Aon estimates Q1 global insured catastrophe losses of $17 billion at least

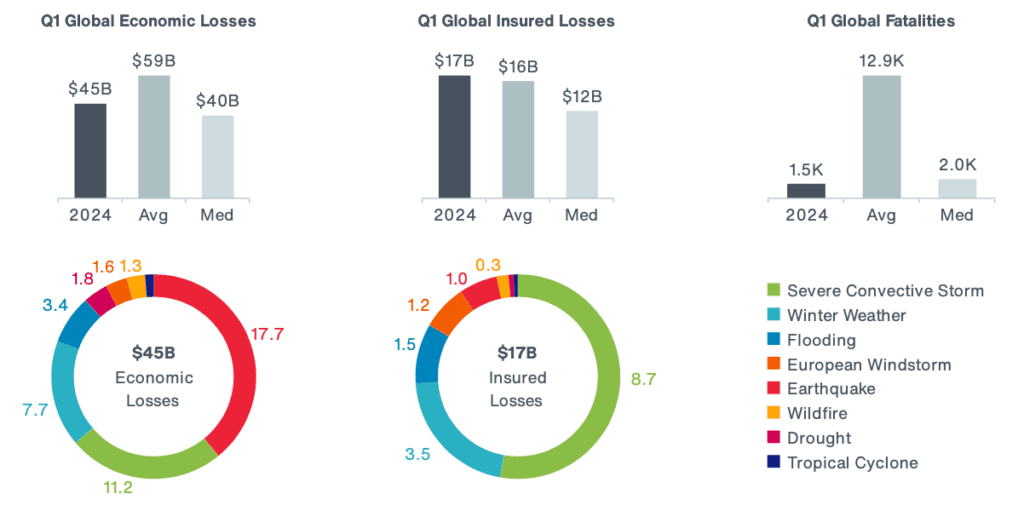

Broking giant Aon has estimated that global insured catastrophe losses amounted to at least $17 billion in the first-quarter of 2024, which was slightly above average by its measure.

The $17 billion of losses for the global insurance and reinsurance industry came off the back of an economic toll of above $45 billion, which was slightly below the 21st Century Q1 cat loss average of $59 billion.

Aon reports that the most expensive event of the first three months, in economic terms, was the Noto Earthquake in Japan, which drove economic losses of $17.6 billion, according to governmental estimates.

Aon puts that Noto earthquake loss, on an insured basis, at just $1 billion although likely to rise somewhat and exceed that figure once all claims are accounted for, with a significant protection gap therefore evident.

Out of the $17 billion of insured catastrophe losses, once again it is US severe convective storms (SCS) that drove the majority.

The top two insured loss events were US severe convective storms, with an outbreak in January costing $2.2 billion and a March outbreak $3.5 billion, Aon estimates.

Other drives of insurance and reinsurance market losses from natural catastrophes in the first-quarter of 2024, were US winter storms, as well as windstorms and flooding in Europe.

Aon cautions that all estimates are likely to continue evolving and as we all know that likely means some creep higher.

The gap between economic and insured losses for Q1 2024 was 64%, Aon reports, with the US and European events seeing much more insurance coverage than the quake in Japan.

Aon notes that while currently it estimates there were four billion dollar insured catastrophe loss events in Q1 2024, the broker notes that additional events may cross that threshold as loss quantum continue to be counted as claims settle.

The estimate from Aon of $17 billion in insured catastrophe losses for Q1, can be compared to one from Gallagher Re, with that reinsurance broker estimating that industry losses from natural catastrophes were 10% higher than the most recent 10-year average at $20 billion for the period.