and wealth of experience in our industry. He will create an environment in Bermuda that allows our talented professionals to achieve the best results for our clients, helping them to navigate volatility, optimize capital, and build resilience,” Fox said.

Andy Marcell, chief executive of Aon’s Risk Capital and Reinsurance Solutions, expressed enthusiasm for Romeo’s leadership potential.

“We are excited to have Roman grow and further develop this platform; as a leading jurisdiction, Bermuda continues to offer a unique trading hub that brings together highly innovative solutions and leading carriers that are committed to providing continuity of cover via a broad variety of risk capital,” Marcell said.

What are your thoughts on this story? Please feel free to share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!